4 Minutes

Solana price prediction: will SOL keep $125 into late 2025?

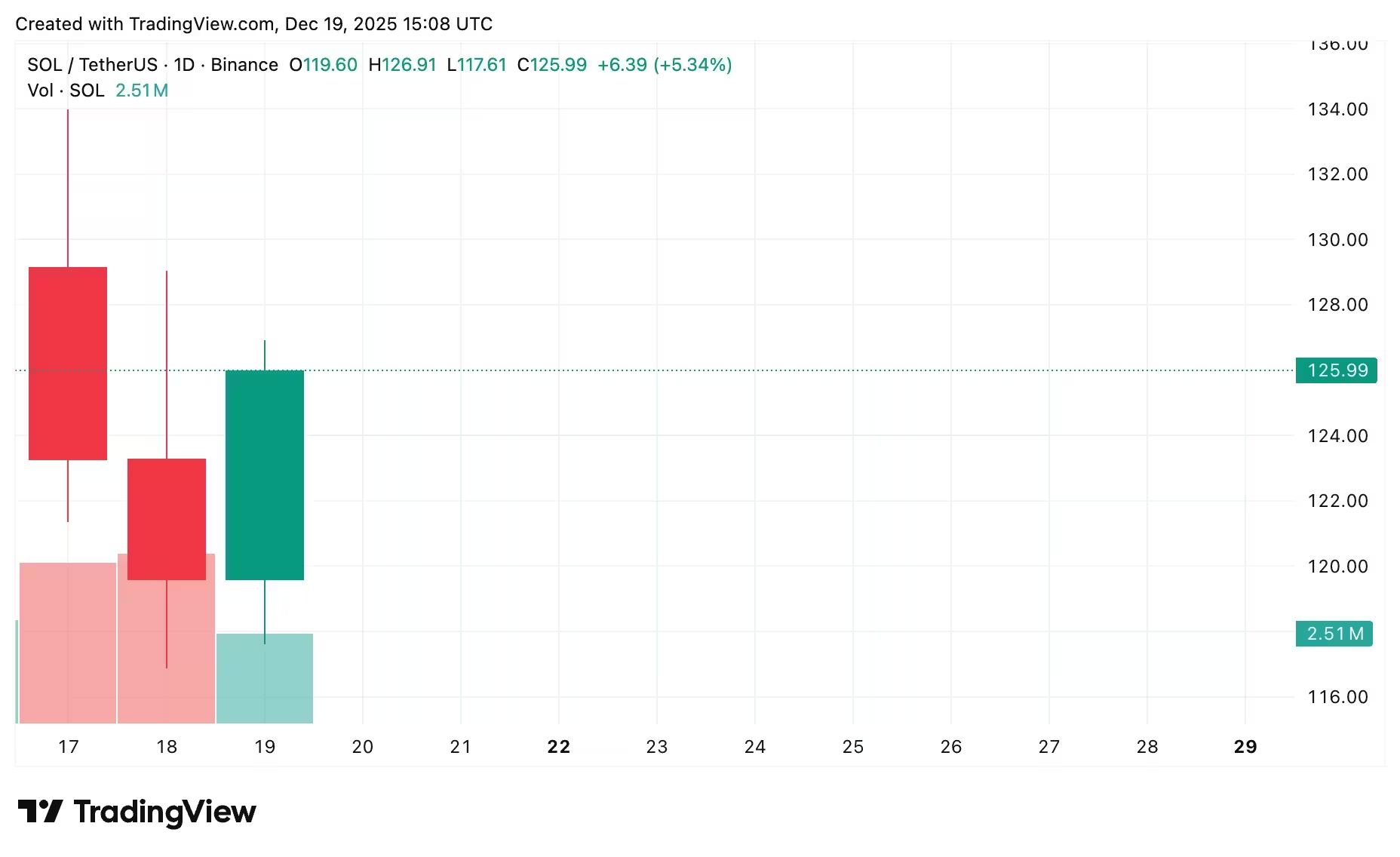

As 2025 draws to a close, Solana (SOL) is trading in a narrow band that highlights growing caution among crypto traders. After months of sharp swings, SOL currently sits just above the psychologically important $125 level. This article examines the current market setup, upside targets, downside risks, and the technical triggers that could determine whether $125 holds as a meaningful support for Solana.

Current market scenario

Solana is hovering near $125.9 after a recent sell-off that erased nearly 10% from its weekly value. That drop followed U.S. CPI data showing slower-than-expected inflation, prompting profit-taking and a reduction in risk exposure across crypto markets. Despite this pressure, a modest daily gain suggests buyers are testing the lows and weighing their next moves.

SOL 1-day chart, December 2025

Over the past year, SOL has oscillated mostly between $125 and $250, repeatedly returning to the lower bound of that range. This repeated reversion has elevated $125 from a round number to a technical support level watched closely by traders. On-chain metrics remain resilient in many areas—network activity and developer growth are supportive fundamentals—but momentum indicators have cooled, implying near-term moves will be driven by volume and macro headlines.

Upside outlook

If the $125 level holds, the most plausible bullish path points toward a test of the $150–$160 zone. That area has historically attracted heavy trading and could act as a profit-taking region for short-term holders. For a sustainable rally, however, SOL needs to see expanding volume, improving momentum, and confirmation from broader crypto leadership—Bitcoin and Ethereum strength often fuels risk-on flows that lift altcoins like Solana.

Key catalysts for a rally

- Higher trading volume and increased buy-side liquidity around $125.

- Positive macro signals, such as weaker recession fears or bullish ETF inflows.

- Renewed developer activity and on-chain demand for Solana-based projects.

Downside risks

Failure to defend $125 could open a pathway to $110–$120 as the next meaningful support range. A decisive break below $110 increases the probability of a deeper sell-off toward sub-$100 levels. Such moves can trigger stop-loss clusters and forced liquidations, amplifying volatility and accelerating price declines.

What could trigger a drop?

- Negative macro surprises, such as hotter-than-expected CPI, that push interest rates higher.

- Loss of market confidence leading to lower liquidity and larger bid-ask spreads.

- Technical breakdowns that cascade through margin calls and automated liquidations.

Solana price prediction based on current levels

The immediate SOL price prediction hinges on whether $125 functions as a durable support. Fundamentals remain solid enough to prevent a total collapse, but technical stress and macro uncertainty are constraining upside in the short term. Traders should monitor volume, Relative Strength Index (RSI), and order-book depth for early signs of either accumulation or capitulation.

In practical terms: staying above $125 keeps a bullish scenario alive with a near-term target of $150–$160. A break below $125 increases the odds of looking to $110–$120 for stabilization, and below $100 for a larger corrective leg. Risk management—position sizing, clear stop-loss placement, and watching leverage in the market—will be crucial for anyone trading SOL in this environment.

Summary

Solana's path into the final weeks of 2025 is defined by the $125 support. While on-chain fundamentals are intact, technical momentum and macro factors will likely determine whether SOL re-accelerates higher or slides into a deeper correction. Watch volume, momentum indicators, and macro updates closely to inform any SOL trading strategy heading into 2026.

Source: crypto

Leave a Comment