3 Minutes

Crypto ETPs record $1.9B inflows as ETFs lead markets

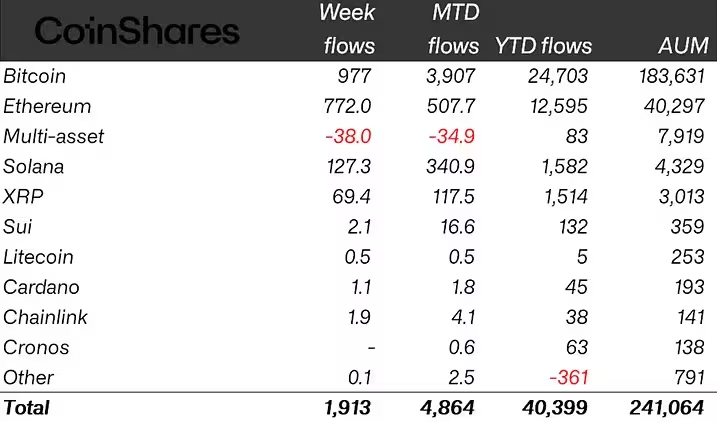

Cryptocurrency investment products attracted fresh capital last week as crypto exchange-traded products (ETPs) logged $1.9 billion in inflows, according to CoinShares data released Monday. Bitcoin and Ether were the primary drivers, helping global crypto assets under management (AUM) climb to new year-to-date highs.

Flows by asset and market highlights

Bitcoin (BTC) and Ether (ETH) topped demand, with CoinShares reporting inflows of $977 million and $772 million respectively. Other altcoins also saw notable interest: Solana (SOL) drew about $127 million, while XRP recorded roughly $69 million in net inflows.

Crypto ETP flows by asset as of Friday (in millions of US dollars)

Overall, CoinShares’ head of research James Butterfill said the latest inflows pushed total AUM in global crypto ETPs to about $40.4 billion year-to-date. Ether ETPs also extended their strong run, taking year-to-date inflows to a record $12.6 billion.

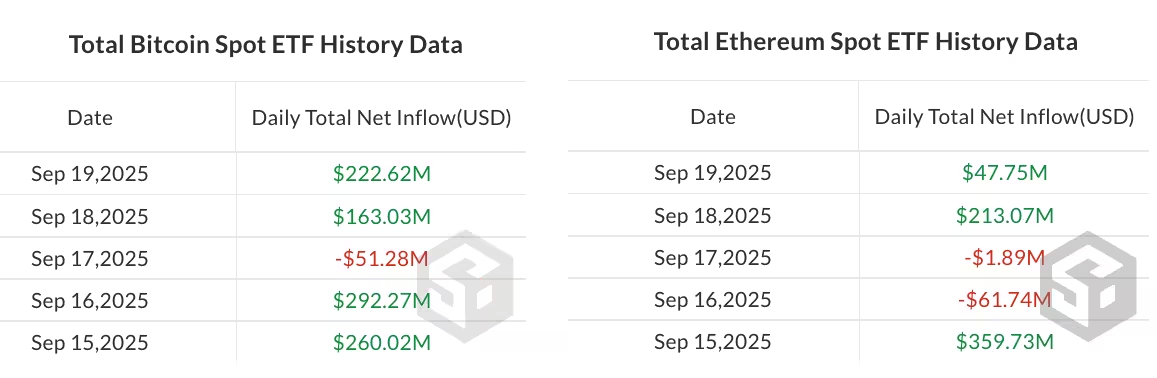

Bitcoin ETF streak extends to four weeks

Bitcoin-focused funds continued their momentum. SoSoValue data showed Bitcoin exchange-traded funds (ETFs) recorded their fourth consecutive week of inflows, bringing the four-week total to roughly $3.9 billion. This follows a particularly strong prior week that saw $2.4 billion flow into Bitcoin products.

In contrast, short-Bitcoin ETPs have seen sustained outflows, with about $3.5 billion withdrawn recently and total AUM for inverse products falling to a multiyear low near $83 million.

Daily flows in spot Bitcoin ETFs versus spot Ether ETFs last week.

Macro backdrop: Fed rate cut and market reaction

The renewed inflows coincided with the US Federal Reserve’s 25 basis-point interest rate cut, its first of the year. CoinShares’ Butterfill said investor response was cautious at first, but inflows resumed later in the week as markets digested the move.

Spot crypto prices showed modest volatility after the Fed announcement. Bitcoin briefly climbed above $117,000 while Ether traded over $4,600 at one point, after opening the week around $4,500 (CoinGecko).

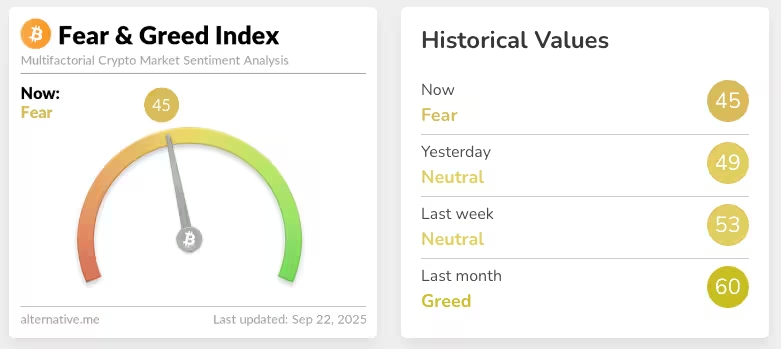

The Crypto Fear & Greed Index

Sentiment and risk considerations

Despite rising flows and higher prices, investor sentiment remained measured. The Crypto Fear & Greed Index averaged neutral at a score of 53 last week but slipped into “Fear” on Monday with a reading of 45. Traders and portfolio managers continue to weigh macro policy, ETF demand, and crypto-specific catalysts when allocating capital.

For investors tracking crypto fund flows, Bitcoin and Ether ETPs remain the primary vehicles for large-scale exposure, while investor caution and macro events can quickly influence short-term inflows and market volatility.

Source: cointelegraph

Leave a Comment