4 Minutes

Market slide prompts traders to look beyond top tokens

As the crypto market cools, many retail and institutional investors are widening their focus beyond Bitcoin and Ethereum. Johann Kerbrat, head of crypto at Robinhood, told Cointelegraph in an exclusive interview that users are treating the downturn as an opportunity to buy the dip and diversify into a broader set of digital assets.

Trading and diversification increase despite volatility

Kerbrat said Robinhood customers are not just sticking with the largest two tokens by market cap — Bitcoin (BTC) and Ether (ETH) — but are extending their exposure across a wider range of altcoins and blockchain projects. This behavior suggests investors are growing more comfortable with crypto as an asset class and are actively seeking ways to manage risk while pursuing returns amid market swings.

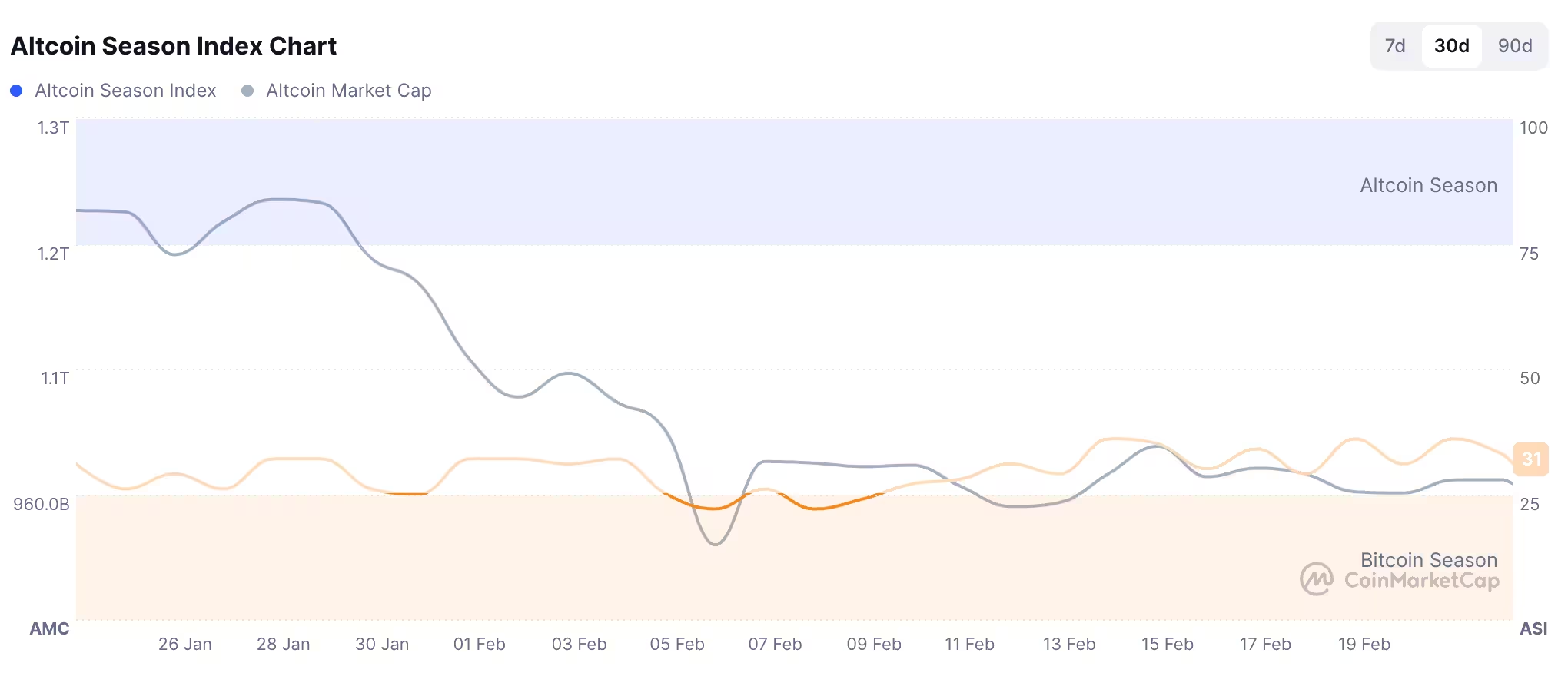

The Altcoin Season Index recorded a Bitcoin Season score of 33 out of 100 on Sunday, showing investors are still heavily favoring Bitcoin over altcoins.

Institutional flows focus on top-tier crypto

While retail traders are exploring beyond the majors, institutional players remain focused on higher-liquidity assets. Basil Al Askari, CEO of institutional trading platform MidChains, told Cointelegraph that large asset managers are executing sizable block trades concentrated in the top 20 cryptocurrencies. According to Al Askari, these institutions are taking cautious steps—prioritizing established assets over small-cap tokens, DeFi yield products, or experimental projects for now.

Clear priorities: Bitcoin and Ethereum lead

Industry observers continue to see Bitcoin and Ethereum as the first priorities for investors. Anthony Bassili, president of Coinbase Asset Management, previously noted that the market lacks consensus on which token should occupy the third spot after BTC and ETH. Solana (SOL) is often mentioned as a contender, but many investors still view Bitcoin and Ethereum as the backbone of any crypto allocation.

Use cases drive on-chain activity: staking and DeFi

Beyond trading, crypto holders are increasingly using tokens for real use cases. Kerbrat highlighted the growing uptake of staking on Robinhood since the company introduced the feature in December. He also observed renewed interest in decentralized finance (DeFi) products as traders look to earn yield or participate in new protocols despite broader market uncertainty.

Staking, yield farming, and DeFi utilities are becoming part of investors’ toolbox for generating returns in a low-rate environment, making these features important touchpoints for platforms and custodians as they compete for onboarding and retention.

Sentiment, ETF flows, and what to watch

Macro and sentiment indicators remain mixed. The Crypto Fear & Greed Index has stayed in the “Extreme Fear” zone since early February, reflecting caution among many market participants. At the same time, U.S. spot Bitcoin ETFs have reported roughly $3.8 billion in net outflows over five consecutive weeks, signaling short-term rotation of capital despite ongoing allocation interest in digital assets.

For traders and investors monitoring the space, key metrics to watch include on-chain activity, staking participation, institutional block trades, altcoin season indicators, and ETF flows. These signals can help distinguish temporary dips from durable shifts in demand across Bitcoin, Ethereum, and broader altcoin markets.

Overall, the current environment shows a market maturing in how participants approach crypto: more diversification, use-case adoption, and selective institutional engagement — even as sentiment and macro flows remain volatile.

Source: cointelegraph

Leave a Comment