5 Minutes

Wall Street sets ambitious Bitcoin price targets for Q4

Leading investment banks and asset managers now project a dramatic year-end rally for Bitcoin (BTC), with forecasts ranging from about $133,000 to as high as $200,000. Analysts point to sustained spot Bitcoin ETF inflows, institutional adoption, and potential capital rotation from gold as the structural drivers that could push BTC toward new all-time highs before the close of 2025.

Market backdrop and current price action

Bitcoin has regained momentum, rising more than 13% over the past seven days and edging back toward its prior record near $124,500 as traders absorb the latest macro signals and ETF flow data. Investors and portfolio managers are watching ETF volumes, liquidity trends, and the post-halving supply dynamics closely to assess whether the rally has legs.

BTC/USD daily price chart

What top banks and managers are forecasting

Citigroup: $133,000 base case, $83,000 bear case

Citigroup’s analysts expect Bitcoin to finish the year around $133,000, driven primarily by steady spot ETF inflows and growing allocations to digital asset treasuries. Citi’s baseline assumes roughly $7.5 billion in fresh ETF inflows through year-end, supporting demand and helping Bitcoin set a new record market valuation.

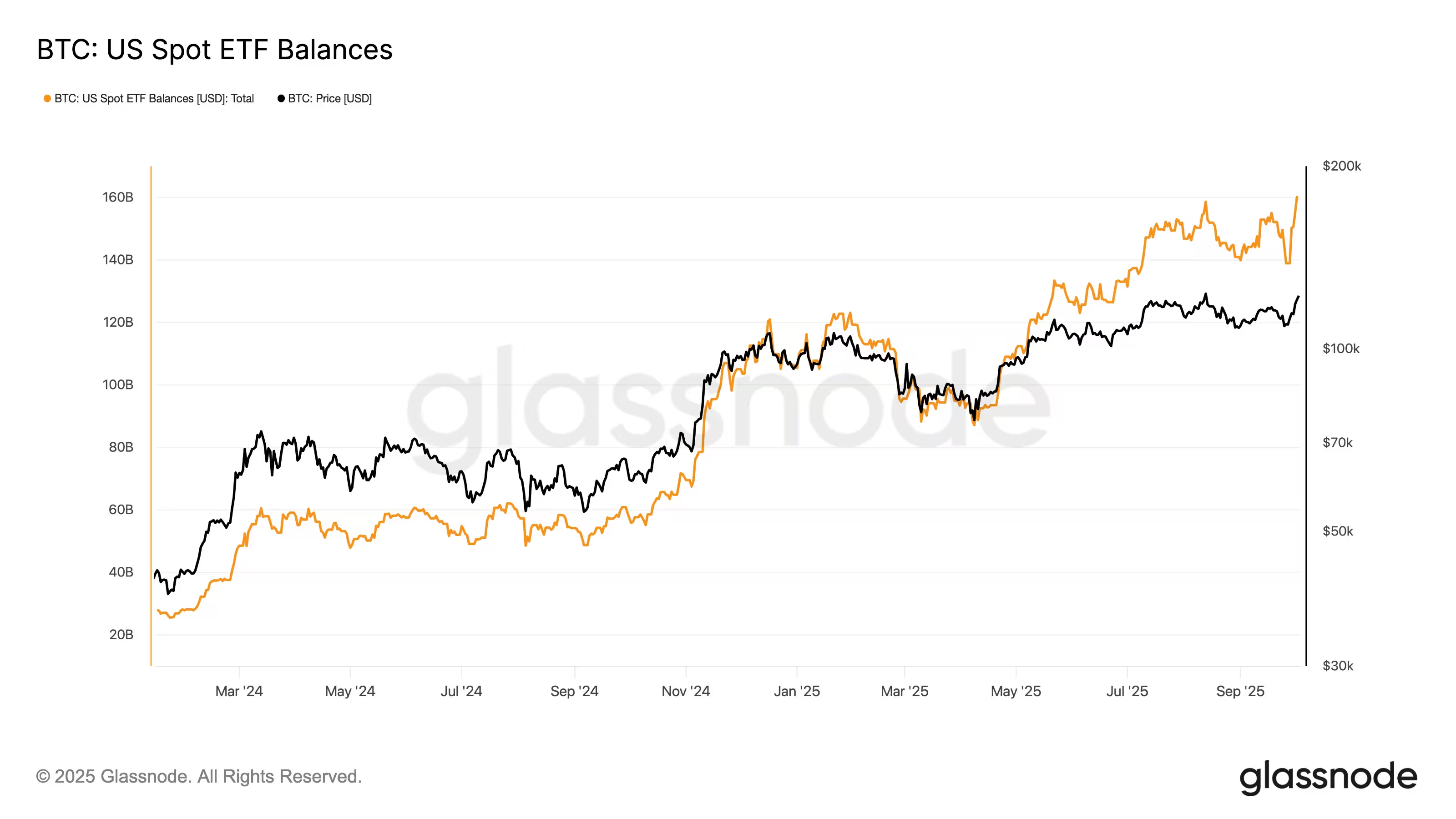

BTC US spot ETF balances

However, Citi’s downside scenario highlights recession risk and weakening investor risk appetite — under that view BTC could fall toward $83,000 if macro conditions deteriorate and ETF momentum stalls.

