13 Minutes

Ethereum 2026: A turning point for scalability

2026 is shaping up to be a watershed year for Ethereum as the network begins a staged transition from full transaction reexecution to verifying zero-knowledge (ZK) proofs for block validity. This shift — part of Ethereum’s broader Lean Execution roadmap — promises to dramatically increase throughput, reduce validator hardware requirements, and move the ecosystem closer to the long-standing goal of 10,000 transactions per second (TPS). In practice, the change means validators will increasingly check compact mathematical proofs that a block executed correctly, rather than re-running every transaction themselves.

Why ZK-proofs matter for Ethereum scaling

Zero-knowledge proofs, specifically succinct proofs that attest to correct execution, address a core bottleneck in blockchain design: the need for every validator to perform the full computational work to confirm a block. Under the current model, each validator reexecutes every transaction; this provides security and consensus but constrains throughput because validators must match the hardware required to run that execution. ZK-proofs flip that model: a trusted proving process does the heavy lifting and outputs a small cryptographic proof that can be quickly verified by lightweight nodes.

That verification step is so cheap that, in theory, it can be run on devices with minimal compute — even low-end laptops, smartphones, or watches — which preserves decentralization while enabling far higher transaction capacity. Today, Ethereum reliably handles roughly 30 TPS under typical conditions. By offloading execution and proof generation to specialized provers and block builders, while letting the bulk of validators perform only proof verification, the network can scale far beyond current limits without raising the barrier for home validators.

How the switchover will unfold: Lean Execution phases

Ethereum’s transition to ZK-based verification is planned in phases. We are currently in an early adoption period where enthusiasts and experimental validators test the mechanics. Phase One — expected to gain traction in 2026 — aims to onboard a meaningful minority of validators to validate ZK-proofs. Longer-term, Phase Two will push for a mandatory proving model where block builders must produce proofs and the network collectively runs on a zkEVM-style environment.

Phase Zero: early opt-ins and experiments

In the initial stage, only a small fraction of validators are expected to opt in. These early validators absorb additional operational complexity and cost while proving the model under production conditions. The incentives are still being tuned, so adoption remains cautious.

Phase One: opt-in validation and higher gas limits

Phase One is projected to see as many as 10% of validators switch to ZK-proof validation. The expectation is that the validators most likely to opt in are lower-spec, home-run nodes, since offloading execution to a small set of powerful provers relieves those home operators. As more modest nodes choose to validate proofs, Ethereum can safely raise gas limits without forcing validators to upgrade to expensive hardware.

Phase Two: mandatory proofs and zkEVM normalization

Phase Two entails a fuller conversion: block producers are required to generate ZK-proofs and the network standardizes on zkEVM-compatible execution semantics. This step is where throughput gains accelerate and many of the scaling promises are realized, as proof-producing infrastructure becomes a predictable, production-grade service.

When will validators switch?

Wider adoption depends on some protocol and client-level changes. One important blocker has been the current penalties for delayed execution: validators are expected to attest quickly when a block arrives. ZK-proof generation and propagation can introduce latency that initially penalizes validators choosing to validate proofs. Once protocol upgrades — such as ePBS changes in the Glamsterdam hard fork — relax immediate-attestation requirements and allow validators more time to agree on proofs, adoption should accelerate.

Drake and other protocol researchers estimate a jump from a handful of experimental validators to about 10% participation in Phase One once the timing and penalty mechanics are adjusted. That transition point is expected to land in mid-2026 when the protocol stops discouraging delayed attestations.

