6 Minutes

NFT market overview: sharp weekly decline despite broader crypto gains

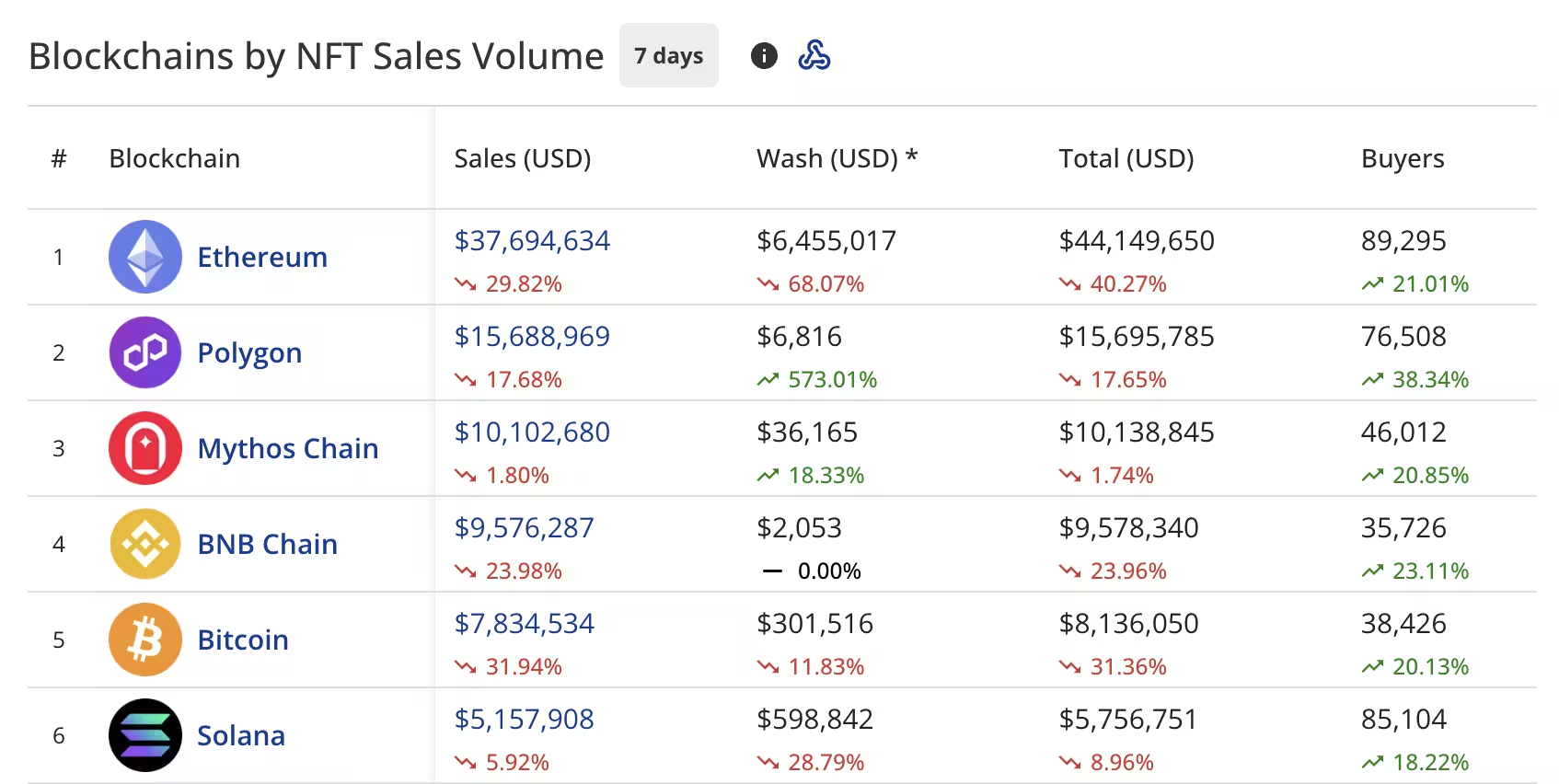

The non-fungible token (NFT) market posted a steep weekly decline, with total sales volume sliding 22.65% to $104.5 million. This marks one of the most pronounced drops in recent months, occurring even as the wider crypto market staged a modest recovery.

Key weekly snapshot

- Total NFT sales: $104.5 million (down 22.65% week-over-week)

- NFT buyers: 622,535 (up 14.89%)

- NFT sellers: 447,821 (up 16.25%)

- NFT transactions: 1,699,318 (down 3.07%)

Market data from CryptoSlam highlights an unusual mix: falling dollar volume and transactions paired with growing buyer and seller participation. That divergence suggests more users are entering the market, but average sale prices and high-value transactions compressed during the week.

