4 Minutes

US spot Bitcoin ETFs post $410M outflows after Standard Chartered downgrade

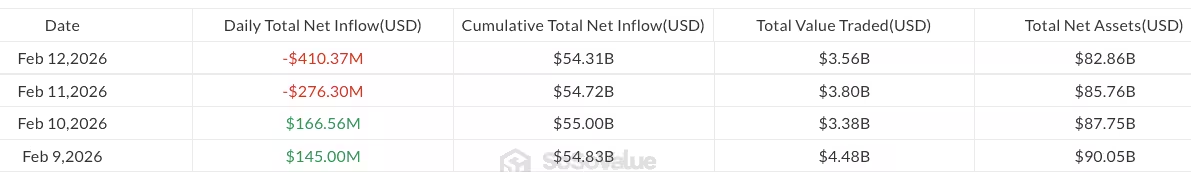

US spot Bitcoin exchange-traded funds experienced heavy selling on Thursday, recording $410.4 million in outflows as Standard Chartered trimmed its 2026 Bitcoin price target. The withdrawals extended weekly net losses to $375.1 million, according to SoSoValue data, putting the funds on track for a fourth straight week of outflows unless a major inflow occurs by Friday.

ETF flows, AUM and market context

Assets under management across US spot Bitcoin ETFs are approaching $80 billion, a sharp decline from the near $170 billion peak seen in October 2025. The sharp reduction in AUM highlights the sensitivity of ETF flows to macro headlines and updated institutional forecasts.

Daily flows in US spot Bitcoin ETFs since Monday.

Standard Chartered's revised view lowered its 2026 BTC forecast from $150,000 to $100,000 and warned Bitcoin could fall to $50,000 before recovering. The bank's report also included an Ether (ETH) projection, anticipating a drop to $1,400 followed by a year-end recovery to $4,000 alongside BTC's eventual rebound to $100,000.

Which ETFs were most affected?

Negative sentiment was broad-based across the 11 US spot Bitcoin ETF products. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund led outflows with $157.6 million and $104.1 million withdrawn, respectively, according to Farside. Ether ETFs saw similar pressure, registering $113.1 million in daily outflows and pulling weekly losses to $171.4 million — a likely fourth consecutive week of red figures for ETH products.

XRP (XRP) ETFs recorded their first outflows since early February, totaling $6.4 million, while Solana (SOL) ETFs bucked the trend and reported a modest $2.7 million in inflows. The mixed flows underscore rotation within crypto ETF products as investors weigh short-term volatility versus longer-term exposure to leading digital assets.

Market structure: are we at the bottom?

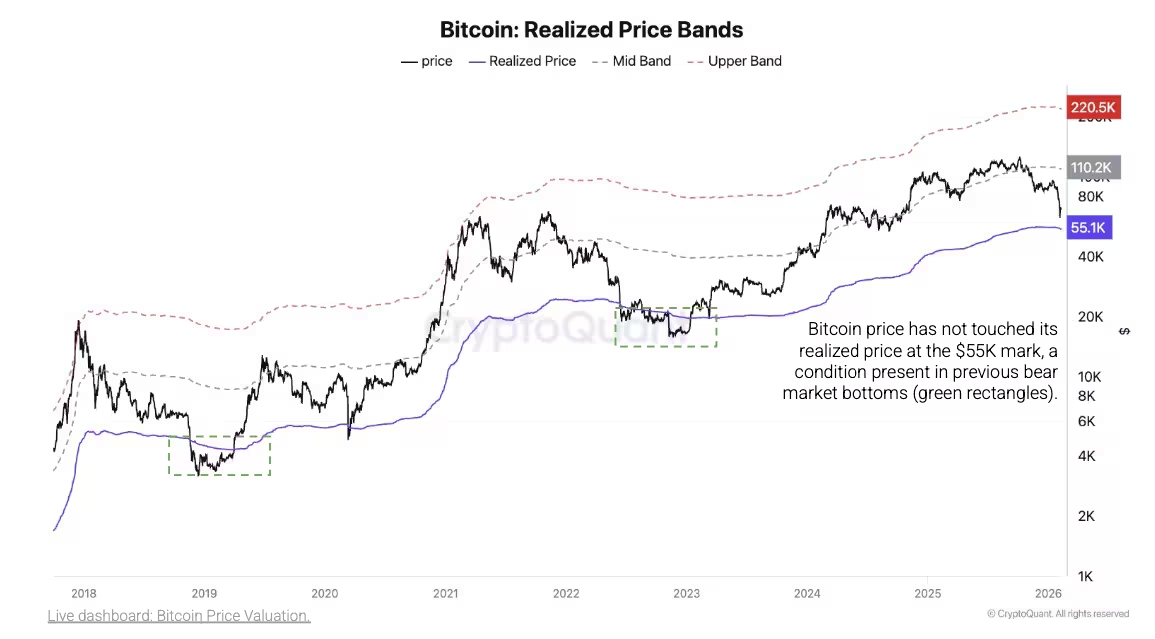

Standard Chartered’s repositioning echoes other analyst calls that BTC could test lower levels before a sustainable recovery. CryptoQuant, a market analytics firm, reinforced that realized price support sits around $55,000 and noted that this level has not yet been tested.

Bitcoin’s realized price chart.

CryptoQuant cautioned that market cycle indicators remain in the bear phase but not the extreme bear phase, a regime that historically signals the start of prolonged bottoming processes. Long-term holder behavior also suggests limited capitulation so far; long-term holders are selling nearer to breakeven levels rather than locking in deep losses. Historically, bear market bottoms often formed after long-term holders experienced 30–40% losses, indicating the possibility of further downside before a full reset.

Price action and outlook

Bitcoin traded around $66,000 on Thursday, briefly dipping to about $65,250 per CoinGecko data. Despite the selling pressure in ETF flows, analysts maintain differing views on timing and depth of any further correction. Institutional forecast adjustments, like Standard Chartered’s, can amplify short-term volatility for spot Bitcoin ETFs, but many market participants remain focused on long-term fundamentals, including on-chain metrics, macro liquidity, and ETF adoption trends.

Investors tracking crypto ETF flows should watch AUM trajectories, rotation between BTC and altcoin products, and realized price support levels to better gauge whether current weakness represents a buying window or the start of a deeper correction.

Source: cointelegraph

Leave a Comment