4 Minutes

Bitcoin eyes $90,000 as global markets reopen

Bitcoin traded higher during the Asia session, nudging resistance near the $90,000 mark as traditional markets returned from the holiday break. Crypto traders watched closely as gold and silver climbed to fresh records, reinforcing a risk-on backdrop for alternative stores of value like BTC.

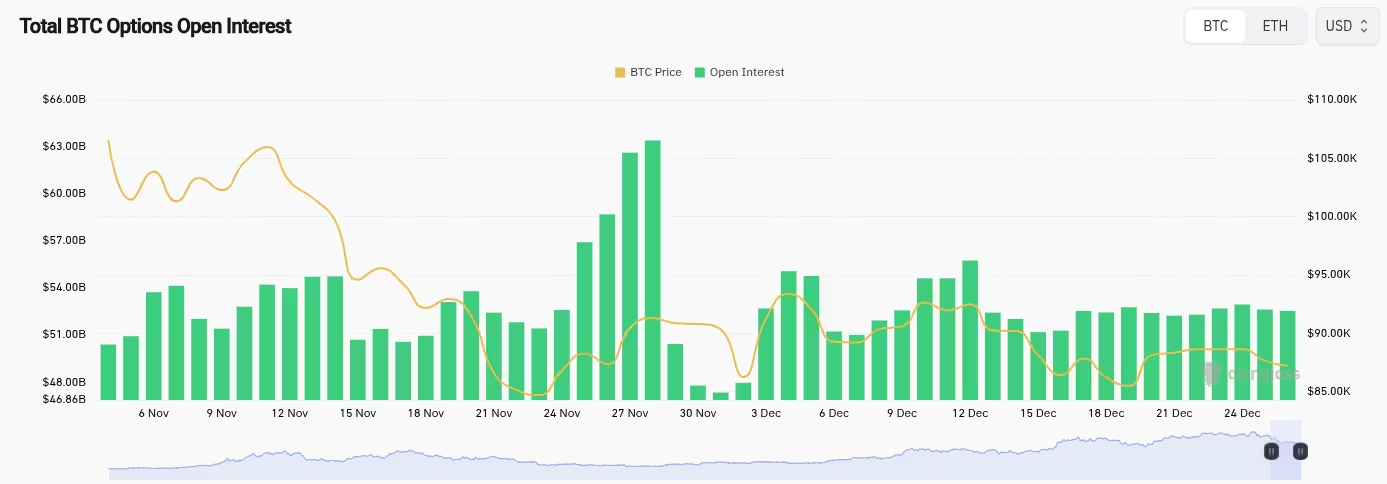

Options expiry could reset price dynamics

Data from TradingView showed BTC/USD rising more than 2% on the day, with Asian liquidity supporting the move. Market participants highlighted a major Bitcoin options expiry worth almost $24 billion ahead of the Wall Street open as a potential catalyst for cleaner price discovery.

BTC/USD one-hour chart

Analysts argued that as large options contracts roll off, the hedging flows that compressed price can diminish, allowing spot dynamics and real positioning to take precedence. Crypto trader BitBull noted that once derivatives-driven pressure eases, direction typically becomes clearer, and price action reflects organic demand and supply again.

Total BTC options open interest (screenshot)

Short-term structure: escaping a downtrend

Bitcoin has been attempting to break out of a downtrend that began in October. Short-term price action remained rangebound, making both long and short entries challenging. The spike toward $90,000 triggered more than $200 million in liquidations within 24 hours, underscoring the volatility around key resistance.

Crypto total liquidations (screenshot)

Analytics accounts emphasized the importance of the daily close to confirm any breakout. A sustained close above the downtrend would target an initial move to $95,000, with a successful hold there opening the path toward the weekly 50-day moving average near the $100,000 zone. At the time of reporting, Bitcoin's 50-day simple moving average (SMA) sat at $91,458 and the 50-day exponential moving average (EMA) at $92,651, levels that traders watch as potential test points.

Precious metals rally lends support to BTC narrative

Gold and silver continued their historic rally on the same session, posting new all-time highs. That outperformance in bullion is relevant to crypto investors because it often signals broader flows into stores of value during uncertain macro regimes.

.avif)

XAG/USD one-hour chart

Market cap rankings briefly reflected silver overtaking Bitcoin in value, placing silver as the third-largest asset by market cap behind gold and Nvidia, according to Infinite Market Cap. These cross-market movements highlight the interplay between commodities, equities, and digital assets as portfolio managers rebalance.

.avif)

Top assets by market cap (screenshot). Source: Infinite Market Cap

Outlook: liquidity return and ETF implications

Veteran trader Michaël van de Poppe said asset managers will likely reallocate in January, and that crypto and Bitcoin could be primary beneficiaries as liquidity flows return. With some institutional products still influencing supply-demand dynamics — including Bitcoin ETFs — incoming new-year positioning could push BTC back toward all-time highs over the coming months.

Related market metrics like open interest, ETF flows, and liquidation snapshots remain critical for traders managing risk until a clear directional breakout is confirmed.

BTC/USDT one-day chart

What traders should watch

Key levels: a confirmed daily close above the two-month downtrend and acceptance above $95,000 would suggest a higher probability of testing the 50-day moving averages near $100,000. Monitor options expiry windows, ETF flows, and macro headlines that affect gold and silver, as these can influence cross-asset correlations and Bitcoin order flow.

In summary, the market is primed for a cleaner directional phase once derivatives-induced hedging eases. Traders and investors should prepare for heightened volatility around major technical thresholds while watching precious metals and institutional flows for confirmation of broader risk allocation shifts.

Source: cointelegraph

Leave a Comment