3 Minutes

Institutional demand pushes ETH staking queue to 2023 levels

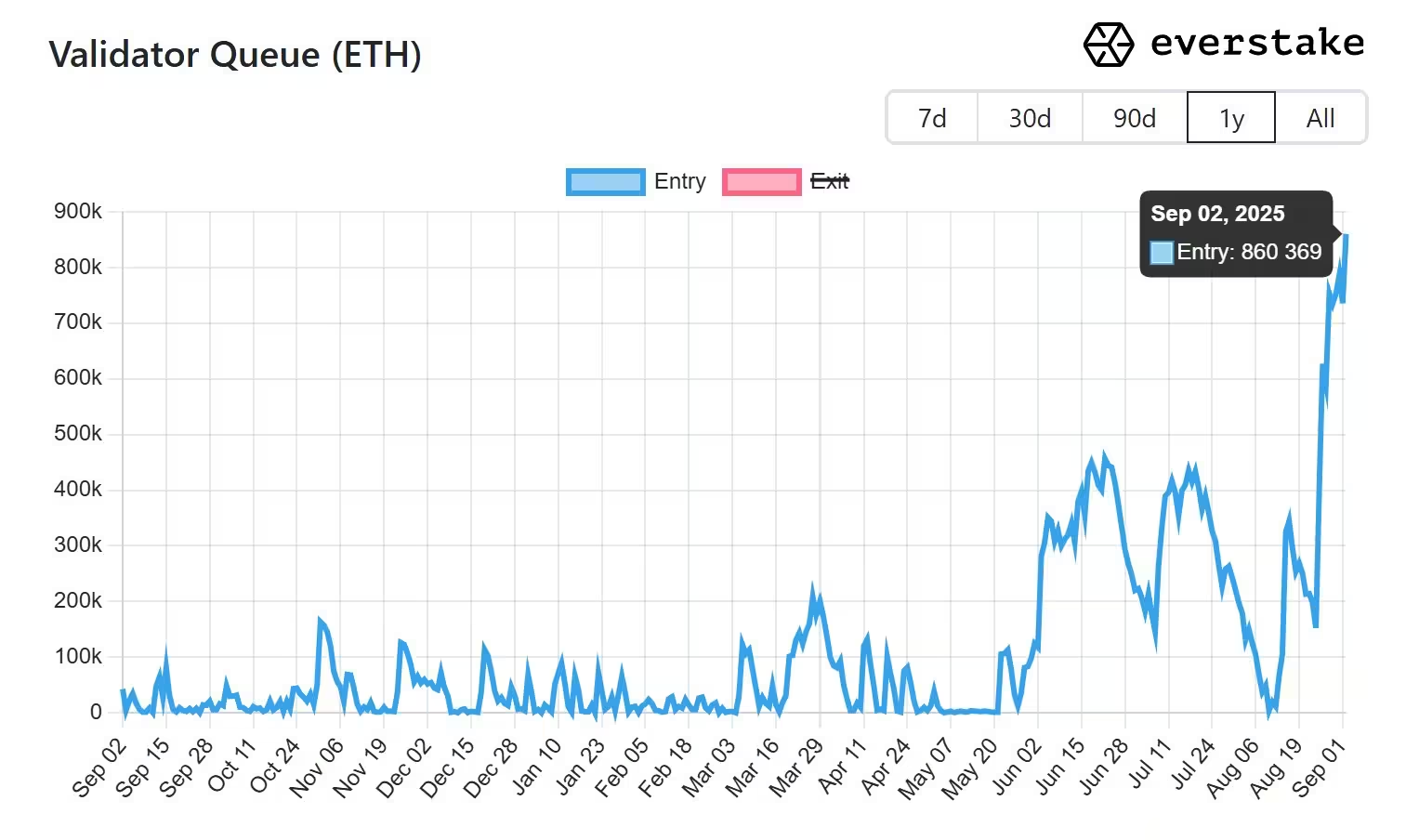

Ethereum’s staking entry queue has climbed to its largest size since September 2023, as a wave of institutional investors and corporate treasuries move to lock up ETH for yield and network participation. On-chain metrics show roughly 860,369 ETH — about $3.7 billion — currently waiting to be staked, signaling renewed confidence in the Proof-of-Stake ecosystem.

Ethereum staking entry queue surges to two-year high. Source: Everstake

Why the queue is swelling

Staking infrastructure providers point to multiple drivers behind the recent influx. First, market conditions have improved: Ether’s rising price combined with persistently low gas fees makes staking more attractive and cost-effective for large and small holders alike. Second, institutional adoption is accelerating — crypto-native funds and traditional treasury managers are increasingly allocating ETH to staking programs to enhance returns.

Finally, broader trust in Ethereum’s long-term roadmap and security has returned since the Shanghai upgrade enabled withdrawals in 2023. As staking firms put it, more organizations now view Ethereum as a core asset to steward and secure, not just trade.

Staking and network supply

Ethereum currently has about 35.7 million ETH staked (approximately $162 billion), representing roughly 31% of total supply according to Ultrasound.Money. Corporate and treasury allocations are a meaningful part of that figure: StrategicEtherReserve reports roughly 4.7 million ETH in corporate treasuries — nearly 4% of total supply — accumulated by more than 70 entities to date. Most of these holdings have been, or will be, committed to staking to capture additional yield.

Exit queue eases, reducing immediate sell-off risk

Concerns about a mass unstaking event following Ether’s all-time high on Aug. 24 have subsided somewhat. The staking exit queue, which spiked to just over 1 million ETH on Aug. 29, has since declined by about 20%, indicating a slowdown in withdrawals. That retreat has helped alleviate fears that the market would see a major liquidity-driven sell-off of staked ETH.

What this means for traders and holders

A larger entry queue indicates growing demand to become validators or to deposit through staking services, which tightens available liquid supply and can exert upward pressure on price over time. However, in the short term, price action still reflects profit-taking: ETH traded around $4,321 at the time of reporting, down roughly 12.4% from its Aug. 24 record high amid ongoing retail selling.

For crypto investors, the combination of institutional treasury accumulation, increased staking participation, and a reduced exit queue points to strengthening fundamentals for Ethereum. Network security benefits from more validators and longer duration stakes, while stakers continue to earn rewards that make ETH a yield-bearing asset in diversified portfolios.

Source: cointelegraph

Leave a Comment