3 Minutes

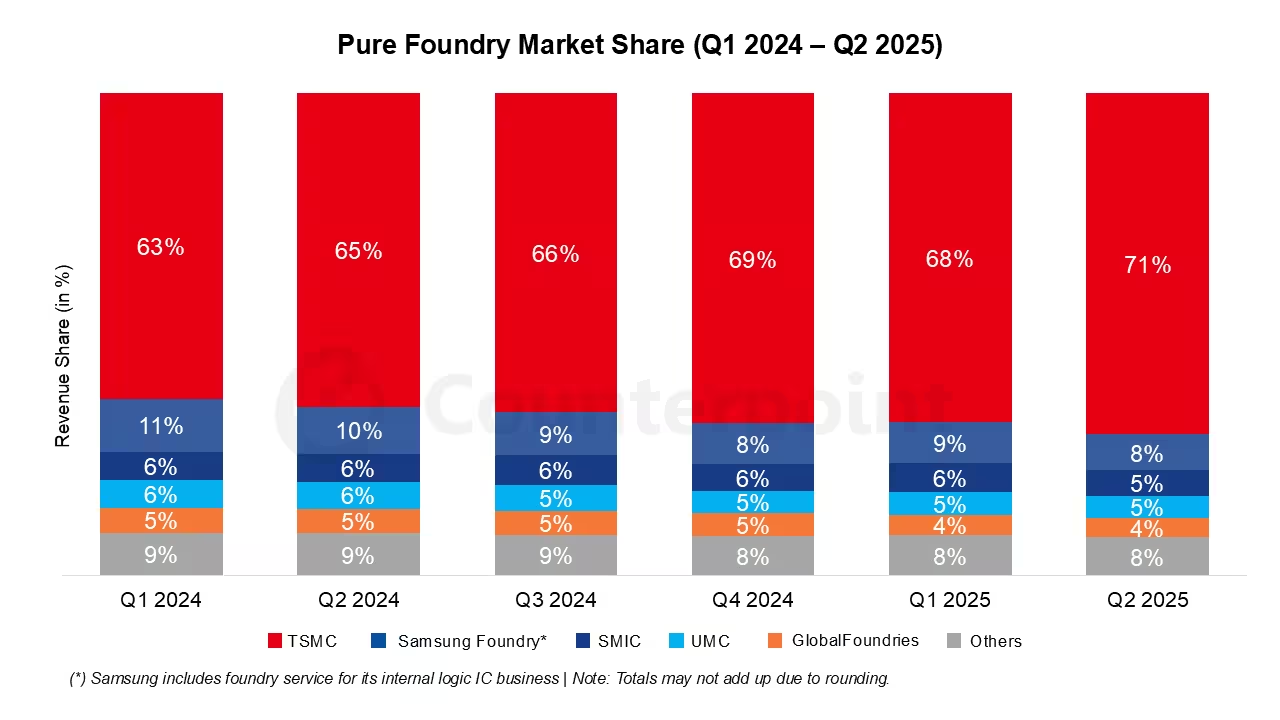

TSMC has widened its lead in the global foundry market, claiming a staggering 71% share. As AI workloads drive demand for advanced nodes, the Taiwan-based chipmaker's dominance is reshaping supplier dynamics and leaving competitors scrambling for relevance.

Why TSMC pulled ahead

According to Counterpoint Research, TSMC added roughly 3 percentage points quarter-over-quarter to reach a 71% share of the pure-play foundry market. That surge isn't accidental — it's the result of sustained investment in cutting-edge process nodes (notably 3nm and 5nm), high-volume manufacturing, and advanced packaging services such as CoWoS.

Imagine large AI customers queuing for wafer capacity that can deliver both performance and efficient power consumption. TSMC’s mix of mature, high-yield nodes and advanced packaging makes it the default partner for firms that include Apple, NVIDIA, AMD and Qualcomm. In short: capability, capacity and client trust.

How the competitive landscape looks

Even with TSMC’s gains, a few players remain in the market, but at much smaller scale. Recent figures put Samsung at about 8% market share, while SMIC and Taiwan’s UMC each sit near 5%. Note that this report focuses on pure-play foundries — companies that primarily manufacture for external customers — so integrated device manufacturers like Intel were excluded.

- TSMC: ~71% (counterpoint: +3pp QoQ)

- Samsung: ~8%

- SMIC: ~5%

- UMC: ~5%

What’s driving customers to stay put?

Switching foundries is expensive and risky. Beyond price, clients look for predictable yields, proven process nodes, and timely capacity — all areas where TSMC has earned long-term trust. Add to that the current AI boom that has pushed utilization rates higher, and you get a situation where many major designers prefer to stick with a known quantity rather than gamble on alternatives.

What this means for AI and chip supply

For the AI industry, TSMC’s dominance means more consistent access to the advanced nodes many neural-network accelerators require. But it also concentrates risk: supply shocks, geopolitical issues, or production hiccups at TSMC could ripple through the entire chip ecosystem. For rivals, the path forward is clear but difficult — invest aggressively in node capability, packaging, and capacity, or pursue niche specializations.

TSMC’s leadership looks set to persist for the near term, given its technological edge and customer relationships. Still, the market’s long-term health benefits from multiple capable foundries — and that’s the challenge competitors will have to solve if they want to close the gap.

Source: wccftech

Leave a Comment