3 Minutes

Market snapshot and context

The son of legendary investor Bill Miller has added his voice to a growing number of analysts forecasting a fresh Bitcoin rally in 2026. Miller IV, chief investment officer at Miller Value Partners, told CNBC that Bitcoin's technical setup and ongoing institutional adoption make the cryptocurrency poised to challenge its all time high.

Technical setup and institutional tailwinds

Miller emphasized that chart patterns and momentum indicators are aligning, suggesting a breakout could be imminent. He pointed to statements from US Securities and Exchange Commission chair Paul Atkins about capital markets moving onchain and noted continued development by Wall Street firms like JPMorgan on blockchain infrastructure. "It’s a whole new ballgame," Miller said, arguing the market has built a higher base since spring 2025.

Analysts weigh in on catalysts for a Bitcoin upswing

Tom Lee: policy and products supporting recovery

Fundstrat Capital CIO Tom Lee told CNBC that Bitcoin entered 2026 with several tailwinds: reduced leverage after October shocks, persistent institutional adoption, and increasing US government support for crypto markets. Lee views these as structural supports that could help BTC regain momentum and recover losses.

Varying price targets from industry players

Predictions for year-end 2026 differ widely. Dragonfly managing partner Haseeb Qureshi projected Bitcoin could be above $150,000 by the end of 2026, while Galaxy Digital described the year as too chaotic to pin down a single forecast, placing a wide range between $50,000 and $250,000. Tom Lee previously suggested the possibility of a new high as early as the end of January, but has not issued a specific updated target.

Current price action and historical perspective

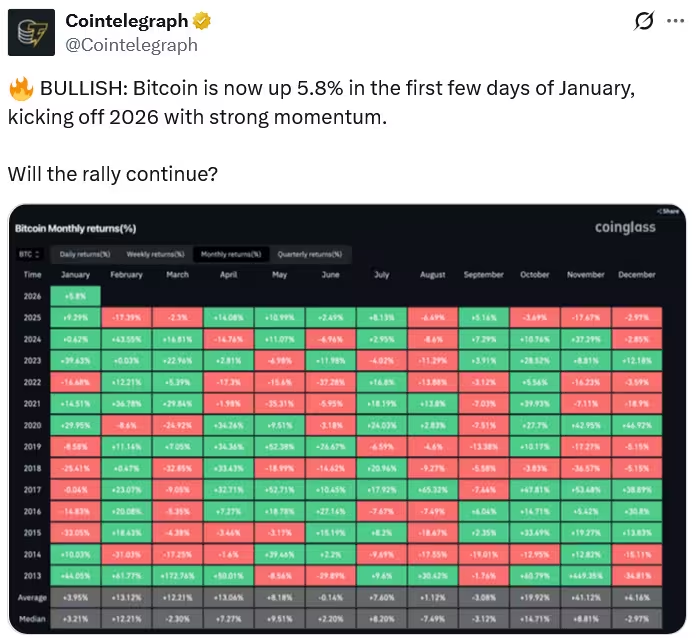

Bitcoin is trading around $93,750, according to CoinGecko, which places it about 25.6% below its $126,080 all time high from October 6 but up roughly 7.1% year to date in 2026. Miller downplayed last year’s 6% pullback and the fact that gold outperformed BTC in 2025, calling it a minor issue for a highly volatile asset and urging investors to zoom out and consider long-term trends.

Market history shows Bitcoin has never posted two consecutive years of losses, a fact analysts use to argue for longer-term resilience.

Key drivers to watch

- Regulatory clarity in the US, especially actions and rhetoric from the SEC

- Continued Wall Street integration and launch of blockchain-based products

- Institutional flows into Bitcoin ETFs and custody solutions

- Macro liquidity conditions and leverage dynamics in crypto markets

What investors should consider

While sentiment and onchain adoption present optimistic signals, risks remain: regulatory shifts, macro volatility, and execution risk in institutional products. Traders and investors should balance technical readings with fundamentals such as ETF inflows, custody developments, and regulatory guidance.

In sum, prominent voices like Bill Miller IV and other industry leaders see a constructive setup for Bitcoin in 2026, with potential for a renewed push toward new highs if institutional adoption and supportive US policy continue to align.

Source: cointelegraph

Leave a Comment