3 Minutes

USD1 market cap jumps after Binance launches high-yield program

The World Liberty Financial USD (USD1) stablecoin, associated with the Trump family, saw its market capitalization increase by approximately $150 million after Binance unveiled a new incentive program centered on the token. The announcement coincided with a move that pushed the stablecoin's market value from about $2.74 billion to $2.89 billion in a single trading day.

Binance "booster" program details

Binance's so-called "booster program" offers up to 20% annual percentage rate (APR) for USD1 flexible products, targeting deposits above $50,000. The exchange described this as a "first promotion" intended to help USD1 holders maximize rewards. According to Binance, the bonus tiered APR will be credited daily to users' Binance Earn accounts, and the promotion is scheduled to run through Jan. 23, 2026. The high-yield offering has been a clear catalyst for increased investor demand and larger circulating supply.

USD1 market capitalization, one-week chart

Integration into Binance's ecosystem

Binance has steadily expanded USD1 support across its platform. On Dec. 11, the exchange added fee-free trading pairs for major cryptocurrencies using USD1 and announced it would convert collateral backing Binance USD (BUSD) into USD1 at a 1:1 ratio. The deeper integration has helped USD1 gain traction and utility within Binance's liquidity pools and earn products.

USD1 climbs the stablecoin rankings

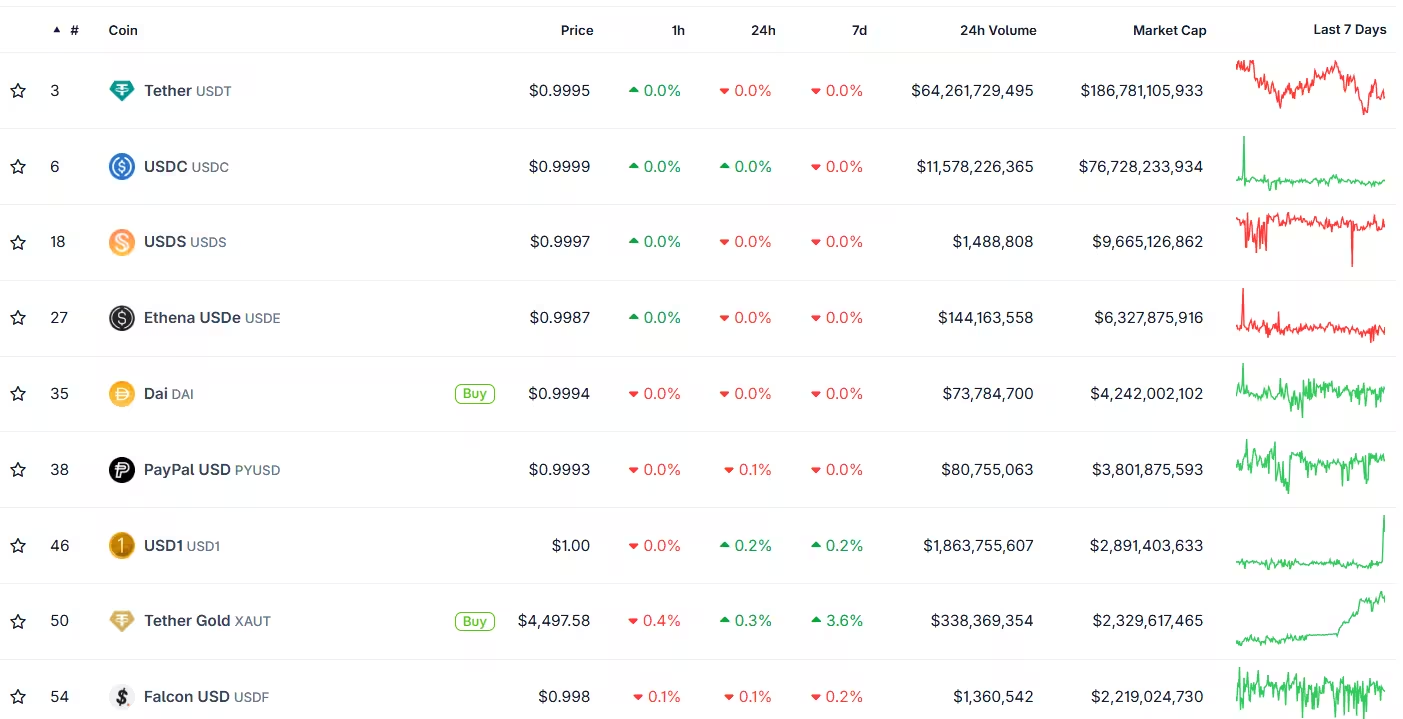

The adoption by the world's largest exchange has coincided with USD1's ascent in the stablecoin market. Recent use cases include settling large institutional deals — Eric Trump noted USD1 was used to settle a $2 billion investment by MGX into Binance — and the token has moved into the top tier of stablecoins by market capitalization, currently ranking seventh and trailing PayPal USD (PYUSD).

Top stablecoins by market capitalization

Questions over development ties and regulatory scrutiny

Despite the momentum, questions remain about the relationship between Binance and World Liberty Financial (WLFI), the issuer behind USD1. A July Bloomberg report cited anonymous sources claiming Binance helped develop parts of USD1's codebase. Binance founder Changpeng Zhao disputed the article, calling parts of it factually incorrect and suggesting potential legal action for defamation.

Lawmakers have also expressed concern. Connecticut Senator Chris Murphy publicly commented that Binance.US appeared to be promoting a Trump-linked crypto project, noting the timing came shortly after a presidential pardon involving Binance's owner. These political and regulatory questions add complexity to USD1's rapid growth and the broader discussion around exchange-issued stablecoins.

What this means for crypto investors

For traders and crypto investors, the Binance APR promotion highlights how centralized exchanges can drive demand through yield incentives and product integration. While the yields and convenience may attract capital, market participants should weigh counterparty and regulatory risks tied to exchange relationships, issuer transparency, and ongoing political scrutiny. USD1's recent gains demonstrate the interplay between exchange product launches, stablecoin liquidity, and market capitalization dynamics in the crypto ecosystem.

Source: cointelegraph

Leave a Comment