8 Minutes

Bitcoin and equities diverge in the second half of 2025

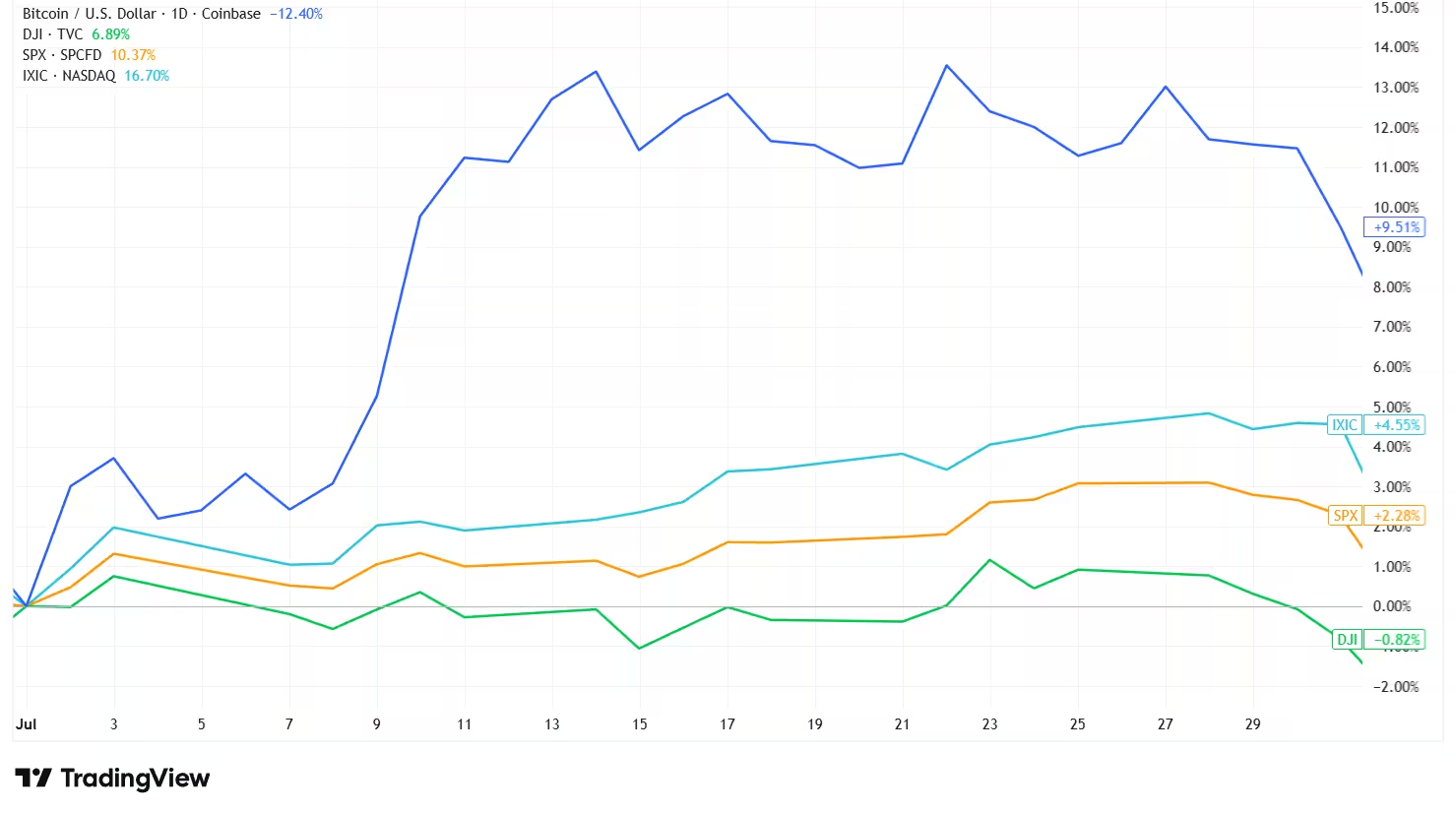

Throughout the second half of 2025, Bitcoin's path increasingly separated from conventional equity markets. While major US stock indices rallied on expectations of easier monetary policy, Bitcoin experienced a pronounced correction after its summer all-time highs. That split has reshaped how traders, institutional investors and crypto-native participants view BTC's correlation to traditional assets.