JPMorgan: $165,000 through a volatility-adjusted gold comparison

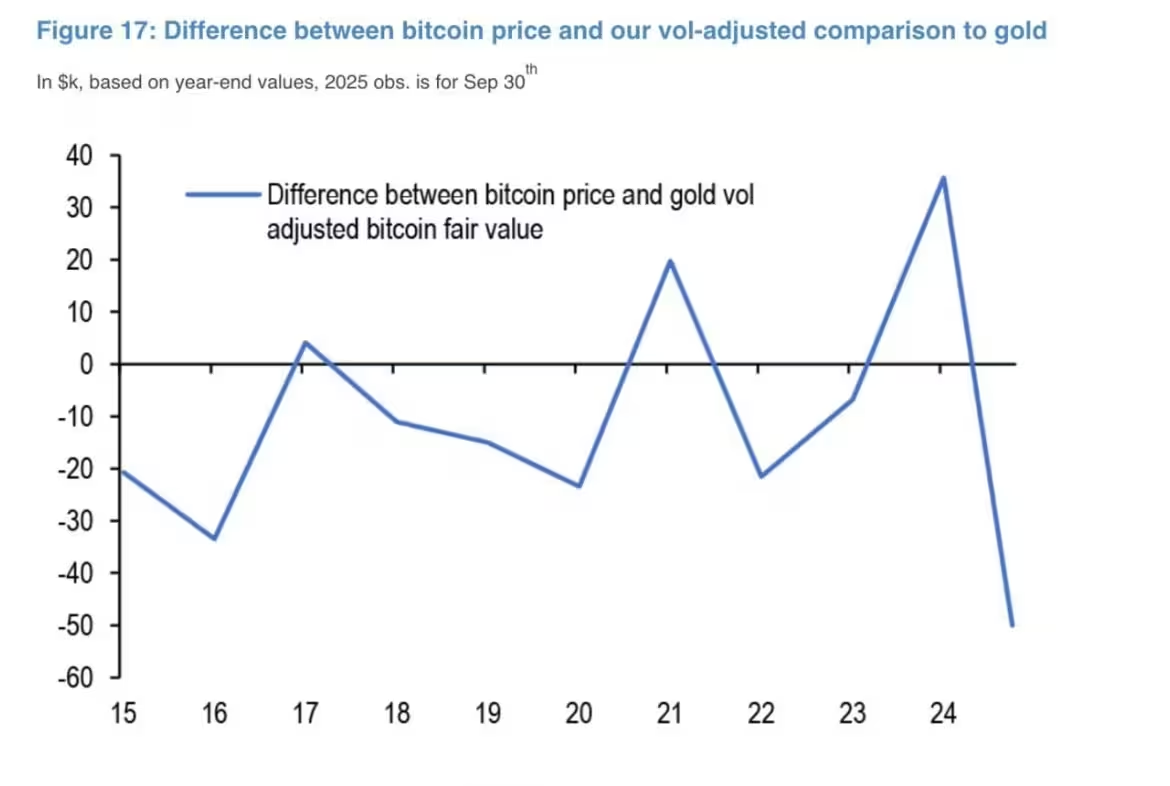

JPMorgan strategists, led by Nikolaos Panigirtzoglou, frame Bitcoin as undervalued relative to gold once volatility-adjusted metrics are considered. Their analysis shows Bitcoin currently absorbs roughly 1.85 times more risk capital than gold. If BTC were to match private gold holdings’ implied market exposure, JPMorgan estimates a theoretical Bitcoin price near $165,000.

Bitcoin and gold’s volume-adjusted comparison

Gold’s strong year-to-date performance (roughly +48%) has pushed its yearly RSI to historically overbought territory — a signal that could encourage capital rotation into risk assets like Bitcoin if gold’s rally fades.

XAU/USD yearly performance chart

JPMorgan also notes BTC’s lagging correlation with gold in recent cycles and assumes continued steady ETF inflows, especially if U.S. interest rates begin a prolonged easing cycle.

Standard Chartered: bold $200,000 target

Standard Chartered is the most optimistic among major banks, projecting Bitcoin could reach $200,000 by December. The bank’s thesis is built on sustained average ETF inflows exceeding $500 million per week, increasing institutional adoption, a weakening U.S. dollar, and an improved global liquidity backdrop.

US Bitcoin ETF Weekly Net Flows Chart

For Standard Chartered, the $200,000 scenario represents a structural uptrend based on shifting capital allocations rather than a short-lived speculative spike.

VanEck and cycle-based optimism: $180,000

Asset manager VanEck points to post-halving supply dynamics as a key bullish factor. The April 2024 halving tightened new BTC issuance and, combined with ETF demand and corporate treasury adoption, VanEck sees a pathway toward a $180,000 peak during the 2025 cycle window.

Bitcoin price performance since halving

