3 Minutes

Metaplanet expands Bitcoin treasury with $451M late‑December buy

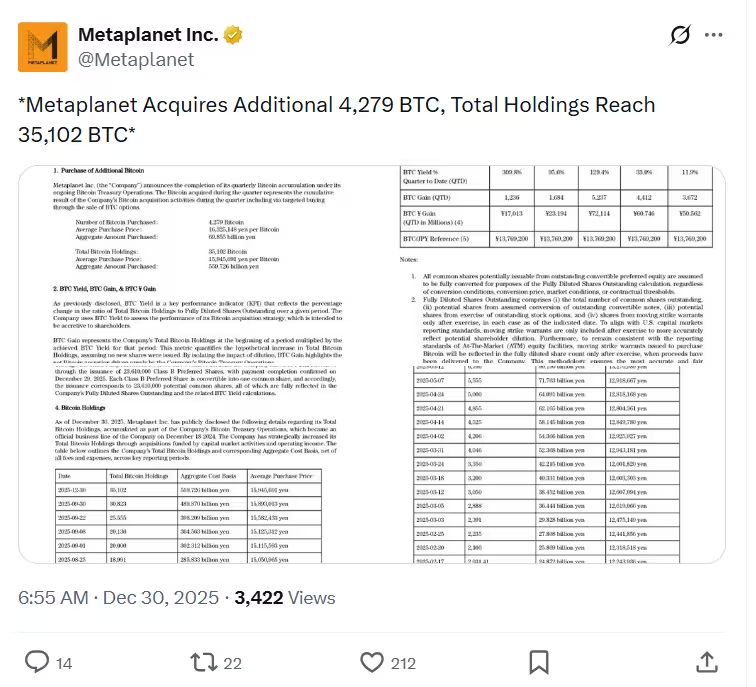

Tokyo-listed Metaplanet increased its Bitcoin holdings by 4,279 BTC in late December, paying roughly $451 million for the acquisition and bringing its total treasury to 35,102 BTC (approximately $3 billion at current prices). The company said the move complements its hybrid model that combines a long-term Bitcoin treasury with an active Bitcoin Income Generation business.

In a regulatory filing, Metaplanet also disclosed that revenue from the Bitcoin Income Generation arm outperformed prior guidance, delivering 8.58 billion Japanese yen (about $54 million) for 2025. That result highlights growing institutional interest in yielding strategies that extract recurring cash flow from BTC holdings while preserving a core long-term stash.

How Metaplanet generates income from BTC

Metaplanet’s income strategy relies on option-based trading techniques. The firm segregates a portion of its Bitcoin to sell options, collect premiums and recycle trades to produce steady revenue streams. Crucially, these option pools are kept separate from the firm’s long-term Bitcoin reserve, helping maintain the treasury’s exposure to long-term upside while managing short-term volatility.

These option-based strategies are fast-scaling: Metaplanet reported a quarterly compounded growth rate near 57% since Q4 2024, with revenue rising from about $4.3 million in Q4 2024 to roughly $26.5–$27 million in Q4 2025. That acceleration underlines demand for institutional-grade yield products built on Bitcoin.

Metaplanet acquires 4,279 BTC

Industry context: accumulation and market pressures

Metaplanet’s accumulation mirrors a broader trend among public firms that treat BTC as a core treasury asset. The company’s approach resembles the aggressive accumulation playbook seen across the sector in 2025, with several corporations — including the firm formerly known as MicroStrategy — continuing to add Bitcoin through equity and debt programs.

However, the shift toward Bitcoin-centric business models has not been without headwinds. Metaplanet’s market-to-Bitcoin net asset value (mNAV) ratio dipped below 1 in October, indicating the stock traded at a discount to the firm’s underlying BTC holdings. Several listed Bitcoin-treasury companies have faced NAV discounts, index-driven selling pressure and, in some cases, delisting risk—factors that can weigh on equity performance despite robust crypto accumulation.

What’s next for Metaplanet

The company said it is still reviewing how the Bitcoin Income Generation results will affect consolidated earnings and plans to update its guidance once the assessment is complete. For investors and crypto observers, Metaplanet’s blend of long-term BTC accumulation and option-based income generation will remain a closely watched example of how firms can monetize Bitcoin holdings while preserving core treasury exposure.

Key themes to watch include ongoing accumulation rates, the sustainability of options-driven revenue, and how market valuations reconcile with on‑balance‑sheet Bitcoin value as listed crypto-native treasury companies navigate NAV compression and regulatory scrutiny.

Source: cointelegraph

Leave a Comment