3 Minutes

Nvidia reported a blockbuster quarter as demand for its AI chips outpaced expectations. The company said some AI GPUs have sold out, while its datacenter business grew by $10 billion in just three months.

Blackwell rush: cloud GPUs sell out

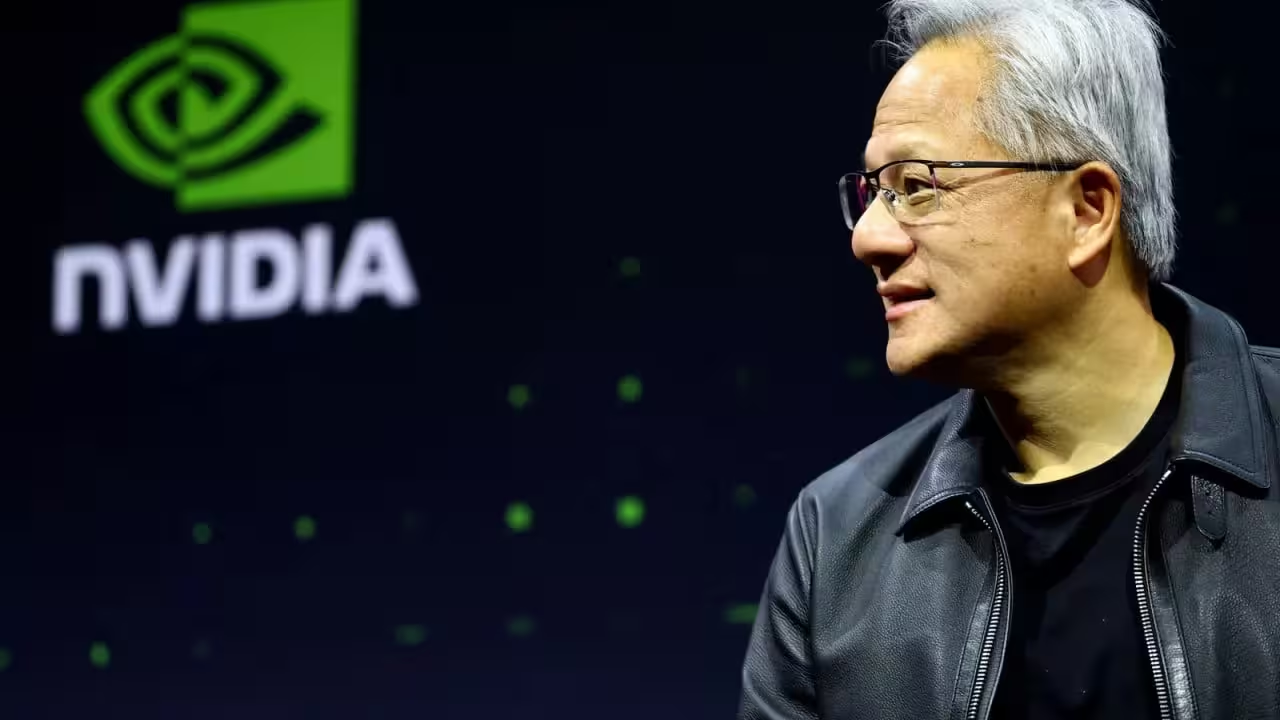

In its Q3 2026 earnings report, Nvidia said it sold more AI chips than ever before, beating Wall Street forecasts and setting a new revenue record of $57 billion. CEO Jensen Huang described Blackwell sales as "unprecedented," adding that the company’s cloud GPUs are currently sold out. He also reassured investors that Nvidia still has a large stock of Blackwell chips and plans to ship more.

Numbers that turn heads

The datacenter division — the engine behind Nvidia’s AI surge — generated $51.2 billion in revenue, a 66% year-over-year increase. Overall revenue hit $57 billion for the quarter, which the company noted equates to roughly $4,000 in net profit every second. Nvidia expects even stronger results next quarter, forecasting $65 billion in revenue and requiring roughly another $8 billion of growth to hit that target.

Why investors are watching the AI bubble conversation

Talk of an "AI bubble" has circulated across markets, but Huang pushed back during the investor call, saying, "There's a lot of talk about an AI bubble. From our point of view, it's something completely different." He repeated Nvidia’s long-standing view that AI will be transformative, predicting a shift toward physical, agent-driven AI systems that will create major new markets.

- Quarterly revenue: $57 billion

- Datacenter revenue: $51.2 billion (up 66% YoY)

- Datacenter growth this quarter: +$10 billion

- Gaming revenue: up 30% YoY — a positive sign for Blackwell GPUs

- Q4 revenue target: $65 billion

Market moves and outside pressure

Despite the upbeat report, some major investors moved to liquidate positions this week — SoftBank and tech investor Peter Thiel reportedly sold all their Nvidia shares. Still, Nvidia appears confident in continued datacenter traction, driven largely by its Blackwell Ultra chips and sustained enterprise demand for AI infrastructure.

Whether you're tracking hardware supply constraints, revenue records, or the broader AI market narrative, Nvidia’s latest quarter shows how central AI chips have become to the company’s growth — and to the industry at large.

Leave a Comment