5 Minutes

Crypto market capitalization falls to eight-month low

The total crypto market cap slipped to $2.93 trillion in late trading, the lowest level since April, according to CoinGecko data. That drop erases much of 2025 gains and leaves the industry roughly 14% below its value at the start of the year. Since peaking near $4.4 trillion in early October, total market capitalization has declined around 33%, reinforcing growing concerns that a prolonged bear phase may be unfolding.

Range-bound movement and recent history

After hitting a 2025 low of $2.5 trillion on April 9, the market staged a recovery to fresh highs six months later. But from March 2024 onward the crypto market cap has largely traded within a range, and current prices have moved the index back toward the midpoint of that band. Volatility remains elevated across major assets, with Bitcoin and large-cap altcoins driving much of the directional momentum.

Macroeconomic catalyst: Bank of Japan rate hike

A key event this week was the Bank of Japan raising its policy rate to 0.75% on Friday morning, a move that analysts say could pressure risk assets. MN Fund co-founder Michaël van de Poppe warned that short-term pain may continue until the BOJ decision is fully discounted by markets. Despite those concerns, Bitcoin recorded a 2.3% intraday gain following the announcement, illustrating the market's mixed reactions to macro news.

Analyst outlook and short-term risk

Van de Poppe suggested that BTC could cascade into a capitulation phase over the next 24 hours, which could translate into steep 10% to 20% corrections for many altcoins before a quick rebound. Other strategists point to reduced risk appetite among retail and short-term leveraged traders as a driver of this pullback.

Pullback may reveal accumulation opportunities

Nick Ruck, director of LVRG Research, told Cointelegraph that the decline largely reflects macroeconomic pressures and a near-term reduction in risk appetite. However, Ruck emphasized that these retracements can create buying windows for fundamentally strong blockchain projects and tokens that continue to attract institutional capital. For long-term investors, disciplined accumulation during such phases often improves risk-reward profiles.

