5 Minutes

GM tells thousands of suppliers to end China sourcing — and fast

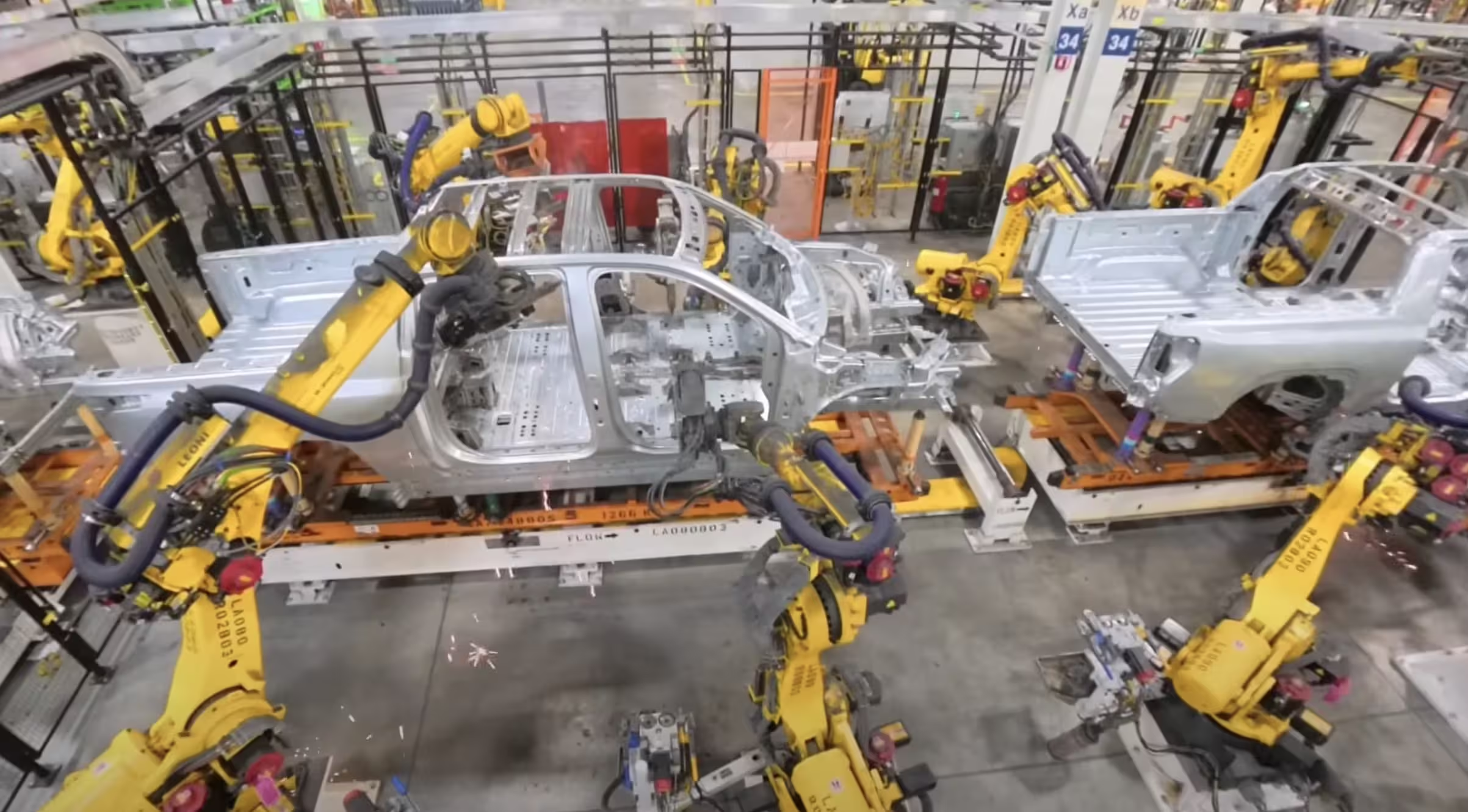

General Motors has quietly instructed thousands of its suppliers to phase out parts and raw materials sourced from China, signaling a major shift in how one of the world's largest automakers manages supply chain risk. The move — which industry insiders say could see some vendors sever China ties as soon as 2027 — reflects mounting concern over geopolitical disruption, tariffs, export controls and concentrated supply of critical materials like rare-earths and semiconductors.

