4 Minutes

BitMine pushes to raise authorized shares to 50 billion

Tom Lee, chairman of BitMine — a publicly listed company that pivoted to an Ether (ETH) treasury strategy in 2025 — is asking shareholders to approve a dramatic rise in the company’s authorized share count from 50 million to 50 billion. Lee argues the change will give BitMine the flexibility to execute future stock splits as Ether’s price drives the company’s market capitalization higher, keeping shares accessible to retail investors.

Why the jump in authorized shares matters

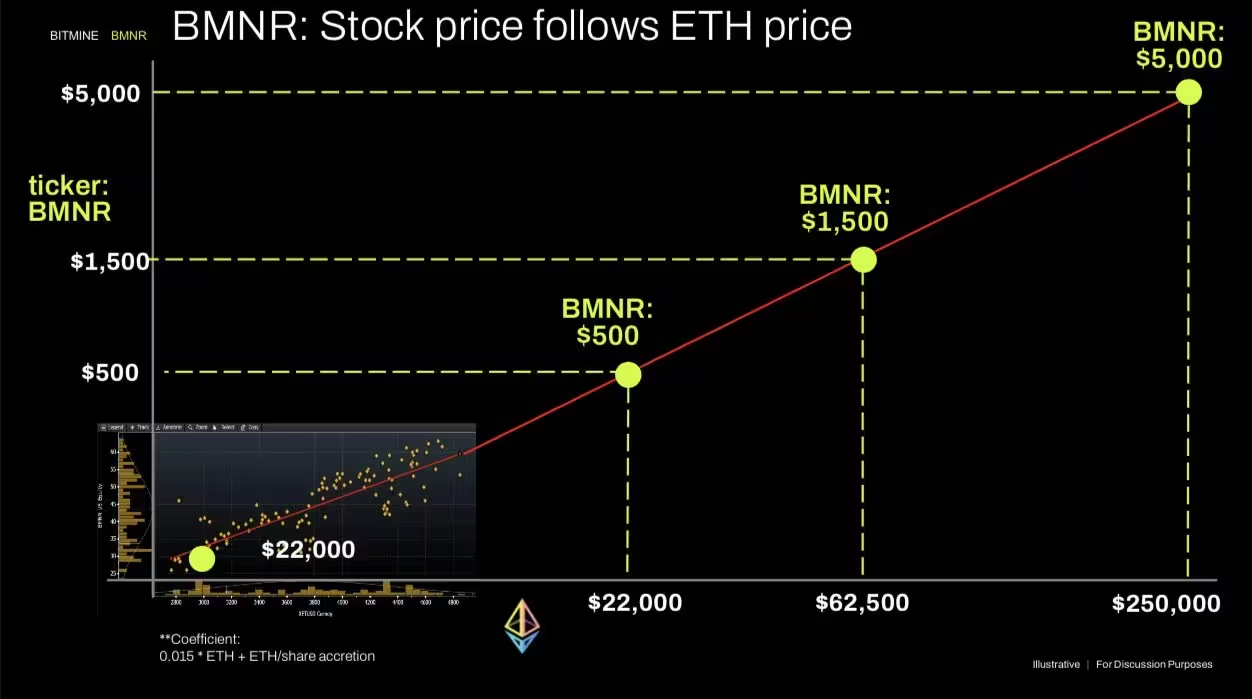

Lee explained that BitMine’s share price closely tracks ETH, and he has modeled scenarios in which ETH rallies far beyond current levels. Using ETH/BTC ratios, Lee suggested a hypothetical where ETH reaches $250,000 if Bitcoin (BTC) climbs to $1 million — a move that would push BitMine’s individual share price into a range that would be unaffordable for most small investors.

