3 Minutes

Market overview: demand slows and price structure weakens

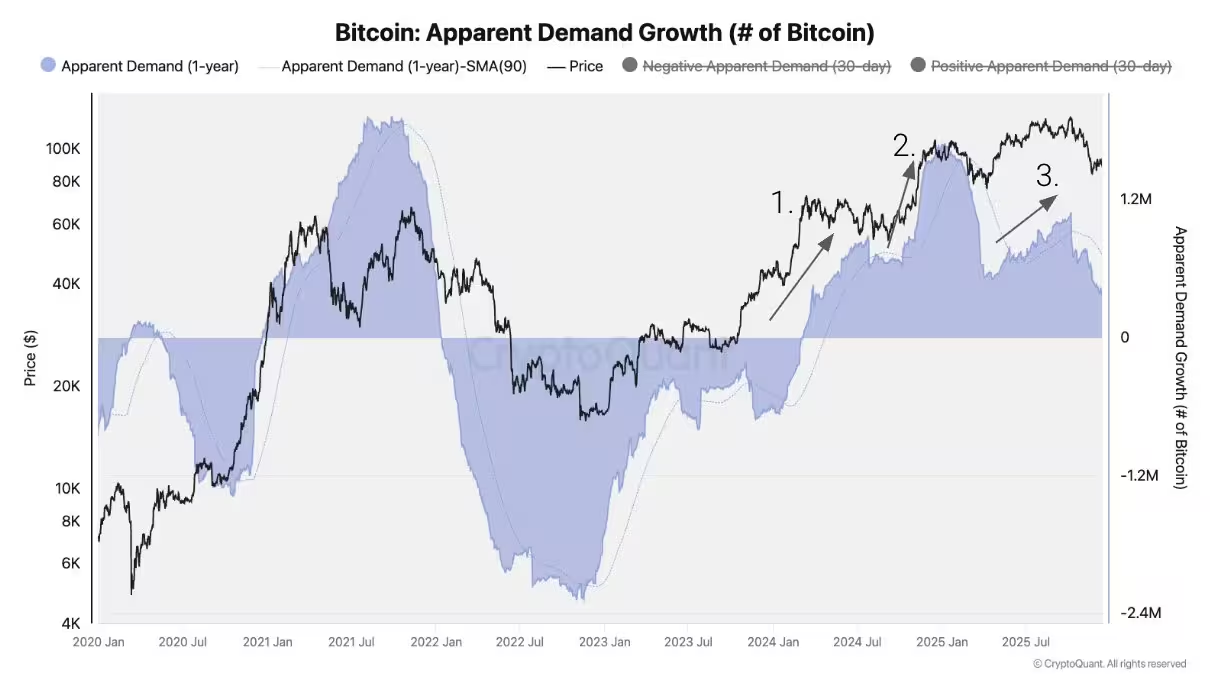

CryptoQuant analysts report that Bitcoin demand growth has slowed markedly since October 2025, a development that many market watchers interpret as the start of a fresh BTC bear market. After three distinct demand waves earlier in the cycle, the marginal buying that supported higher prices appears to have largely dissipated, removing a key pillar of price support for Bitcoin and amplifying downside risk for traders and investors.

Three demand waves and the shift in momentum

According to CryptoQuant, the present cycle featured three concentrated demand surges: first, the US spot Bitcoin ETFs launch in January 2024; second, market reactions after the 2024 US presidential election; and third, a period of heavy accumulation by BTC treasury companies. Since early October 2025, however, apparent demand growth has fallen below its historical trend, signaling that the cycle’s incremental demand is largely exhausted.

Apparent demand for Bitcoin fell in Q4 2025

Institutional flows, funding rates and technical breakdown

Institutional demand has also cooled. ETF holdings fell by roughly 24,000 BTC in Q4 2025, a sharp contrast with the accumulation seen in the prior year. In tandem, perpetual futures funding rates — a gauge of leverage and trader conviction — have slipped to their lowest levels since December 2023. Lower funding rates typically reflect reduced bullish pressure from derivatives traders and can be a reliable early warning of a bear phase.

365-day moving average breach

Perhaps the most visible technical signal is Bitcoin trading below its 365-day moving average, a dynamic support level many analysts use to assess trend health. A sustained break under that average often marks a regime change from risk-on to risk-off for risk assets like BTC.

Bitcoin continues to trade well below its 365-day moving average of about $98,172.

Macro backdrop and market sentiment

Macro factors are reinforcing the bearish structure. Crypto markets remain in a state of fear according to sentiment indicators such as CoinMarketCap’s Crypto Fear and Greed Index. Expectations for imminent Fed rate cuts are muted — CME Group’s FedWatch shows only about 22.1% probability of a rate cut at the January 2026 FOMC meeting — limiting a key potential catalyst for a reflation of risk assets.

Interest rate target probabilities for the January 2026 FOMC meeting

Outlook: cautious, but not unanimous

Some market participants remain optimistic about 2026, citing the potential for renewed demand if interest rates fall and macro liquidity improves. Yet the convergence of ETF outflows, contracting on-chain demand, falling funding rates, and the technical breakdown below the 365-day moving average underpin a cautious near-term outlook. For investors and traders, the current environment emphasizes disciplined risk management, close monitoring of institutional flows and funding rates, and attention to macro developments around Fed policy.

Key SEO-focused takeaways: bitcoin demand is weakening, ETF inflows have reversed, funding rates are subdued, and BTC trading below the 365-day moving average increases the probability of a prolonged bear market unless macro conditions shift in favor of risk assets.

Source: cointelegraph

Leave a Comment