2 Minutes

Dogecoin's Breakout and Institutional Surge

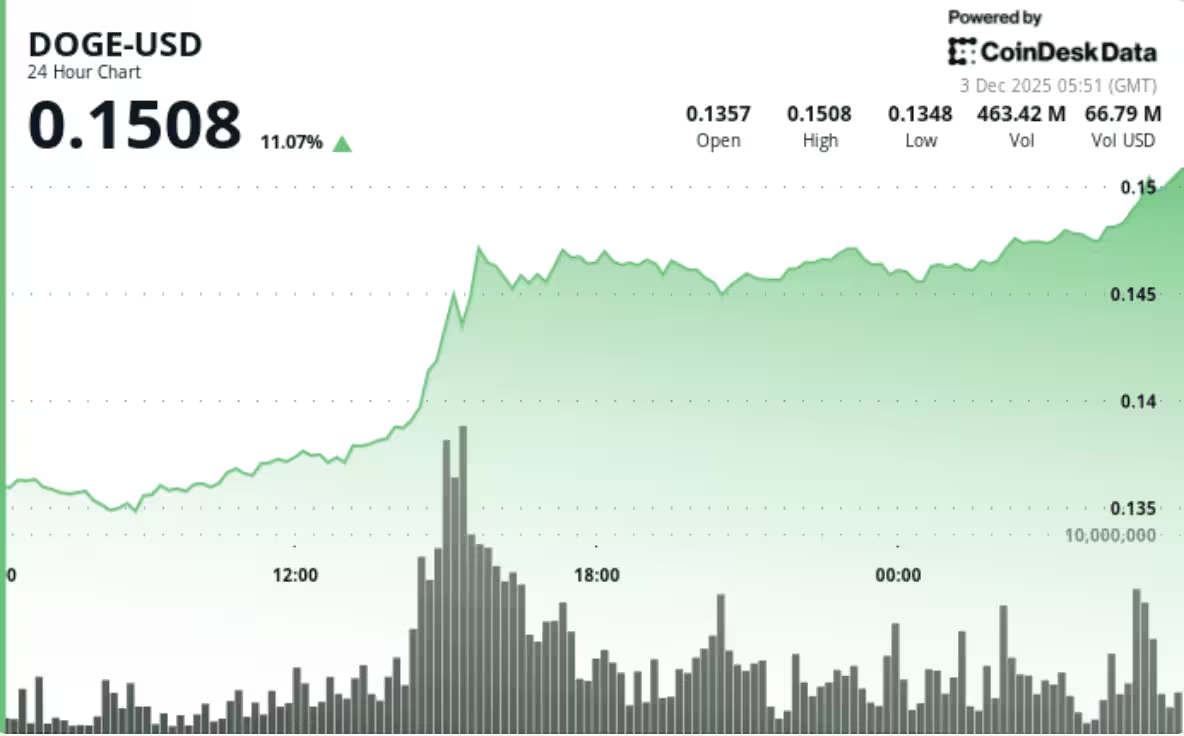

Dogecoin (DOGE) posted its strongest upside move in weeks as institutional-sized flows returned to the memecoin market. The token jumped roughly 8% intraday while volume exploded to 1.37 billion DOGE, far above recent averages — a clear sign of accumulation rather than retail noise. Market momentum and volume profile point to a bullish tilt, with traders eyeing $0.15 as the next meaningful target.

News Snapshot

- DOGE climbed from about $0.1359 to $0.1467 during the session - On-chain and exchange volume hit 1.37B tokens, ~242% above the 24-hour average - The surge tracked broader meme-coin strength tied to ETF speculation - Multiple higher lows and a 9.3% trading range confirmed buying pressure - Key intraday resistance at $0.1475–$0.1480 was tested as institutions dominated volume

Technical Analysis

The structure flipped decisively bullish after DOGE cleared a multi-session ceiling and printed consecutive higher lows from a $0.1347 base. The decisive breakout candle delivered the month’s strongest volume confirmation — 1.37B tokens — suggesting institutional accumulation. The $0.1475–$0.1480 band aligns with the upper edge of a short-term ascending channel; a clean break above this zone would open a path toward the next high-liquidity band at $0.1500–$0.1520. Momentum indicators and a strong volume node between $0.145–$0.147 support a continuation scenario.

Price Action and Risk Levels

DOGE surged sharply beginning at 15:00, leaping from $0.1419 to $0.1477 on the volume burst before settling near $0.1467. A confirmed higher low at $0.1347 now marks the critical downside invalidation for short-term bulls. Traders should watch for sustained hourly volume above ~17M and total session volume north of 1B to validate follow-through; failure to clear $0.148 could prompt a corrective pullback toward $0.142–$0.144.

What Traders Should Watch

Clearing $0.1475–$0.1480 is the key continuation signal toward $0.1500–$0.1520. Institutional flows and ETF-related memecoin momentum remain material catalysts. Risk management is essential: $0.1347 invalidates the short-term bullish thesis, while elevated volume is required to sustain any rally toward $0.15.

Source: coindesk

Leave a Comment