3 Minutes

Institutional buying outpaces miners as Bitcoin demand returns

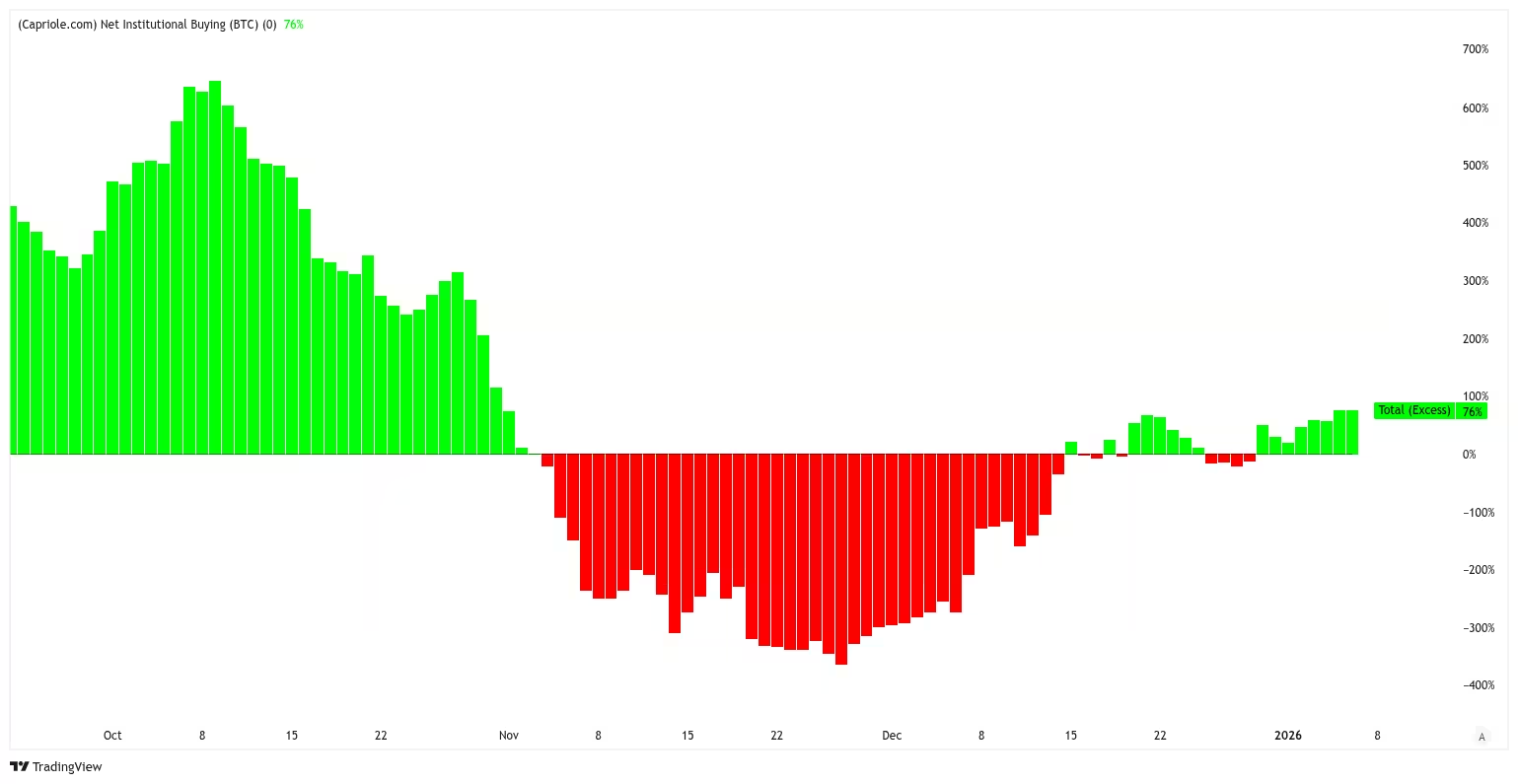

Bitcoin buying momentum reappeared in 2026 after institutions purchased more BTC per day than miners added to circulating supply. A dedicated tracking metric shows institutions have been 'net buyers' of Bitcoin for eight consecutive days, signaling renewed demand from corporate treasuries and US spot Bitcoin ETFs.

Key points covered in this report include the 76% surplus of institutional purchases over mined BTC, historical upside averages tied to this metric, and analyst views that Bitcoin may soon revisit $100,000 after a multi-month pullback.

Institutions exceed miners by 76%

Data from quantitative Bitcoin and digital asset fund Capriole Investments indicates institutional buying beat mined supply by approximately 76% on the most recent observation. Capriole’s Net Institutional Buying metric aggregates corporate treasury purchases and flows into spot Bitcoin ETFs to measure whether institutional appetite surpasses daily miner issuance.

This metric has printed eight 'green' days in a row, meaning on each day institutional net demand outstripped what miners introduced into circulation. That sustained demand dynamic often precedes meaningful BTC price rallies.

Bitcoin Net Institutional Buying chart

Historical performance and upside potential

Capriole founder Charles Edwards highlighted that when institutional buying flips positive versus newly mined supply, BTC/USD has historically experienced substantial gains. Since 2020, the average post-flip upside stands near 109%, while the prior flip led to about 41% appreciation.

