5 Minutes

Ethereum breaks the $2,900 floor amid rising whale sell pressure

Ethereum has slipped under the $2,900 support level and is trading around $2,803 at press time, pressured by increasing whale activity and traders exiting positions. ETH is down roughly 0.9% over the past 24 hours and about 5% on the week. Over the last 30 days the token has slid nearly 28%, leaving it approximately 43% below its August all-time high of $4,946.

Trading activity is intensifying even as prices drop. Spot volume rose about 46% to roughly $30 billion in the past 24 hours, while derivatives volume climbed near 19% to about $70 billion. Conversely, open interest on futures has eased by around 4%, a combination that typically signals position unwinding rather than fresh directional bets.

Derivatives and on-chain signals point to distribution

Derivatives metrics and on-chain flow suggest a market dominated by exits. When trading volume increases but open interest declines, traders are more likely closing trades than initiating new ones. That pattern is often observed during rapid liquidations or when large holders shift to risk-reducing strategies.

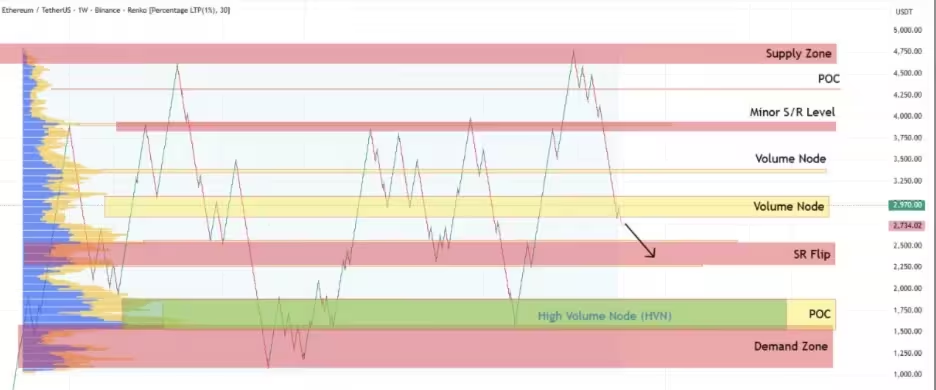

On-chain analysis from CryptoQuant contributor CryptoOnchain shows Ethereum has broken below the $2,900 volume node — a level that acted as structural support for several months. The Renko chart structure now leans bearish and highlights a potential support zone near $2,250 if selling pressure continues.

Ethereum’s Renko chart

Signals from exchange flows reinforce the bearish read. Whale inflows to centralized exchanges have increased, and when large holders dominate exchange activity they frequently prepare for downside by selling or hedging. Ordinarily Bitcoin drives broader market direction, so heavy whale movement into Bitcoin liquidity pools can indirectly pressure ETH as well.

What the Fusaka upgrade could change

The Fusaka upgrade, scheduled for Dec. 3, is designed to improve Ethereum's base layer efficiency and reduce the cost of rollup transactions. While protocol upgrades typically support long-term fundamentals, they do not always translate into immediate price reversals amid strong selling momentum.

Key Fusaka features and expected impacts

- Peer Data Availability Sampling: Enables nodes to validate blob data without downloading full payloads, lowering resource needs and enabling higher rollup throughput.

- Expanded blob capacity and revised fee mechanics: Aims to make block space more efficient and align incentives for lower rollup transaction costs.

- Leaner historical data storage and improved proposer scheduling: Optimize node requirements and block production predictability.

Collectively, these changes should reduce gas costs for rollups, increase throughput, and improve Ethereum's long-term economic profile. Higher on-chain activity and greater fee burns could support ETH price over time, but short-term technical pressure may delay any immediate recovery.

Technical analysis: momentum remains bearish

The daily chart shows ETH below major moving averages, signaling a clear downtrend. Most short- and long-term indicators favor continued selling pressure: the RSI sits near 33 without a clear reversal signal, Bollinger Bands have widened after the drop, and the MACD remains negative though attempting to flatten.

Ethereum daily chart

The commodity channel index is neutral and stochastic oscillators show weak momentum, reinforcing the need for buyers to reclaim key levels to shift sentiment.

Support and resistance to watch

- Immediate support: $2,700 area. A break below this could invite accelerated selling.

- Deeper support: Approximately $2,250, aligned with Renko-based structure levels.

- Key resistance and momentum shift: Reclaiming the $3,000 zone would be necessary for bulls to regain control and flip short-term technicals bullish.

What traders should monitor

Traders and investors should watch several inputs in the coming days:

- Exchange inflows and whale activity: Continued concentration of large transfers to exchanges often precedes further downside.

- Open interest trends: Rising OI with higher volume would indicate new bets entering the market; declining OI typically signals exits.

- Post-upgrade on-chain metrics: If Fusaka reduces rollup fees and improves throughput, expect to see rising transactions, higher fee burns, and more active rollup demand — all fundamentals that could support ETH over weeks to months.

- Macro and Bitcoin correlation: Bitcoin’s direction still tends to set the tone; a sudden Bitcoin reversal could lift altcoins including Ethereum.

Conclusion

Ethereum's drop beneath $2,900 reflects distribution and risk-off behavior as whales and leveraged traders pare positions. The Fusaka upgrade represents a meaningful protocol improvement that can enhance scalability and reduce rollup costs, but its short-term impact on price is uncertain while technical momentum stays negative. For a sustainable recovery, ETH needs to reclaim the $3,000 zone and show rising open interest alongside stronger on-chain usage after the upgrade.

Investors should weigh short-term technical risk against medium-term fundamental gains from improved scaling and lower fees when positioning around the Dec. 3 Fusaka activation.

Source: crypto

Comments

Marius

Fusaka sounds legit, but upgrades dont fix market sentiment overnight. Need 3k reclaim + rising OI, otherwise more chop imo

blockfin

Whales selling again? feels like they wait for Fusaka hype then dump. BTC swing could drag ETH lower... nervous

Leave a Comment