Macro backdrop: Fed rate cuts and mixed risk appetite

The US Federal Reserve delivered multiple rate cuts in the latter half of 2025, reinforcing optimism across stocks. The Fed’s third cut of the year in early December helped lift equities even as Bitcoin slipped and later staged a rebound. The dislocation between crypto and equities highlights an evolving market structure where capital flows into digital assets are no longer perfectly synchronized with traditional risk-on rallies.

Month-by-month: Events that widened the gap

July — GENIUS Act fuels crypto optimism

July saw equities rise on healthy earnings and robust risk appetite. Trade-related headlines briefly rattled markets but attention quickly returned to corporate fundamentals. On July 9, Nvidia reached a $4 trillion valuation and the S&P 500 and Nasdaq posted fresh highs even after US tariff announcements.

Crypto markets benefited as well: Bitcoin closed July up 8.13%, its strongest monthly gain in the back half of the year to that point. The signing of the GENIUS Act into law injected renewed confidence, particularly for stablecoin businesses and regulatory clarity — a catalyst for both retail and institutional allocators.

Equities crab walk, while Treasurys and stablecoins lift crypto

August — Monetary outlook and Ether’s surge

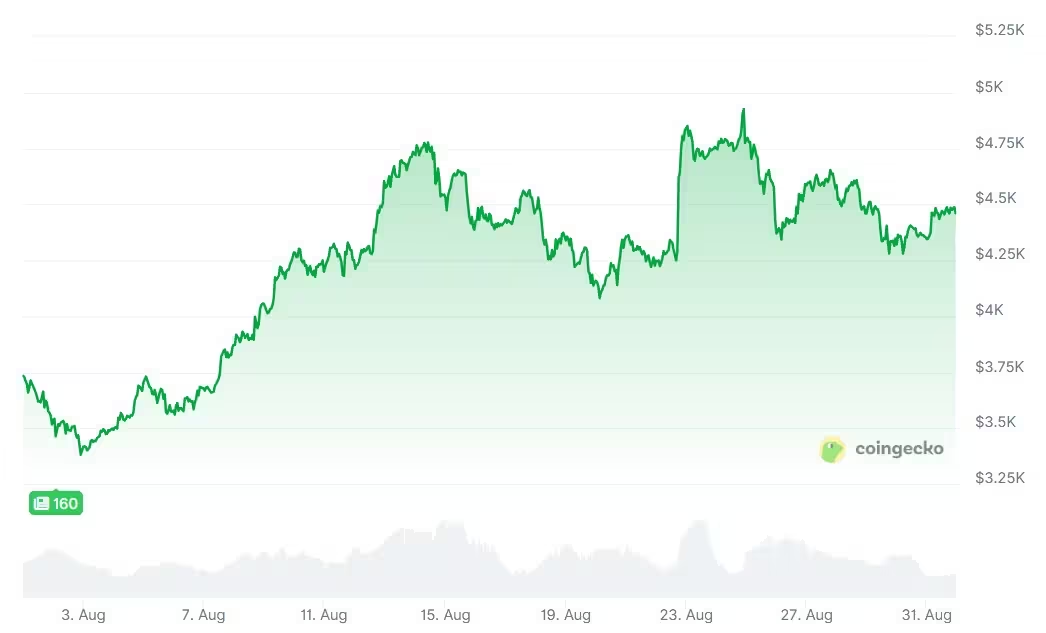

August was dominated by expectations of Fed easing. As the US dollar softened and risk-on flows intensified, Bitcoin climbed to a new all-time high near $124,000 on Aug. 14. The Jackson Hole symposium and Fed Chair Jerome Powell’s dovish signals later in the month strengthened the view that rate cuts were coming, which helped push Ether to record levels.

