3 Minutes

Xapo Bank report: Bitcoin-backed loans move from liquidity to strategy

Gibraltar-based Xapo Bank’s 2025 Digital Wealth Report reveals a notable shift in how high-net-worth clients use Bitcoin-backed loans. Rather than tapping crypto lending for short-term liquidity, borrowers increasingly take out USD loans secured by Bitcoin as part of longer-term financial planning. The trend highlights Bitcoin's evolving role as productive collateral within regulated banking rails.

Key findings from Xapo’s first year of lending

According to the report shared with Cointelegraph, 52% of Bitcoin-backed loans issued by Xapo in 2025 carried a 365-day term. Even after new loan issuance slowed later in the year, outstanding loan balances continued to rise — an indicator that borrowers are keeping positions open rather than using loans as quick cash solutions. Xapo’s product allows qualified clients to borrow US dollars against Bitcoin with conservative loan-to-value ratios and terms up to one year.

Why borrowers prefer loans over selling Bitcoin

For many long-term Bitcoin holders, collateralized lending offers a way to access liquidity while maintaining exposure to potential upside. Xapo Bank serves private clients and wealthy individuals who often hold most of their wealth in Bitcoin; the report says these clients felt comfortable realizing some profit through borrowing, yet retained the bulk of their Bitcoin through periods of market volatility. CEO Seamus Rocca characterized the behavior as disciplined, private-bank-style financial planning rather than speculative borrowing.

Product design and risk approach

Xapo launched its Bitcoin-backed USD loans on March 18, 2025, positioning the product as a conservative alternative to earlier crypto lending models. Lower loan-to-value ratios, regulated custody arrangements, and up-to-365-day terms were emphasized to attract long-term bitcoiners who want liquidity without selling their positions. The design reflects a broader move in crypto lending toward regulated, bank-integrated collateral solutions.

Regional concentration and market implications

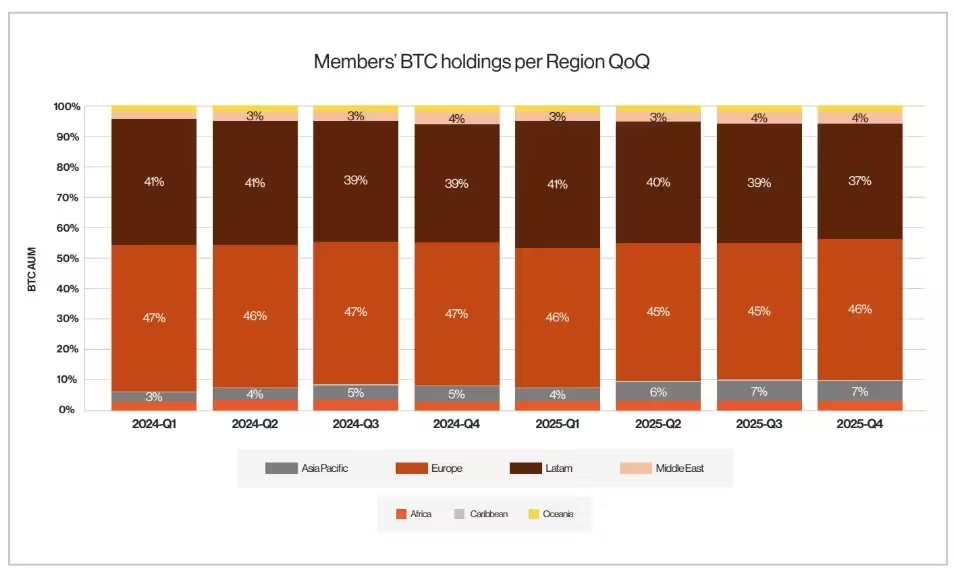

Loan volumes were concentrated in Europe and Latin America, which together accounted for 85% of total loan volume (56% and 29%, respectively). The concentration suggests regional demand for regulated Bitcoin lending products is strong, particularly among clients seeking USD liquidity via Bitcoin collateral. As these bank-offered loans become part of private wealth strategies, they may influence how institutional and retail Bitcoin holders think about capital efficiency and portfolio construction.

Members' BTC holdings, per region, quarter-on-quarter.

What this means for crypto lending and the market

The Xapo data underscores a maturing crypto credit market where regulated banks offer conservative lending products that prioritize capital preservation and long-term exposure. For crypto investors, Bitcoin-backed loans can be a strategic tool to manage liquidity needs, tax planning, or portfolio rebalancing without triggering a sale. For the broader market, growth in regulated, collateralized lending enhances the narrative of Bitcoin as an investable asset integrated into traditional private banking services.

As Bitcoin adoption grows among high-net-worth individuals, expect more regulated loan products that emphasize low loan-to-value ratios, clear custody, and terms aligned with long-term investment horizons. Xapo’s first-year lending behavior offers an early window into how these products may be used as part of comprehensive wealth management strategies.

Source: cointelegraph

Leave a Comment