3 Minutes

Market Snapshot and Emerging Trends

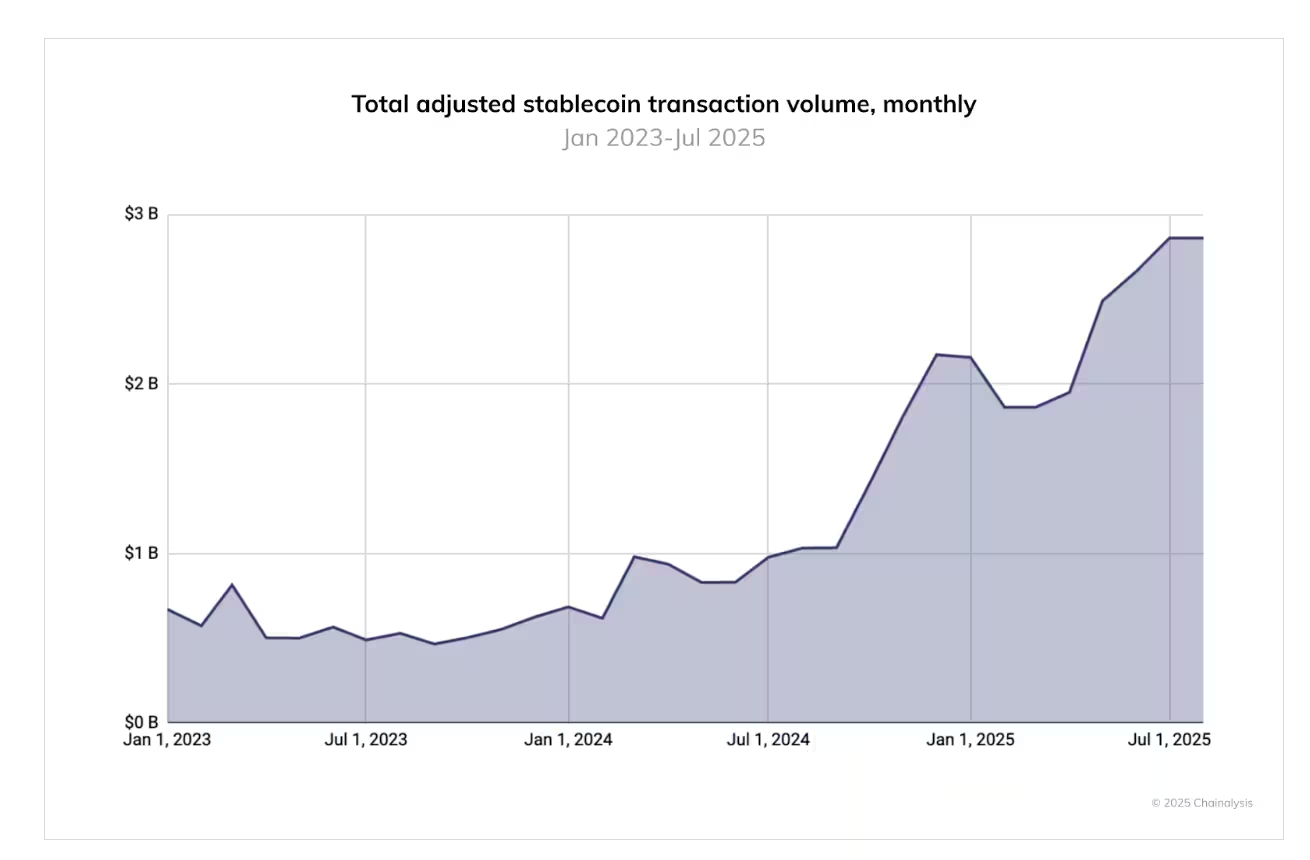

Stablecoins are shifting from crypto-only tools to broader financial infrastructure. While USDT and USDC still dominate liquidity pools in many emerging markets—acting as digital cash proxies for U.S. dollars—newer entrants like PYUSD and EURC are posting rapid growth as adoption diversifies across retail, merchant, and institutional use cases.

Why Liquidity and Utility Trump Brand

Reeve Collins, chairman of STBL.com, told Cryptonews that USDT’s prevalence in developing markets is driven less by branding and more by liquidity and utility. PYUSD, backed by PayPal’s payments network, is helping normalize regulated stablecoins in everyday payments, although overall adoption remains modest. CoinMarketCap lists PYUSD’s market cap at roughly $1.18 billion as of this writing.

