3 Minutes

US spot Bitcoin and Ether ETFs attract $646M on first trading day

US-based spot Bitcoin and Ether ETFs began 2026 on a solid footing, recording combined net inflows of roughly $645.8 million on the first trading day despite mixed sentiment across the wider crypto market.

Flows by asset: Bitcoin leads, Ether posts healthy gains

Spot Bitcoin (BTC) ETFs brought in $471.3 million, while spot Ether (ETH) ETFs added $174.5 million, according to Farside data — totaling about $646 million across both product types. For US spot Bitcoin ETFs this marked the largest single-day net inflow in 35 trading days, a level not seen since Nov. 11 when the group collectively pulled in $524 million.

Spot Ether ETFs also registered their strongest day in roughly 15 trading sessions, the biggest inflow since Dec. 9 when $177.7 million was recorded.

Why ETF inflows matter for crypto markets

Crypto ETF inflows are closely watched as an on-ramp for mainstream and institutional capital into digital assets. Strong inflows often signal renewed demand and can influence short-term price action, while persistent outflows may indicate waning investor appetite.

Over the past 30 days, spot prices for Bitcoin and Ether slipped 1.56% and 1.39%, respectively, reflecting ongoing caution after a volatile October that saw a major deleveraging across derivatives markets and record single-day liquidations.

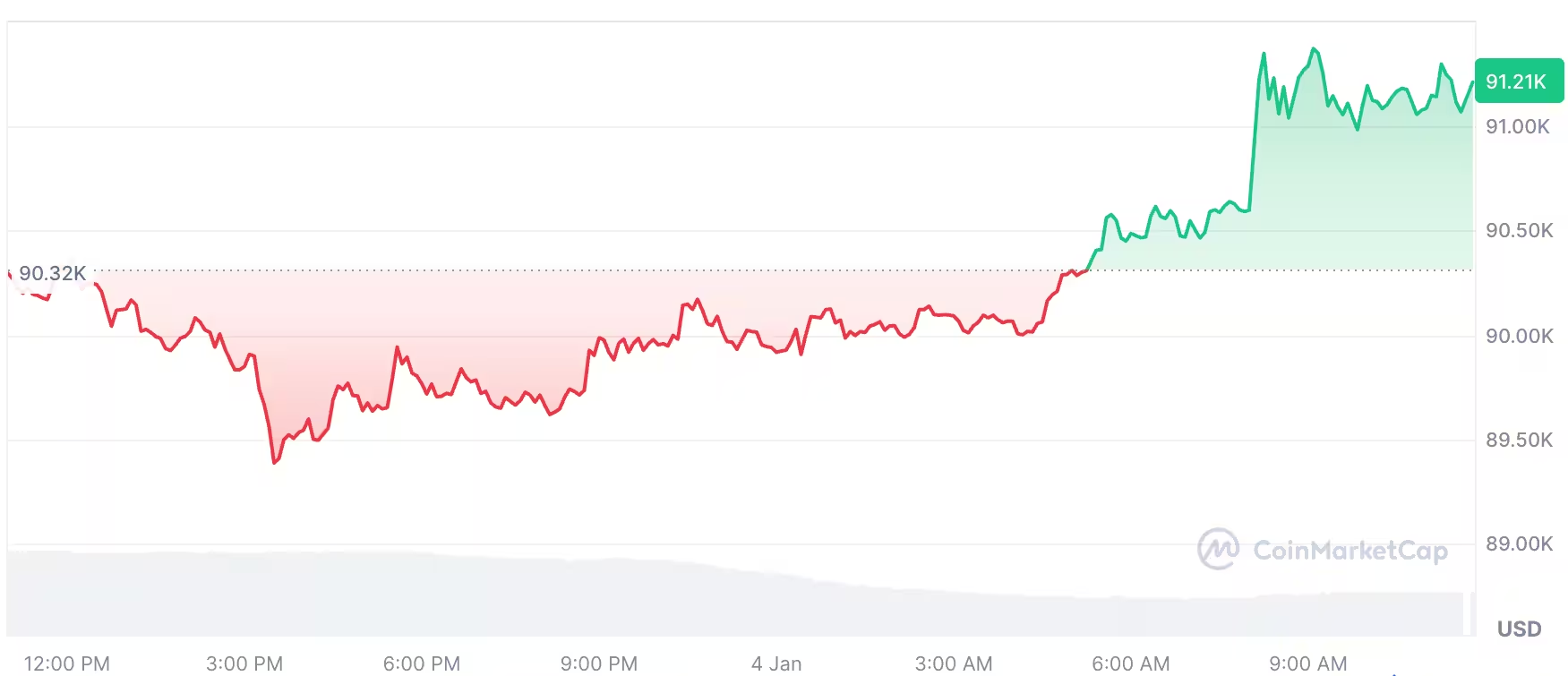

Bitcoin is up 1.03% over the past 24 hours

Market sentiment has been subdued: the Crypto Fear & Greed Index has hovered between "Fear" and "Extreme Fear" since early November, and on Sunday the index returned to "Extreme Fear" with a reading of 25.

Institutional activity and year-to-date flows

Industry observers say institutional investors are re-entering positions after year-end tax strategies. Tonso's chief marketing officer “Wal” noted on X that many institutional holders sold BTC in Q4 2025 to harvest tax losses and are now "loading up," suggesting the recent inflows could be an early phase of renewed institutional accumulation.

Despite market headwinds at the end of 2025, US investors poured about $31.77 billion into US crypto ETFs during the year. Spot Bitcoin ETFs captured the bulk of that demand with $21.4 billion of net inflows in 2025, down from the $35.2 billion net inflows seen in 2024.

Outlook: cautious optimism for crypto ETFs

The strong opening-day inflows for spot Bitcoin and Ether ETFs offer a positive sign for crypto asset adoption among mainstream investors, particularly institutions. However, with broader market volatility and sentiment still in lower ranges, traders and asset managers are likely to remain cautious. Continued ETF inflows would support price stability and signal growing acceptance, while renewed outflows could quickly weigh on market momentum.

For crypto market participants, monitoring ETF flows, institutional buying, and on-chain metrics will remain essential to gauge the next directional moves for Bitcoin and Ether.

Source: cointelegraph

Leave a Comment