3 Minutes

Analyst: traditional altseason probably won’t return in 2026

CoinEx Research chief analyst Jeff Ko tells Cointelegraph that the classic altcoin rally is unlikely to reappear in 2026. Instead of a broad market where many altcoins surge together, Ko expects liquidity to concentrate in a smaller group of established, high-quality tokens — the so-called blue-chip survivors.

Selective liquidity and the fate of altcoins

Ko warns that retail traders hoping for a rising tide to lift all boats will be disappointed. He predicts no traditional altseason next year; liquidity will be ruthlessly selective and flow to blue-chip cryptocurrencies that demonstrate real-world adoption, active networks, and durable liquidity.

The macro backdrop may offer modest global liquidity tailwinds in 2026, Ko notes, but divergent central bank policies will temper that support. He also says Bitcoin’s historical sensitivity to M2 money supply growth has softened since the 2024 ETF launches, and correlation between money-supply metrics and price action has diminished.

CoinEx’s base case targets Bitcoin at $180,000 by 2026, a bullish projection that assumes continued adoption and concentrated capital inflows into leading crypto assets.

Contrasting view: extended bear or late-cycle peak

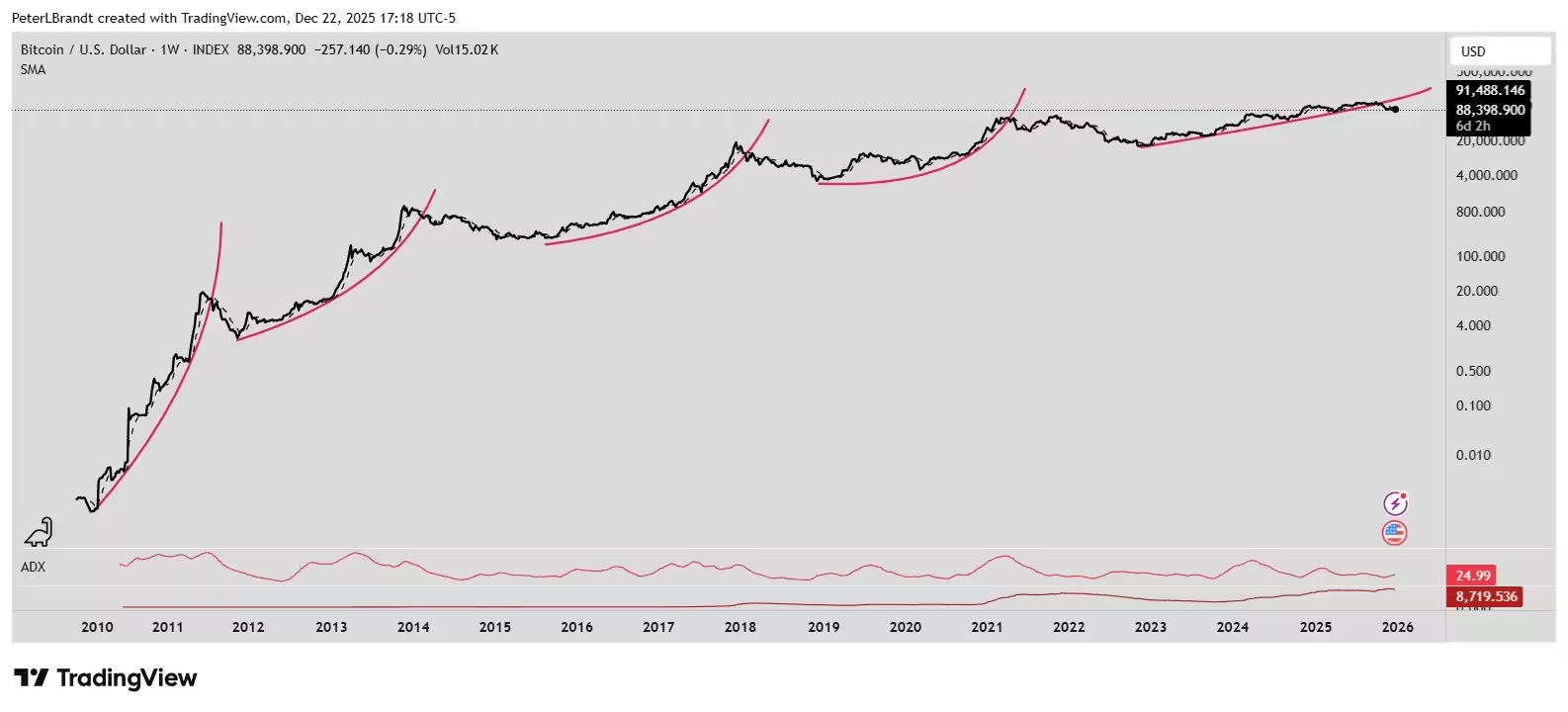

Not every market veteran agrees. Peter Brandt, a long-time futures trader and chartist, argues the cycle is not yet complete and projects the next Bitcoin bull market high could arrive in September 2029. His chart-based view highlights five past parabolic advances followed by deep drawdowns, sometimes exceeding 80%.

Bitcoin’s five parabolic advances

If another severe correction were to occur, BTC prices could revisit levels near $25,000 before a multi-year bull run resumes — a scenario consistent with earlier cycles but not guaranteed.

Is the four-year cycle still relevant?

Historically, Bitcoin has shown seasonal strength in the fourth quarter: eight of the last 12 fourth quarters produced the largest quarterly gains. Yet this current quarter is down more than 22%, marking one of the weakest fourth-quarter outcomes on record.

Macro-focused outlets note that a heavy reset often clears excess risk and weak positioning. That cleansing can create healthier conditions for the subsequent cycle, but it does not automatically guarantee an immediate rebound in 2026.

What traders should watch

Crypto investors should monitor liquidity flows, ETF demand, halving-related narrative cycles, and adoption metrics when positioning for 2026. Blue-chip tokens with clear utility, deep on-chain activity, and institutional support are most likely to capture new capital if the market becomes selective.

Bitcoin (BTC) is trading around $88,000, down roughly 30% from its October all-time high, underscoring the market’s ongoing volatility. For traders and institutions, the message is to favor quality — established Bitcoin and top-layer altcoins — over broad exposure to smaller, speculative tokens in the near term.

Source: cointelegraph

Leave a Comment