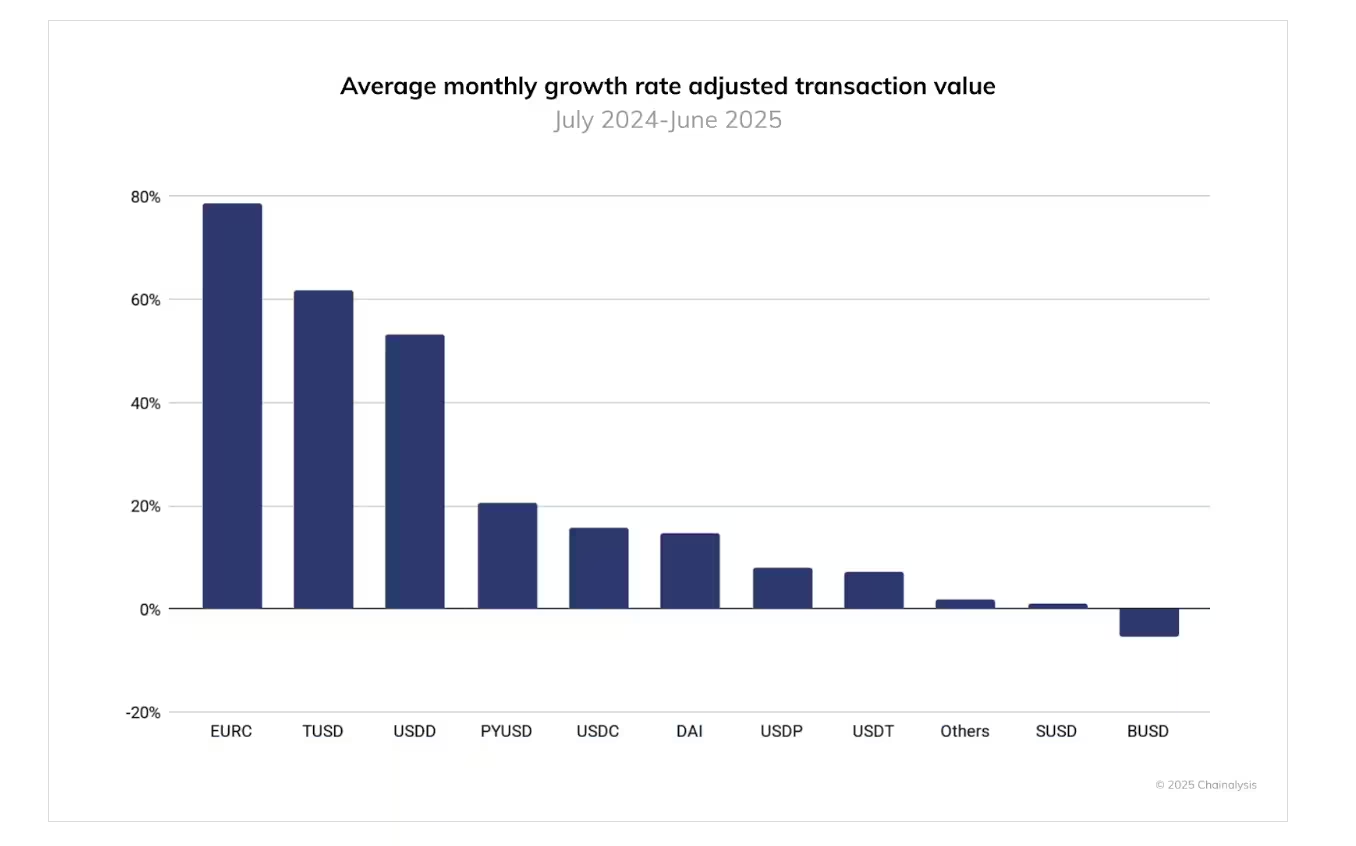

Rapid Growth Among Smaller Stablecoins

Chainalysis data highlights strong month-over-month expansion for smaller issuers: EURC averaged an ~89% monthly growth rate, rising from about $47 million in June 2024 to over $7.5 billion by June 2025. PYUSD also accelerated from roughly $783 million to $3.95 billion in the same period—underscoring shifting market dynamics where regulated alternatives gain share.

Stablecoins for Institutions

Enterprise-grade stablecoins are emerging with compliance and transparency at their core. Ripple’s RLUSD is positioned for regulated enterprise utility—targeting instant settlement of cross-border payments, remittance liquidity, treasury operations, and integration with DeFi rails. As major payment networks like Stripe, Mastercard, and Visa roll out stablecoin-enabled products, banks including Citi and Bank of America are also exploring offerings and potential issuances.

DeFi, Treasury, and Cross-Border Settlement

Institutional demand is pushing stablecoins into treasury management and DeFi integrations. Card-linked stablecoin payments from platforms such as MetaMask, Kraken, and Crypto.com make on-ramps and merchant settlements more seamless.

Retail and Merchant Payments

PYUSD’s gains may indicate growing appetite for regulated stablecoins at checkout. Circle, Paxos, and payment partners like Nuvei aim to streamline stablecoin settlement for merchants. In Asia, Kaia’s USDT is becoming a digital currency within LINE Messenger’s mini-app ecosystem and is available via Visa-enabled tap-to-pay solutions in Korea, Thailand, and the Philippines, enabling practical retail use across borders.

Challenges and the Road Ahead

Adoption faces headwinds: regulatory caution, legacy banking resistance, and user experience complexity. Industry leaders argue that clearer regulation, improved UX, and collaborative standards will unlock mainstream utility. Looking forward, Collins predicts Stablecoins 2.0—where digital dollars are financialized, offering yield, governance, and programmability. The key innovation will be separating principal from yield so users can spend dollars while accessing income streams, all aligned with evolving regulatory frameworks.

Source: cryptonews

Leave a Comment