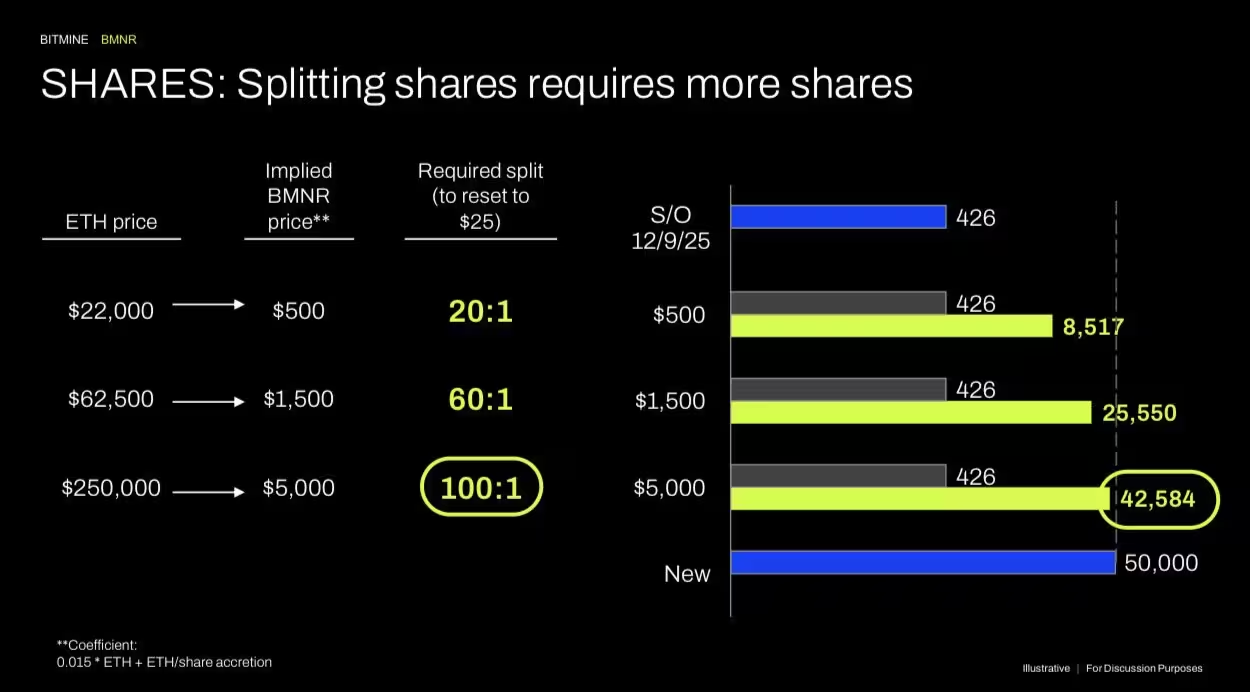

According to Lee’s estimates, ETH at $250,000 would place BitMine shares at an implied value near $5,000 apiece. To preserve a retail-friendly per-share price (Lee cited a target near $25), the company would need to perform a significant stock split — potentially a 100:1 split — which would create roughly 43 billion shares outstanding from today’s base.

"The current shares outstanding are 426 million, and we are trying to get the authorized share count to 50 billion. That doesn't mean we're issuing 50 billion shares. That's what we want the total maximum shares to be," Lee said, underlining that the proposal is about authorization rather than immediate issuance.

Unit bias, dilution concerns, and community reaction

Lee framed part of the discussion around unit bias — the tendency for investors to focus on the number of shares or tokens they own rather than on proportional ownership or returns. He argued that without extra authorized shares ready for splits, BitMine could end up with a per-share price that deters retail participation.

Not everyone on crypto social channels agreed. Reactions on X (formerly Twitter) skewed strongly negative, with many users calling an increase to the authorized share limit a potentially dilutive or suspicious move. Critics urged that the change could be postponed until market conditions improve rather than expanding the share cap while the stock is trading at depressed levels.

BitMine’s ETH accumulation and staking strategy

Alongside the governance push, BitMine has been aggressively growing its Ether treasury. The company recently purchased 32,938 ETH in a single transaction — a purchase valued at roughly $102 million at the time — bringing its holdings above 4 million ETH. That stash, now worth in the multibillion-dollar range, has also become a source of yield as BitMine began staking ETH to earn rewards.

What this means for investors

For shareholders and crypto investors, the proposal highlights several intersecting themes: crypto-price correlation with equity valuation, the operational mechanics of stock splits and authorized shares, and community sensitivity to perceived dilution. Investors focused on exposure to Ether should weigh BitMine’s treasury growth and staking income against governance changes that could alter share dynamics in the future.

Ultimately, the authorized-share increase is a preparatory governance step: it enables the company to carry out large-scale stock splits if ETH appreciation drives per-share prices up, but it does not, by itself, issue new shares or change current ownership percentages.

Source: cointelegraph

Leave a Comment