4 Minutes

Altcoin season remains elusive as market-wide fear persists

The long-anticipated altcoin season has not materialized as traders and investors confront a market still dominated by Bitcoin and marked by elevated fear. The Altcoin Season Index has dropped sharply in recent months while the Crypto Fear and Greed Index remains firmly in the red, a combination that typically slows altcoin gains and pushes capital back into Bitcoin and stablecoins.

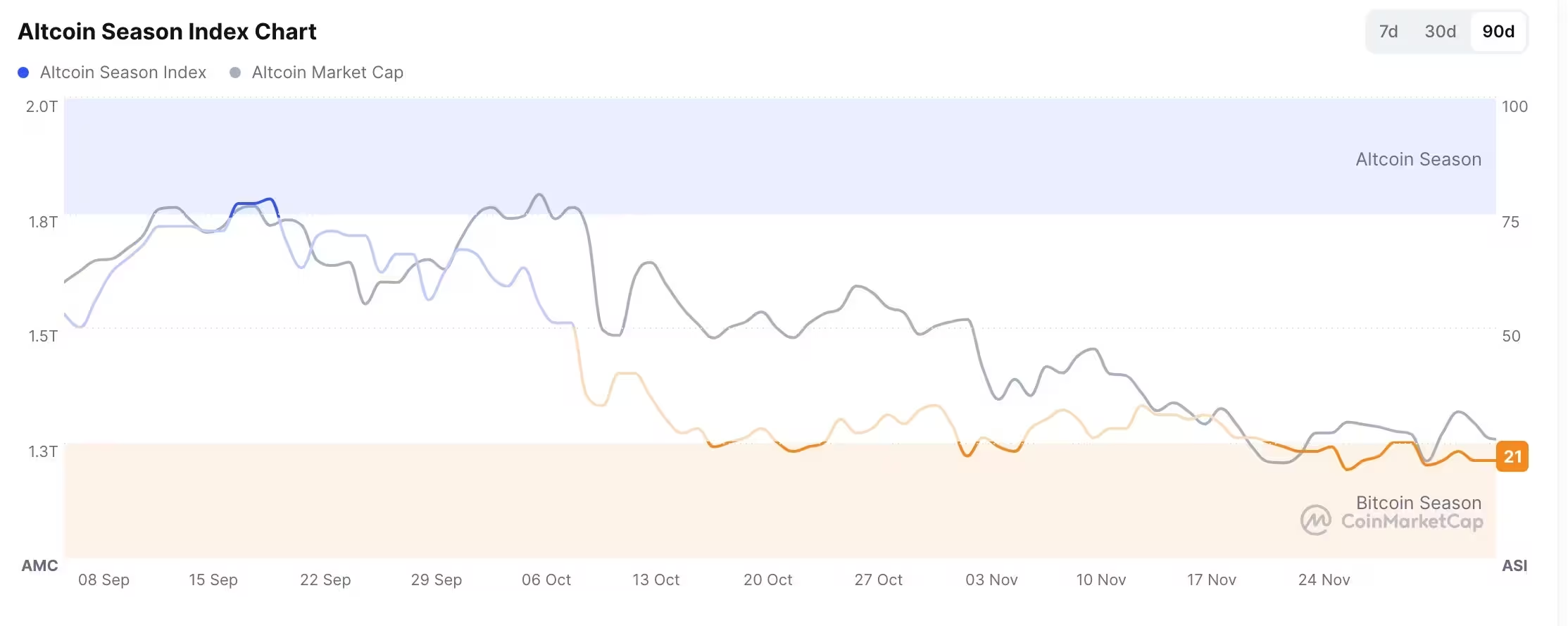

Altcoin Season Index slides amid broad underperformance

Data from CoinMarketCap shows the Altcoin Season Index has fallen to 21, down from a July high of 55. That decline reflects widespread underperformance across many layer-1 tokens, memecoins, and niche projects. Tokens including Double Zero, Story, Celestia, Ethena, Pudgy Penguins, Cronos, Aptos, and Arbitrum have all lost more than 60% over the last three months, highlighting how fragile speculative altcoin positions have become in this cycle.

Altcoin Season Index

Bitcoin dominance climbs while Ethereum market share slips

As altcoins slide, Bitcoin Dominance has risen sharply — from about 37% in January to roughly 58% today. Ethereum dominance, meanwhile, has declined from a year-to-date high near 20% to about 11%. Historically, prolonged Bitcoin strength or dominance tends to suppress broad altcoin rallies because capital recirculates into Bitcoin during periods of uncertainty or risk-off sentiment.

Crypto Fear and Greed Index signals caution

Market psychology has also shifted toward risk aversion. The Crypto Fear and Greed Index sits around 21, indicating pronounced fear. That metric correlates with on-chain behavior: futures open interest has fallen from approximately $225 billion in October to near $122 billion as traders deleveraged after a major liquidation event on October 10 wiped out over $20 billion. Funding rates have flattened, suggesting less speculative long exposure across derivatives markets.

.avif)

Crypto Fear and Greed Index

Investor commentary has compounded the cautious tone. Prominent voices have warned that many smaller altcoins face structural challenges, and some argue only Bitcoin and Ethereum will retain meaningful long-term value. Meme coins such as Shiba Inu and Pepe have been particularly hard-hit, magnifying losses for retail traders who chased short-term momentum.

Possible catalysts for a future altcoin rebound

Despite the current red readings, historical patterns show that strong altcoin seasons can begin from deeply negative readings on both the Altcoin Season Index and the Fear and Greed Index. Several potential catalysts could rekindle risk appetite: expectations for Federal Reserve rate cuts, improving macro liquidity conditions, and seasonal market behavior such as a Santa Claus rally that often lifts both equities and crypto markets.

Traders looking to prepare for a possible altcoin resurgence should monitor Bitcoin dominance, on-chain flows, derivatives open interest, and the funding rate environment. Diversified position sizing, risk management, and selective exposure to high-quality layer-1 and DeFi projects may offer better risk-adjusted opportunities than indiscriminate bets on low-liquidity memecoins.

Bottom line

Altcoin season is delayed for now as market sentiment remains cautious and Bitcoin dominance climbs. However, historically, deep fear and low altcoin readings have preceded strong recoveries. Key macro events — notably central bank policy moves and year-end liquidity flows — will likely determine whether altcoins regain momentum in the coming weeks.

Source: crypto

Leave a Comment