Equities advanced, but Bitcoin could not sustain peak momentum. After a brief spike post-Powell, BTC began a larger correction, diverging from the broader market rally by the end of August. Bitcoin closed the month down 6.49% from earlier highs.

The Fed’s dovish signal sends Ether to new highs

September — Historic ‘red September’ avoided

September is traditionally Bitcoin’s weakest month, yet in 2025 BTC bucked that history and posted gains for a third straight September. The Fed’s first 25-basis-point rate cut, prompted by cooling labor data, supported risk assets and aided a modest recovery for crypto. Bitcoin ended the month up roughly 5.16% as equities continued their third-quarter advance.

October — Liquidations and political shocks

October began positively with another Bitcoin all-time high on Oct. 6, but the month quickly turned turbulent. A massive liquidation event erased about $19 billion in leveraged positions — the largest in Bitcoin’s history — driven by futures-based mechanics and a price glitch on a major exchange.

The immediate trigger was a high-profile social media post threatening 100% tariffs on Chinese imports. The comment stoked a risk-off move across markets and amplified forced liquidations across leveraged crypto positions. Although equities recovered from the trade shock, Bitcoin’s downturn intensified and the asset posted a negative October after years of historically strong autumn performance.

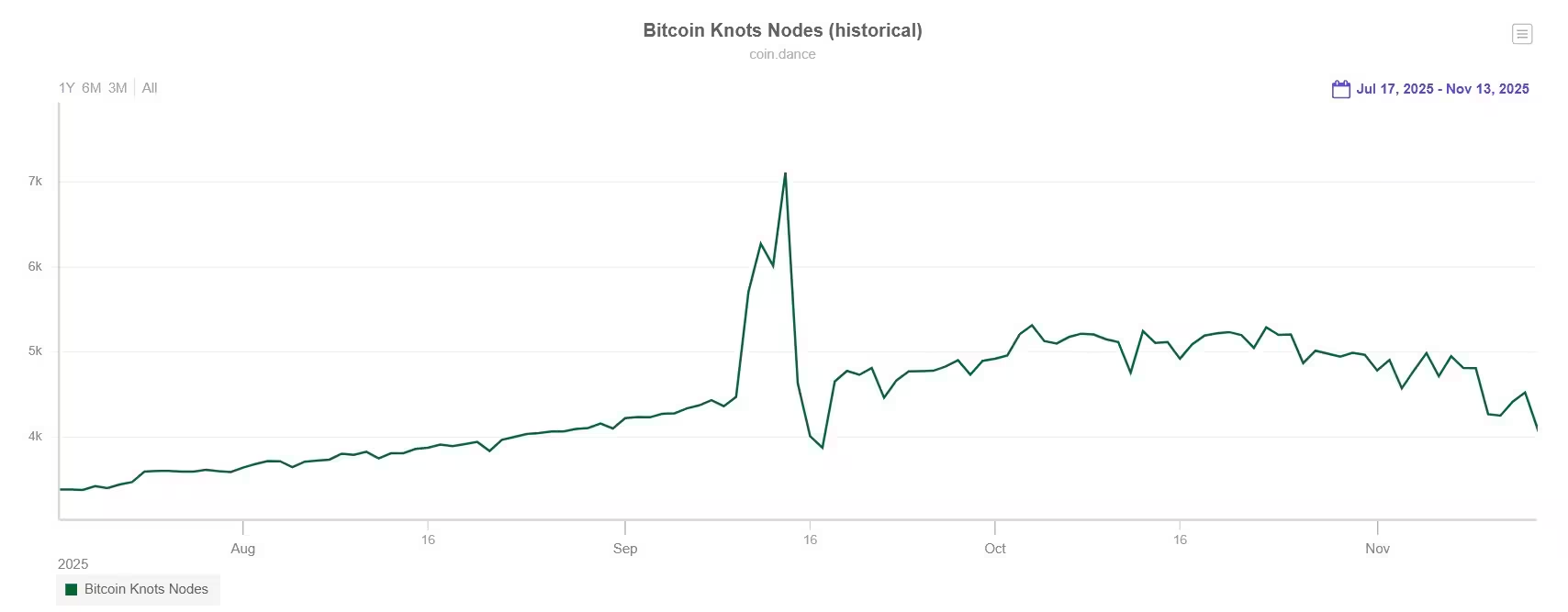

Bitcoin’s upgrade divides the community as Knots nodes rise as alternatives

November — Shutdown resolution but deepening crypto sell-off

November has often been Bitcoin’s strongest month on average, yet in 2025 it delivered BTC’s worst monthly performance. Selling pressure deepened and drove prices below $100,000 mid-month, leaving Bitcoin down roughly 17.67% for November.

Equities, by contrast, largely traded sideways as the US government shutdown finally concluded and investors balanced AI enthusiasm with valuation concerns. Strong earnings from Nvidia later in the month helped stabilize tech equities, highlighting how different catalysts were driving equities and crypto markets.

November is historically Bitcoin’s best month, but it was the worst month of 2025

Key market structure drivers behind the decoupling

1. Increased futures and leverage exposure in crypto

Crypto markets’ heavy reliance on derivatives and leverage magnified downside moves. When liquidations cascade, price declines can accelerate independently of equities. The October $19 billion washout demonstrated how structural elements of crypto trading — perpetual swaps, concentrated leverage and exchange-specific glitches — can trigger volatility that isn’t mirrored in traditional markets.

2. Regulatory shifts and on-chain debates

