3 Minutes

Diverging ETF Flows in Crypto Markets

Solana and newly listed XRP spot ETFs extended notable inflow streaks on November 14, even as Bitcoin and Ethereum ETFs continued to see multi-day redemptions. Data from SoSo Value shows a clear rotation of capital across major crypto spot ETFs: Bitcoin funds recorded significant outflows, Ethereum lost assets for a fourth straight day, while Solana kept attracting steady purchases and XRP posted a strong second-day debut.

Bitcoin and Ethereum ETFs Register Continued Outflows

Bitcoin ETFs: $492.11M outflow on November 14

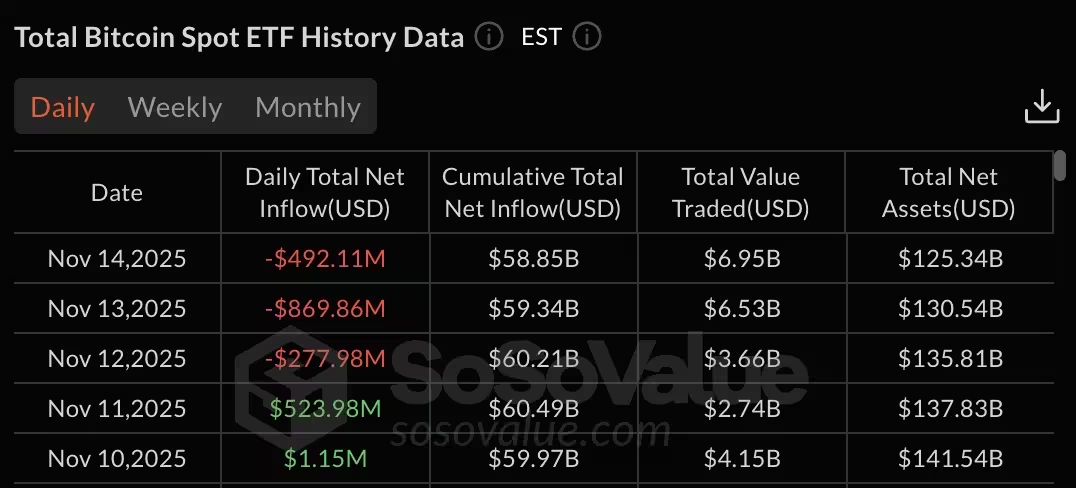

Bitcoin spot ETFs experienced a net outflow of $492.11 million on November 14, part of a three-day withdrawal streak. SoSo Value reports November 13 saw the largest single-day outflow at $869.86 million, with $277.98 million taken on November 12. Despite these short-term redemptions, the cumulative net inflow across all Bitcoin spot ETFs remains substantial at $58.85 billion, and total assets under management (AUM) stood at $125.34 billion as of November 14.

Ethereum ETFs: Four straight days of redemptions

Ethereum spot ETFs posted their fourth consecutive day of net outflows, losing $177.90 million on November 14. The largest withdrawal during this period occurred on November 13 at $259.72 million. Cumulatively, Ethereum spot ETFs have attracted $13.13 billion in net inflows since launch, with total AUM at $20.00 billion and a reported $2.01 billion in trading volume on November 14.

