4 Minutes

Weekly NFT Market Snapshot: Volume Falls Despite Buyer Surge

NFT sales volume declined 5.41% to $79.31 million this week, down from $84.44 million the previous period, according to CryptoSlam data. The fall in sales came even as the number of NFT buyers exploded — a nearly 990% jump to 222,294 — and sellers rose 714.77% to 189,963. Transactions, however, slipped 20.92% to 1,097,565, signaling a market with more participants but lower average transaction values.

Key figures at a glance

- NFT sales volume: $79.31M (down 5.41%)

- Buyers: 222,294 (up 989.62%)

- Sellers: 189,963 (up 714.77%)

- Transactions: 1,097,565 (down 20.92%)

Top Collections: Algebra Positions NFT-V2 Rockets, Pudgy Penguins Slides

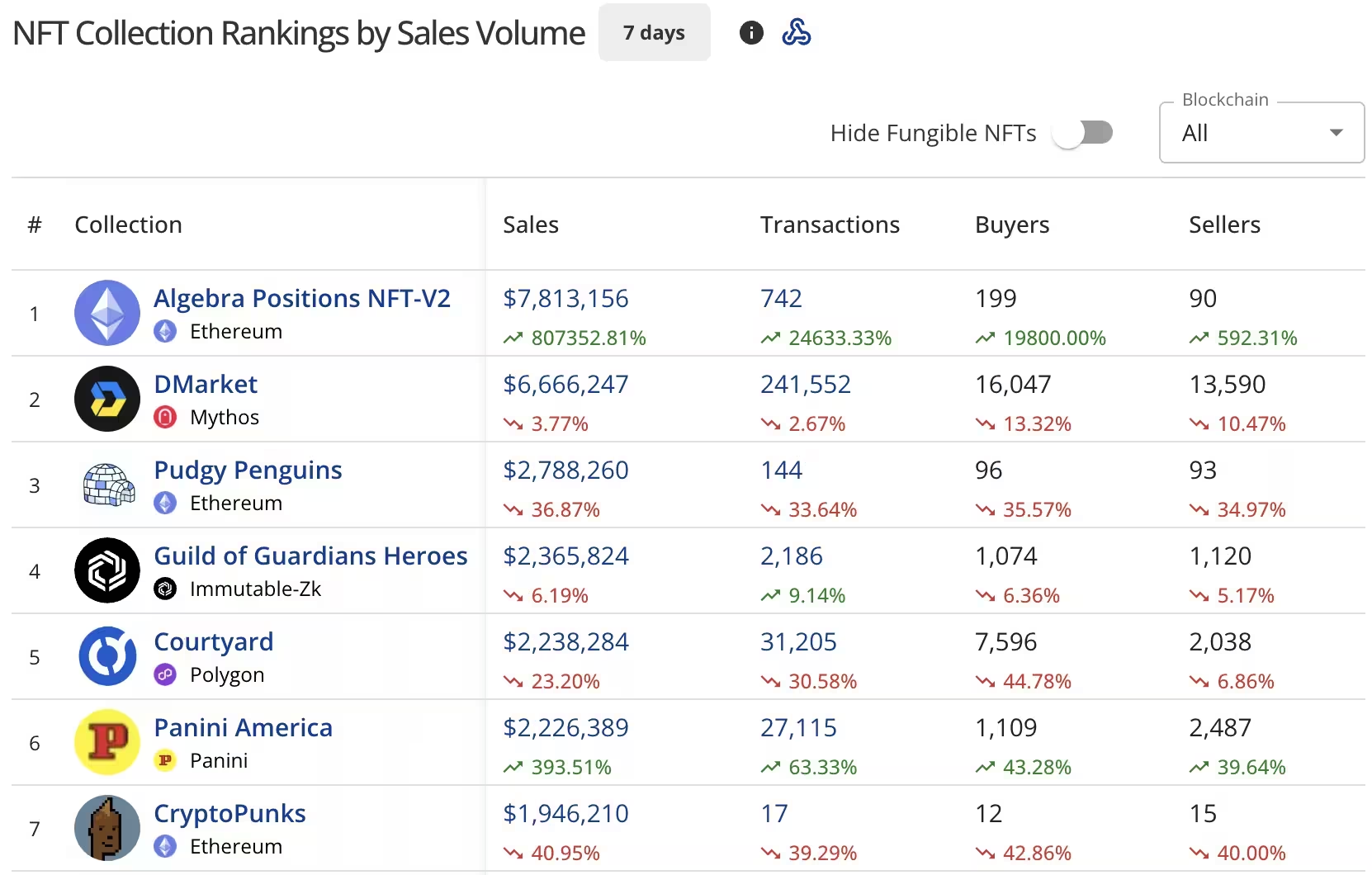

Algebra Positions NFT-V2 on Ethereum surged to the top spot with $7.81 million in sales, an extraordinary climb that registered a reported 807,352.81% surge. The collection processed 742 transactions, involving 199 buyers and 90 sellers — a sign of concentrated high-value activity.

DMarket on the Mythos blockchain slipped to second with $6.67 million in sales, a modest decline of 3.77% from last week. DMarket reported heavy transaction volume: 241,552 transactions with 16,047 buyers and 13,590 sellers.

Pudgy Penguins, once a blue-chip NFT collection, dropped sharply to third place with $2.79 million — plunging 36.87% from last week’s $4.38 million. The Ethereum collection recorded just 144 transactions, with 96 buyers and 93 sellers, reflecting cooling demand.

Top collections by NFT Sales Volume

Other notable movers

- Guild of Guardians Heroes (Immutable-Zk): $2.37M, down 6.19%.

- Courtyard (Polygon): $2.24M, down 23.20% with 31,205 transactions.

- Panini America (Panini blockchain): $2.23M, up 393.51%.

- CryptoPunks: $1.95M, down 40.95% with just 17 transactions.

Blockchain Breakdown: Ethereum and BNB Chain Lead

Ethereum continued to dominate NFT sales with $33.71 million, up 4.68% from last week’s $32.97 million. The network recorded $2.67 million in reported wash trading, bringing the adjusted total to $36.37 million. Buyers on Ethereum rose 69.86% to 21,514, underlining robust interest on the leading NFT chain.