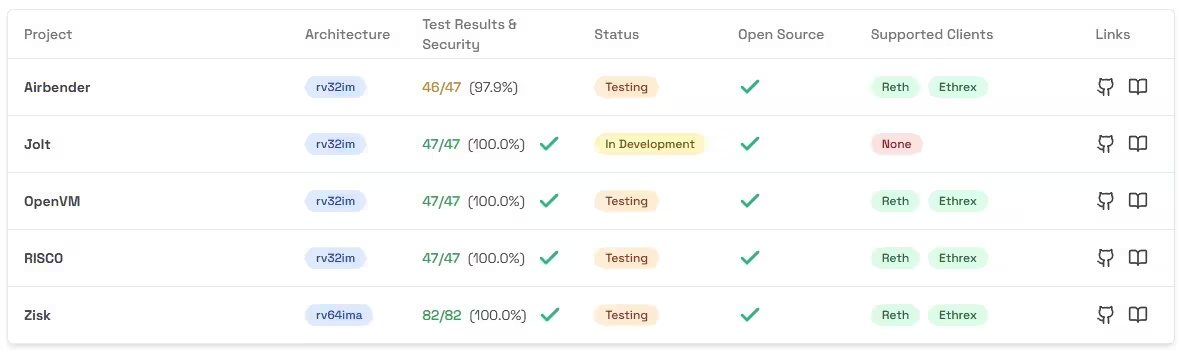

ZkEVM mainnet readiness

Proof generation: the proving ecosystem and hardware profile

Proof generation does not need to be as decentralized as validation: a correct proof is universally verifiable, so fewer specialized provers can serve many validators. Nonetheless, current targets for provers aim to keep the economic and technical bar within reach of serious operators — meaning specialized rigs or cloud infrastructure rather than massive, centralized server farms.

The research community initially set proving hardware targets at a level a well-resourced enthusiast or small operator could run — systems estimated under $100,000 and with power draw similar to a home energy storage unit. But the technology is advancing rapidly: different teams have produced impressive trade-offs between speed, cost, and resource consumption.

Examples from recent development work include:

- SP1 Hypercube used 160 GPUs to generate proofs in sub-12-second windows.

- ZisK demonstrated block proving in 7.4 seconds with 24 GPUs.

- ZKsync’s Airbender team showed how a single GPU can produce proofs in under 50 seconds in lower-security configurations.

These demonstrations indicate a wide design space: provers can optimize for raw speed using massive GPU arrays, or for cost-efficiency with smaller setups that still deliver useful performance. Over time, algorithmic improvements and specialized acceleration (e.g., RISC-V–targeted toolchains) are likely to reduce hardware requirements further.

Multi-prover redundancy and reliability

Because early proving systems will inevitably encounter hiccups or edge-case bugs, the community is exploring redundancy strategies. One pragmatic approach is plural proving: multiple independent proving stacks generate each block’s proof, and validators accept a block once they receive a quorum of matching proofs (for example, three out of five provers). This mitigates single-system failures while the industry works toward a future state in which a single “enshrined” proof can be generated deterministically by formally verified software.

Formal verification of the enshrined proving system remains a long-term goal. The timelines discussed by researchers place such exhaustive formal proofs toward the end of the decade — possibly as late as 2030 — because the correctness bar for a network-level, single-source proving mechanism is extremely high.

Clients, RISC-V debates, and software challenges

The switch to ZK-proofs raises deep questions about the execution environment used by Ethereum. One active debate is whether the Ethereum Virtual Machine (EVM) should be replaced or augmented by a RISC-V-style instruction set architecture to make proofs easier to generate.

Why RISC-V is attractive

RISC-V offers a compact, open instruction set that is easier to target for ZK-friendly compilation and formal tooling. Its simplicity can reduce the complexity of proving an entire execution state and make zkEVM implementations more efficient. Advocates argue this could accelerate real-time proving and reduce the engineering friction for proof generation.

Why some core developers are cautious

However, many mature clients and battle-tested software bases were not designed with RISC-V in mind. Converting large, hardened execution clients to a ZKVM or RISC-V target can introduce risk and complexity. Some teams are developing hybrid approaches, using lighter-weight compilers or adapting subsets of the existing EVM semantics to be more amenable to proving.

The discussion is not about whether ZK-proofs are a valid scaling strategy — momentum there is broad — but about the practical impact on existing client ecosystems and the challenges of real-time proving for established, highly audited clients.