Historically, Bitcoin cycle peaks have clustered between 365 and 550 days after a halving. At roughly 533 days since the April halving, BTC sits within the historical window that preceded earlier cycle highs — though market outcomes always depend on macro, liquidity, and investor behavior.

Key catalysts to watch

1) ETF inflows and institutional adoption

Spot Bitcoin ETFs are the primary near-term liquidity engine cited by analysts. Continued weekly net inflows can create a structural bid, tightening supply available to spot buyers and boosting market capitalization.

2) Gold-to-Bitcoin capital rotation

Several banks highlight a potential rotation from gold into Bitcoin. If gold’s rally cools after overbought indicators, some capital may seek higher-risk assets with superior upside, benefiting BTC.

3) Macro and Fed policy

A sustained Fed rate-cut cycle and improved global liquidity conditions would likely support risk appetite and make the high-end forecasts more attainable. Conversely, recessionary shocks or tighter-than-expected policy could push prices lower.

How traders should interpret these targets

Price targets from Citi, JPMorgan, Standard Chartered, and VanEck reflect different methodologies: ETF flow modeling, volatility-adjusted comparisons with gold, cycle timing, and institutional adoption scenarios. Traders and long-term investors should treat these ranges as strategic scenarios rather than guaranteed outcomes. Risk management, position sizing, and monitoring ETF flows, on-chain metrics, and macro indicators remain essential.

In short, the dominant narratives supporting higher BTC targets are persistent ETF demand, tighter post-halving supply, and potential capital rotation away from gold — all amplified by institutional adoption trends. While some banks foresee mid-six-figure prices, downside scenarios tied to macro shocks remind market participants that volatility and risk remain integral to Bitcoin investing.

Source: cointelegraph

Leave a Comment