Regulatory progress like the GENIUS Act supported crypto sentiment in July, but governance discussions within Bitcoin’s developer and node operator communities introduced new frictions. A contentious upgrade proposal to relax limits on arbitrary data embedded on-chain divided participants. The debate increased adoption of alternative Bitcoin implementations such as Bitcoin Knots among users wary of certain changes to Bitcoin Core.

3. Differing investor bases and capital flows

Although institutional allocation to digital assets is rising, many new entrants are equity-focused investors treating crypto as a risk asset within broader portfolios. At the same time, retail and crypto-native flows respond to on-chain signals, DeFi activity and token-specific developments. Those differing drivers can cause BTC to diverge from stocks — particularly when macro headlines favor equities while crypto-specific news points negative.

Milestones, price targets and outlook into year-end

Despite its retreat, Bitcoin marked several milestones in 2025 — including multiple all-time highs and the avoidance of September’s historic weakness for a third consecutive year. By early December, BTC had posted a modest recovery and was up about 2% for the month at the time of reporting, while major equity indexes also recorded moderate gains.

Analyst revisions and market expectations

Optimism for a year-end BTC surge cooled among some forecasters. Major banks and institutional research teams adjusted targets: Standard Chartered, for example, cut its year-end projection from $200,000 to $100,000 and pushed long-term targets farther into the future. These revisions reflect not only price action but also a recalibration of macro assumptions and adoption timelines.

What traders should watch

Key indicators to monitor include Fed guidance on rates, institutional flows into spot and futures markets, on-chain metrics (such as active addresses and exchange net flows), and developments in stablecoin regulation. Exchange stability and derivatives market structure also remain critical — a single platform glitch has previously cascaded into industry-wide liquidations.

Conclusion: A more nuanced correlation story

Bitcoin’s second-half 2025 path demonstrates that correlation between crypto and equities is dynamic and context dependent. While traditional investors increasingly allocate to digital assets, Bitcoin can still decouple sharply when crypto-specific structural risks, governance debates, or leverage-driven liquidations dominate the market narrative. For traders and institutional allocators, the takeaway is clear: treat correlation as conditional, monitor on-chain and off-chain risk factors, and factor in crypto’s unique market microstructure when building allocation and risk-management strategies.

Source: cointelegraph

Comments

DaNix

Pretty balanced take but feels overfocused on price action.. not enough on user growth and real adoption, imo

blockzen

Is BTC really decoupling or just flashing cuz leverage/exchange mess? Curious how much was glitch vs real flow, seems messy

Leave a Comment