Layer 2s, ZKsync Atlas, and the Ethereum Interoperability Layer

The ZK revolution on Ethereum is not confined to L1 changes. Layer 2 networks are already adopting custom ZK circuits and architectures to push TPS into the tens of thousands, and new interoperability layers are emerging to unify liquidity across rollups and chains.

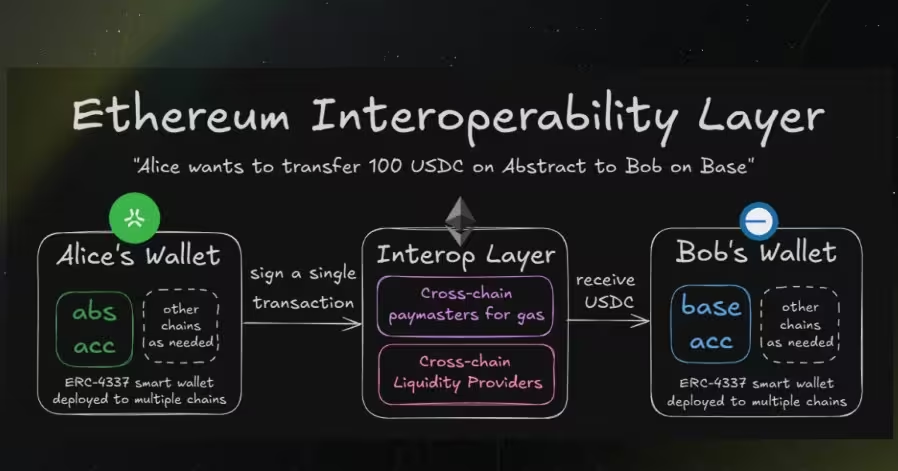

Ethereum Interoperability Layer (EIL)

One major development slated for 2026 is the Ethereum Interoperability Layer (EIL) — a trustless messaging and intent framework designed to let different layer 2 rollups speak to one another without centralized relayers or fragile bridges. Built around ERC-4337 account abstraction concepts, EIL aims to remove the mid-state trust dependency that current solver networks or relayer systems introduce.

Why EIL matters

The rise of dozens of rollups has fragmented liquidity and user experience. EIL seeks to make separate L2 environments feel like a single coherent chain for users, enabling a user on Arbitrum to pay someone on Base in seconds or for wallets to aggregate balances from multiple L2s when executing a single transaction.

The EIL architecture keeps liquidity providers from needing to submit transactions: they only supply gas and assets to cross-chain pools. The user’s own account performs calls directly across chains, reducing avenues for front-running, sandwich attacks, or fund freezes by intermediaries.

“The EIL unifies siloed rollup ecosystems into what feels like a single chain,” says leading rollup operators. If adopted widely, it could significantly reduce the fragmentation that has hampered DeFi composability across rollups.

Taiko and based rollups

Projects like Taiko — a based rollup using Ethereum validators for sequencing — highlight a path toward synchronous composability between based rollups. Combined with EIL, these designs could enable near-real-time interoperability between based and non-based rollups, enhancing connectivity across the entire ecosystem.

ZKsync’s Atlas and Gateway innovations

ZKsync’s Atlas upgrade and Gateway architecture provide another complementary approach: enabling assets to remain custodied on Ethereum L1 while being used in fast L2 execution environments. In practice, Atlas allows L2 chains to reflect ownership and movement of L1-origin assets using ZK-proofs so applications can treat those assets as effectively real-time on L2.

Atlas unlocks several advantages:

- L2 environments can tap Ethereum’s enormous TVL (total value locked) without forcing users to bridge funds and fragment liquidity.

- L1↔L2 transfers finalize faster than a single Ethereum block in many cases, and L2↔L2 transactions can approach ~1 second latency.

- Institutional flows that already await Ethereum finality can now interact with L2s without interop latency being the bottleneck.