Macro crypto context

The pullback in NFT volume comes while major cryptocurrencies experienced small gains. Bitcoin (BTC) recovered toward the $110,000 level, while Ethereum (ETH) held near the $4,300 mark. The total crypto market capitalization rose to about $3.81 trillion from $3.75 trillion the previous week, signaling incremental bullish momentum for the asset class even as NFTs cooled.

Ethereum stays on top but posts large declines

Ethereum-led NFT activity still dominated total sales with $37.7 million, but that represented a 29.88% decline compared with the prior week. Notably, reported wash trading on Ethereum plunged by 68.03% to $6.4 million, indicating a material reduction in potentially manipulative or circular volume on the chain.

Other chains: Polygon, Mythos, BNB, Bitcoin, Solana

- Polygon (POL, formerly MATIC) held second place with $15.7 million in sales, down 17.43%. Polygon also led growth in buyer participation, with a 38.34% increase in buyers week-over-week.

- Mythos Chain ranked third at $10.1 million in sales, a modest decline of 1.73%.

- BNB Chain recorded $9.5 million (down 23.59%), while Bitcoin-native NFTs totaled $7.8 million (down 32.40%).

- Solana (SOL) came in sixth with $5.1 million, down 6.81%.

Buyer counts rose across the major blockchains, with BNB Chain buyers increasing 23.11% and Ethereum buyers growing roughly 21%. The mix of rising participant counts and falling volumes suggests buyers may be pursuing lower-priced listings or experimenting with smaller transactions.

Top NFT collections and notable movers

Collections leaderboard

- Courtyard (Polygon) retained the No. 1 collection spot with $14.6 million in sales, though sales declined 17.41%. The collection saw explosive seller growth (+333.68%) while buyers dropped 18.39%, pointing to saturation among holders or heavy turnover by existing owners.

- CryptoPunks held second place with $8 million in sales, bucking the broader market with modest growth of 4.73%.

- DMarket ranked third with $4.8 million (down 4.81%).

- DKTNFT on BNB Chain rose to fourth with $3.9 million, up 7.84%.

- Panini America entered the top five with $3.1 million, surging 46.16% as interest in sports trading cards continues to fuel secondary-market demand.

- Guild of Guardians Heroes rounded out the top six with $2.8 million, down 27.50% and showing declines across participation and volume metrics.

CryptoPunks stood out as a rare green performer in an otherwise soft market, maintaining liquidity and high-value sales that continue to draw collector attention.

High-value NFT transactions this week

Notable single-item sales underlined where collectors still allocate capital despite the broader slowdown:

- CryptoPunks #5898 — sold for 100 ETH (~$445,786)

- CryptoPunks #843 — sold for 90.1 ETH (~$403,268)

- CryptoPunks #9721 — sold for 81 ETH (~$361,995)

- CryptoPunks #490 — sold for 80 ETH (~$345,757)

- Known Origin #88512 — sold for 70 ETH (~$307,384)

These headline transactions show that premium blue-chip NFT assets continue to trade at significant prices, even as aggregate market volumes compress.

What the metrics imply for traders, collectors and projects

The current data paints a mixed picture for participants in NFTs and digital collectibles. Volume and average sale values have slipped meaningfully, but increased buyer and seller counts indicate sustained interest and onboarding activity. Key takeaways for market participants:

- For collectors and long-term holders: High-value blue-chip items such as CryptoPunks remain liquid and can still command robust prices. Recent sales highlight ongoing collector demand for iconic NFTs.

- For creators and projects: Growing seller counts on collections like Courtyard suggest supply-side pressure. Projects may need to focus on utility, community benefits, and curated drops to maintain pricing power.

- For traders: Falling wash trading volumes on Ethereum reduce noise in on-chain signals, but lower overall liquidity can increase slippage on larger orders. Watch orderbook depth on marketplaces and chain-specific activity.

- For market observers: Rising participation with falling monetary volume often precedes renewed price discovery as new cohorts enter at lower price points. Monitor buyer retention and whether increased participants translate into higher secondary-market spending.

Outlook: cautious optimism

NFT markets are demonstrating resilience in participation metrics while reconsolidating in dollar volume. With broader crypto markets inching higher, the stage is set for a potential rebound if macro momentum continues and collectors return to higher priced assets. For now, the market environment favors selective buying of blue-chip collections, careful assessment of wash trading indicators, and attention to chain-level dynamics across Ethereum, Polygon, BNB Chain, and Solana.

Investors and collectors should track weekly volume trends, wash trading figures, and buyer-seller ratios to separate transient noise from sustainable demand shifts in the evolving NFT ecosystem.

Source: crypto

Leave a Comment