Bitcoin Net Institutional Buying vs. BTC/USD

Analyst outlook: $100,000 target in January?

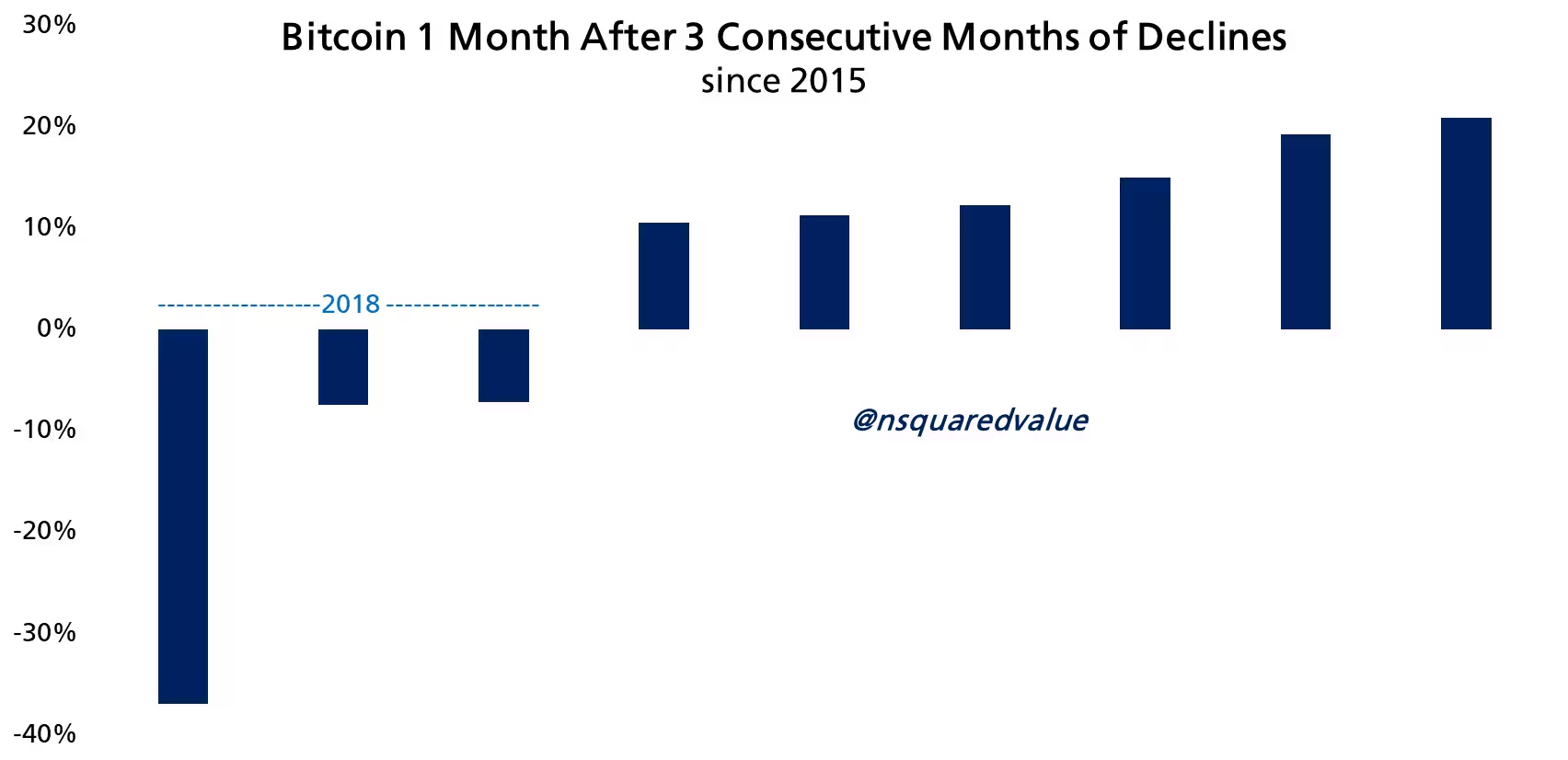

Network economist Timothy Peterson added a cautiously optimistic view, noting that Bitcoin’s recent three-month decline — following October’s $126,200 all-time high — is a pattern that has appeared only a handful of times since 2015. Historically, one month after three consecutive down months, BTC was positive 67% of the time, though Peterson observes the exceptions in 2018 signaled the end of a major bear market.

Peterson’s calculation produced a more conservative average gain figure of roughly 15% following similar sequences, but combined with the institutional buying signal, some market participants anticipate a move back above $100,000 in January.

BTC price performance comparison

What traders and investors should watch

Market participants will monitor continued ETF inflows, corporate treasury allocations, and miner selling pressure. If institutional demand remains sustainably above miner supply, the imbalance could support a relief rally after BTC’s recent drawdown. However, investors should weigh macro conditions, regulatory developments, and liquidity before assuming a persistent uptrend.

BTC returned to about $94,000 after Wall Street opened on Monday, reaching its best levels since mid-November, as renewed institutional interest helped lift sentiment across crypto markets.

This data-driven signal — showing institutions buying 76% more BTC than miners produced and historical average gains near 109% since 2020 — offers traders and long-term investors a useful lens for assessing potential upside in Bitcoin’s next leg higher.

Source: cointelegraph

Leave a Comment