ZKSync makes interoperability between L1 and L2 seamless. Source: ZKSync

Together, Atlas, Gateway, and EIL represent a suite of solutions addressing both liquidity fragmentation and the friction of moving assets between execution environments.

Security, decentralization, and the blockchain trilemma

A crucial selling point of ZK-proofs is their ability to preserve decentralization while improving throughput and maintaining security — a rare win for the so-called blockchain trilemma. Because proof verification is cheap, many more nodes can participate in consensus without needing specialized hardware. Security remains grounded in cryptographic guarantees: a valid proof is unambiguous.

However, risks remain:

- Prover centralization: If a small number of proving operators dominate proof production, they could exert outsized influence on execution ordering or chain availability. Multi-prover redundancy and open competition in proving services are vital guardrails.

- Software correctness: Proving systems and proof-verification code must be robust and thoroughly audited. The move to an enshrined single proving system will require deep formal verification work.

- Latency and propagation: Real-time block proving imposes new network propagation dynamics. Protocol upgrades that relax immediate-attestation pressures (ePBS, etc.) are necessary to make the system resilient.

Developers are actively designing governance, incentives, and protocol-level protections to mitigate these risks, and the community’s early test deployments will inform future safeguards.

Practical user impacts and ecosystem transitions

For end users, the shift to ZK-proofs should be largely seamless: transactions will feel faster and cheaper as throughput improves and rollup interoperability becomes more fluid. For validators, the operational profile changes: fewer validators will need beefy machines to remain effective, while a smaller set of provers and builders will operate high-performance infrastructure.

DeFi and institutional flows stand to benefit immediately from improvements such as Atlas, which enables near-instant use of L1 funds on L2s without risky bridging.

Timelines, expectations, and what to watch in 2026

Key milestones to monitor in 2026 include:

- Mid-year protocol upgrades that modify attestation timing and penalty mechanics, enabling validators to validate ZK-proofs without undue risk.

- Growth of validator opt-in to proof validation, targeting ~10% participation in Phase One.

- Continued performance improvements in proving stacks, with fewer GPUs and lower costs needed to produce timely proofs.

- Broader adoption of interoperability layers like EIL and upgrades such as ZKsync Atlas that unlock L1 liquidity for L2 apps.

While the path is ambitious, the combination of Lean Execution, zkEVM development, and L2 interoperability upgrades makes 2026 a pivotal year for Ethereum’s next scaling chapter.

Conclusion: A new era for Ethereum scaling

The move to ZK-proofs is not a single patch but a multi-year transformation that changes the roles of block builders, provers, and validators. By enabling lightweight verification at the edges and concentrating heavy computation where it’s most efficient, Ethereum can reconcile decentralization with high throughput. The early signs — successful real-time proof demos, pragmatic multi-prover strategies, and cross-rollup interoperability designs — point to a realistic path toward vastly higher TPS while keeping the network open to home validators.

For developers, validators, and users, 2026 will be the year to pay attention: protocol upgrades, client implementations, and production-grade proving services will set the tone for whether Ethereum’s ZK-driven scaling ambitions achieve their full potential.

Keywords embedded in this article include Ethereum, zero-knowledge proofs, zkEVM, scalability, validators, ZK-proofs, Layer 2, ZKsync, Atlas, EIL, interoperability, TPS, proving, block builders, and Lean Execution.

Source: cointelegraph

Comments

byteflux

I've run small provers, the hardware targets sound realistic, under $100k is doable for labs, but ops and bugs will be the devil. excited tho

Marius

Is this even true? relaxing attestation timing seems risky, might open attack surface. curious how penalties get tuned, or is that naive

v8shift

Feels overhyped but the multi-prover idea is smart. who pays for all that GPU time? not convinced on those mid-2026 timelines

neurobit

Whoa, 10k TPS sounds like sci-fi but if ZK proofs actually cut validator burden this could be huge. still skeptical about prover centralization tho

Leave a Comment