Why this matters for the auto industry

China has been a cornerstone of global automotive supply networks for decades, particularly for lighting, electronic modules, custom tooling and many EV components. That dependence made manufacturers vulnerable to sudden policy changes, export restrictions and shipping shocks. GM’s directive is part of a broader push to increase supply chain resiliency and to source more parts closer to where vehicles are assembled — especially in North America.

According to people familiar with the plan, GM started asking suppliers to identify alternatives in late 2024, but the program accelerated through spring 2025 amid rising trade tensions between Washington and Beijing. While the automaker prefers North American suppliers for cars built in the region, it’s also open to vetted alternatives outside China, so long as they meet regulatory, logistical and quality standards.

Practical steps GM has already taken

Longstanding investments underscore the company’s intent to reduce reliance on a single source:

- Equity and development in a Nevada lithium mine to secure battery-grade materials.

- Partnerships with U.S.-based rare-earths firms to lock in supply of materials used across EV motors and sensors.

- Broadening supplier searches beyond China for components previously sourced almost exclusively from Asia.

GM executives have framed this shift as evolving beyond a purely cost-driven procurement strategy. “Resiliency matters — you need control and visibility across your supply chain,” said GM’s global purchasing chief at a recent conference. CEO Mary Barra has reiterated that the company prefers sourcing where vehicles are built whenever feasible.

Which parts are most at risk — and which will be hardest to replace?

Not all vehicle components are equally affected. Segments dominated by Chinese suppliers are the most difficult to relocate quickly:

- Lighting assemblies and LED modules

- Electronics and infotainment modules

- Custom tooling and specialized stamping

- Some EV battery supply-chain inputs, including magnets tied to rare-earths

Semiconductors are another pinch point. Recent incidents — such as an abrupt halt in chip shipments tied to supplier disputes — highlighted how intellectual property and legal conflicts can ripple through production lines.

Supplier and industry reaction

For many tier suppliers, reworking decades-old relationships is a major undertaking. “Suppliers are scrambling,” said an executive at a major parts maker. Industry bodies warn that reversing supply networks that were built over 20 to 30 years can’t be completed overnight. Automakers and suppliers must balance costs, capacity and speed as they attempt to reconfigure sourcing without jeopardizing vehicle availability or profitability.

Key challenges include:

- Finding qualified manufacturing partners outside China at scale

- Meeting stringent automotive validation and regulatory timelines

- Potential near-term cost increases for components and logistics

Geopolitics, trade policy and the business case

The directive comes amid a volatile policy backdrop. Talks between U.S. and Chinese leaders led to partial tariff rollbacks in late 2025, but automakers remain cautious. Past tariff moves and Beijing’s export controls on rare-earths illustrated how quickly supply conditions can change. For GM, the calculus is partly strategic: reducing exposure to geopolitical risk while still maintaining efficient production and competitive vehicle pricing.

For consumers and the broader market, this could mean mixed outcomes: stronger, more secure supply lines in the long run, but potential price pressure or limited feature availability on some models in the short term if alternative suppliers are more expensive or capacity-constrained.

What comes next?

Expect a multi-year transition. GM’s push will likely accelerate investments in local manufacturing, spark new supplier qualification programs, and encourage consolidation among tier suppliers that can invest to meet North American demand. Regulators and policymakers — particularly in countries offering reshoring incentives — will play a role, too.

Highlights:

- Some suppliers face a 2027 timeline to cut China ties.

- GM is prioritizing North American sourcing for vehicles built in the region.

- The strategy spans both EV-critical materials and many conventional parts.

GM’s move is a clear signal to the industry: automakers are actively rewiring sourcing strategies to manage geopolitical risk. For car enthusiasts and fleet buyers, the long-term goal is supply stability and consistent vehicle availability — even if the short-term route to get there is bumpy.

Source: autoevolution

Comments

mechbyte

Is this even doable by 2027? Seems like semiconductors and rare earths alone will bottleneck things. Who eats the extra cost, buyers or investors? hmm

v8rider

Whoa, big move by GM... supply chains rewired, huh? Hope they planned the scale, suppliers can't flip overnight, could get messy and pricey, tbh

Leave a Comment