5 Minutes

A decentralized tug-of-war

In 2025, Bitcoin’s price action reflects a shifting balance between a handful of powerful forces: large BTC holders (whales), core developers implementing protocol upgrades, and governments shaping markets through policy and regulation. Add macroeconomics and market sentiment to that mix, and price becomes a real-time gauge of confidence, liquidity and narrative. Below we break down how each group influences BTC price dynamics and why no single actor fully controls the market.

How do whales influence Bitcoin?

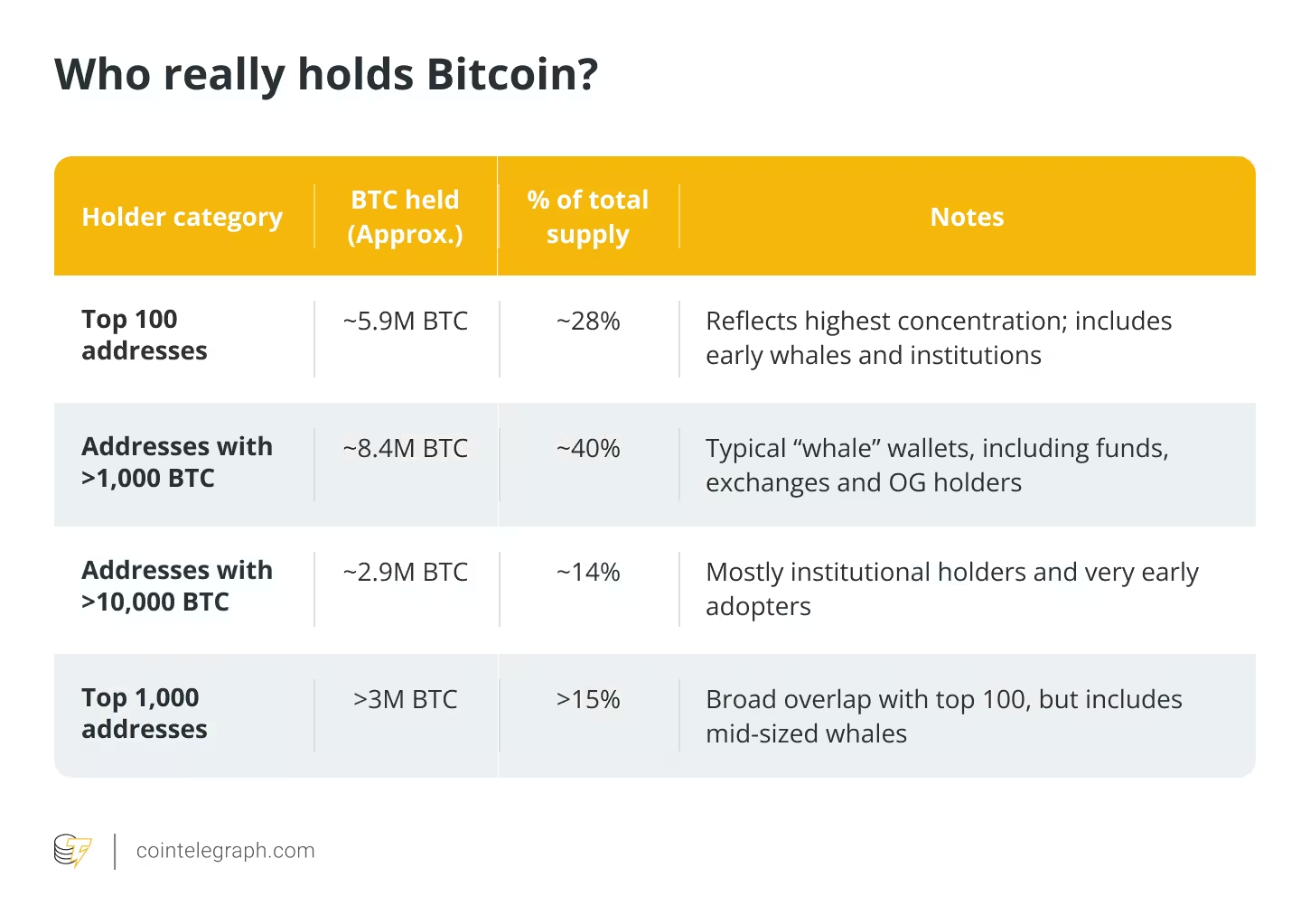

If any group can “move the market,” it’s the whales — wallets holding thousands of BTC. Many of these belong to institutions, funds or early Bitcoin holders who control meaningful portions of circulating supply. As of May 2025 the number of wallets holding over 1,000 Bitcoin has climbed to 1,455, a sign of renewed large-scale accumulation.