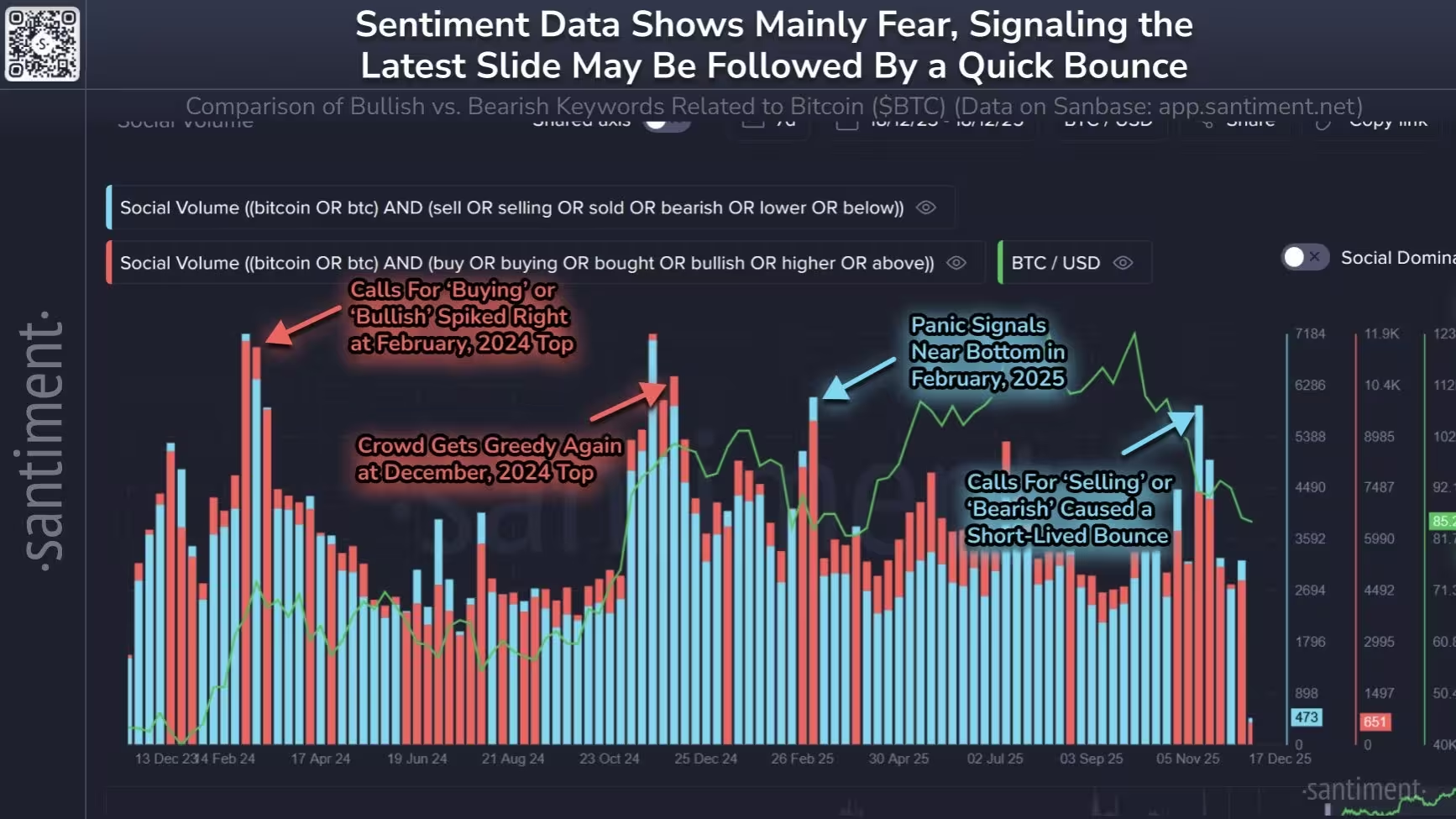

Social sentiment and the Fear & Greed Index

Blockchain analytics firm Santiment reported social sentiment back at fear levels, highlighting bearish commentary following a rapid pump-and-dump move. Santiment noted that Bitcoin briefly rallied to $90.2K and then retraced to $84.8K, a pattern that stoked negative chatter across social channels.

"Commentary is mainly showing fear after Bitcoin bounced to $90.2K yesterday, and then quickly retraced to $84.8K," Santiment said, adding that historically a dominant bearish retail narrative can precede price reversals.

Social sentiment at bear market levels could cause a quick bounce

The crypto Fear & Greed Index was at 16, signaling extreme fear, and has remained in the fear band below 30 since early November. Such readings often coincide with heightened volatility but can also mark attractive entry points for patient traders and institutional allocators looking to buy quality exposure at discounted valuations.

What traders should watch next

Market participants will be watching central bank cues, especially follow-up commentary from the BOJ, U.S. inflation and employment data, and on-chain signals like exchange flows and active addresses. Short-term traders should manage risk given the potential for swift moves in Bitcoin and altcoins, while longer-term investors may find selective opportunities in fundamentally resilient projects as the sector matures.

Conclusion

The recent drop in total market capitalization to an eight-month low underscores persistent macro-driven volatility and subdued sentiment. While analysts warn of more downside ahead, the correction also opens potential accumulation windows for well-capitalized projects and investors with a longer time horizon. Monitoring sentiment indicators, macro policy decisions, and on-chain metrics will be key as the market navigates this turbulent phase.

Source: cointelegraph

Comments

coinflux

i lived through 2018 dips, same vibes. Strong projects bounced back. Good time to pick winners if you're patient. Volatility brutal tho, keep stops tight and some dry powder

opticore

Is the BOJ really the main cause? Feels like a scapegoat tbh. Markets just fragile, maybe liquidity draining or pump unwind? idk..

Leave a Comment