BNB Chain climbed to second with $8.66 million in sales, up 28.21% week over week. The chain reported $174,526 in wash trading, increasing its gross total to $8.83 million. Bitcoin ranked third at $8.18 million, down 15.56% from $9.15 million the week prior.

Mythos Chain placed fourth at $6.84 million, while Solana recorded $5.50 million, an increase of 12.27%. Immutable and Polygon rounded out the top seven, though Polygon’s reported wash trading — $6.63 million — pushed its gross adjusted figure to $9.89 million.

.avif)

Blockchains by NFT Sales Volume

Market context

The NFT slowdown coincided with broader market weakness. Bitcoin has slid toward the $96,000 level as selling pressure mounts, and Ethereum fell below $3,200, extending recent losses. The total crypto market capitalization contracted to about $3.26 trillion from last week’s $3.48 trillion, weighing on speculative NFT demand and driving lower average sale prices.

Top Individual Sales This Week

High-end collectible sales still punctuated the week. Autoglyphs #141 led with a top sale at $199,135.19 (56 WETH) three days ago. Two V1 Wrapped CryptoPunks also posted strong results, selling for $196,267.55 (57 WETH) and $194,923.31 (57.0299 WETH). Other notable sales included CryptoPunks #6207 at $152,619.45 (43.99 ETH) and CryptoPunks #4427 at $131,430.42 (36.9 ETH).

Outlook: What to watch next

Market watchers should monitor floor prices and buyer counts across core collections, along with on-chain signals such as wash trading flags and concentrated wallet activity. Ethereum’s continued dominance, BNB Chain’s resurgence, and Mythos Chain’s strong volume suggest that NFT liquidity is shifting across chains. For traders and collectors, volatility creates opportunities, but due diligence is critical: examine transaction depth, buyer diversity, and potential wash trading before making significant NFT purchases.

As always, NFT and crypto investing carries risks. Follow reliable on-chain analytics, track market-wide liquidity, and consider macro crypto trends when evaluating NFT strategies.

Source: crypto

Comments

labcore

feels kinda overhyped, numbers look noisy and concentrated. nice for whales, bad for casuals. meh

coinflux

wait 990% more buyers but volume down?? is this even real or just wash trading skewing stuff, someone explain pls

Leave a Comment