Institutional concentration and exchange liquidity

Institutional players are a major part of this whale class. Some entities now hold hundreds of thousands of BTC — Strategy alone controls over 580,000 BTC (roughly 2.76% of total supply), and BlackRock’s allocations through its iShares Bitcoin Trust and related vehicles have grown substantially. Together, the two firms are estimated to control around 6% of total supply, an outsized share in an asset with fixed issuance and thinning exchange liquidity.

Whale behavior: accumulation, profit-taking and market impact

Whales don’t act as a single monolith. Many buy at scale and sell into strength, often offloading when retail demand spikes. Several corrections since early 2025 followed large inflows from whale wallets to exchanges — a recurring on-chain pattern flagged by analysts. Conversely, stretches of whale dormancy have coincided with upward momentum, such as Bitcoin’s climb past $110,000 in April. On-chain analytics show older whale addresses realized about $679 million in profits since April, while newer large holders realized over $3.2 billion, indicating long-term consolidation by early holders and faster cash-outs by recent entrants.

Can developers influence the Bitcoin price?

Developers don’t set price directly, but protocol upgrades change Bitcoin’s utility, capacity and narrative — and those changes attract attention from investors and markets.

Historical upgrade examples

SegWit (August 2017) improved block efficiency and enabled the Lightning Network, contributing to the infrastructure that preceded the 2017 bull run. Taproot (November 2021) enhanced privacy and smart-contract capability, arriving as BTC neared its then all-time high. More recently, the Ordinals and BRC-20 phenomena in 2023–2024 demonstrated how developer-enabled features can give rise to new use cases — NFTs and memecoins on Bitcoin — driving over $2 billion in market value and soaring miner fees.

What’s next: covenants and new opcodes

Into 2025, discussion around covenants and opcodes like OP_CTV and OP_CAT could expand programmable spending and vault functionality, potentially increasing institutional and developer interest. Developer activity has rebounded: more than 3,200 commits were recorded across core repositories in the past year, signaling renewed momentum in protocol development.

How governments don’t control Bitcoin — but still move the market

Governments can’t centrally control a decentralized ledger, yet their policies and enforcement actions materially affect liquidity, investor access and sentiment.

Regulation, ETFs and market flows

The 2024 approval of spot Bitcoin ETFs in the U.S. was transformational: multiple funds attracted billions and helped push BTC above $73,000. These flows also lifted CME futures open interest to record levels in Q1 2025. Conversely, proposals for stricter surveillance on self-custodial wallets in the EU created short-term market nervousness in 2023–2024. Even bans have limits: China’s restrictions pushed trading and mining activity offshore, but demand persisted via OTC desks and alternative channels — and OTC volumes in China remained robust into 2025.

What ultimately drives Bitcoin’s price?

No single actor controls Bitcoin’s price outright. Whales, developers and governments each exert powerful but partial influence. Macro conditions — interest rates, inflation and dollar strength — set the broader risk environment, while sentiment and narratives (from ETF adoption to memecoin mania) can spark rapid moves. In 2025 we’ve seen spot ETF approvals produce record inflows without always sustaining rallies, regional regulatory crackdowns prompt localized sell-offs, and whale movements trigger volatility in thin markets.

In short, Bitcoin’s price is less a final verdict than a pulse: it reflects collective beliefs, liquidity flows and ongoing negotiation among users, builders, institutions and regulators. For traders and investors, that means monitoring on-chain metrics, developer roadmaps and regulatory headlines together — because any of those can tip the balance in the next big move.

Source: cointelegraph

Leave a Comment