Solana Keeps Momentum

Consistent inflows since late October

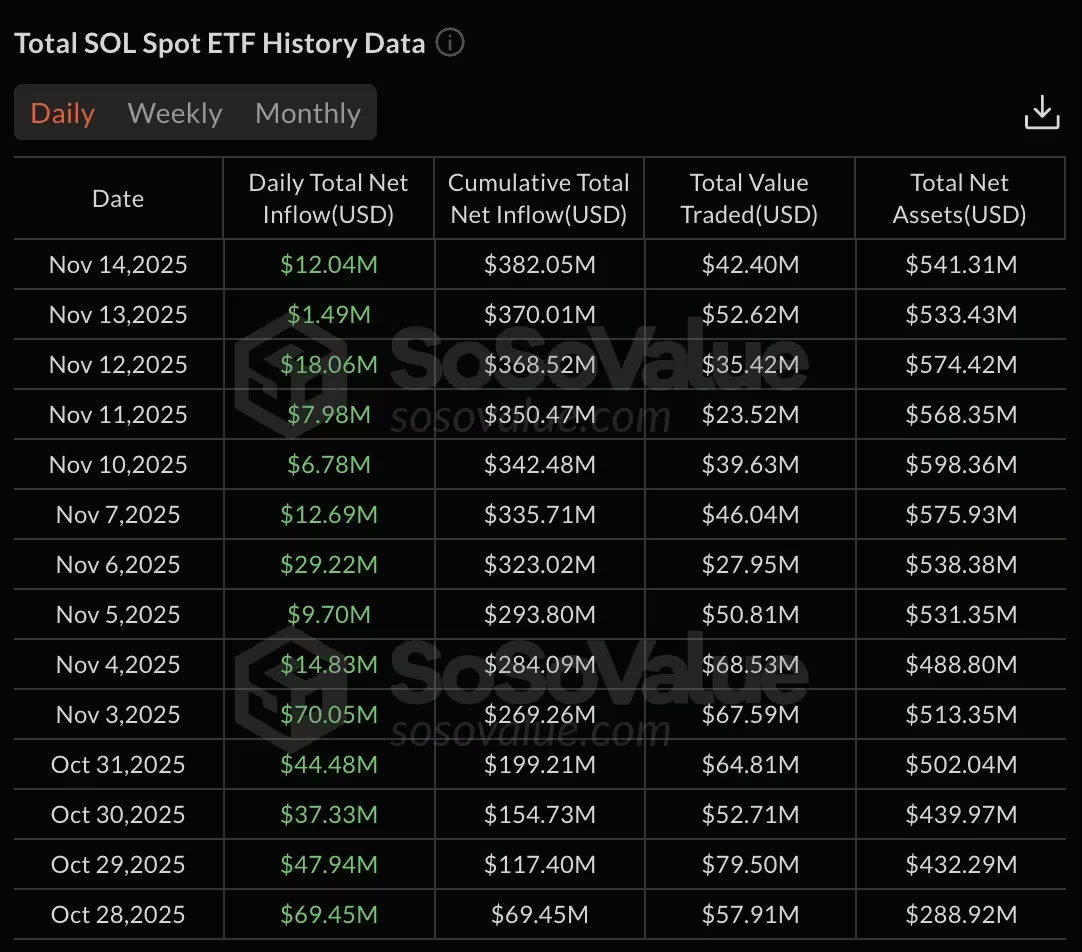

Solana spot ETFs continued to draw investor demand, posting $12.04 million in net inflows on November 14. This follows steady daily gains earlier in the month: $18.06M (Nov 12), $1.49M (Nov 13), and several other inflow days including $7.98M (Nov 11) and $6.78M (Nov 10). Solana ETF cumulative net inflows reached $382.05 million, with total AUM at $541.31 million, indicating sustained interest in SOL exposure via spot ETF wrappers.

XRP ETFs Make a Powerful Debut

$243.05M inflow on second trading day

XRP spot ETFs launched on November 13 with no recorded flows on the listing day, then saw $243.05 million in net inflows on November 14 through cash and in-kind creations. After two trading days, XRP ETF total net assets hit $248.16 million. The strong second-day activity highlights investor appetite for regulated XRP exposure following the fund listings.

What This Means for Crypto Investors

The recent ETF flows suggest active portfolio rebalancing across crypto spot funds: investors are trimming Bitcoin and Ethereum allocations while rotating capital into altcoin exposure via Solana and XRP ETFs. Short-term outflows from BTC and ETH do not negate their sizable cumulative inflows and large AUM, but they can signal profit-taking or tactical shifts tied to market volatility. For traders and long-term crypto holders, monitoring ETF inflows/outflows remains a key indicator of institutional demand and liquidity trends.

All flow and AUM figures cited are sourced from SoSo Value and reflect activity through November 14.

Source: crypto

Leave a Comment