3 Minutes

Bitcoin rallies toward $93K amid geopolitical headlines

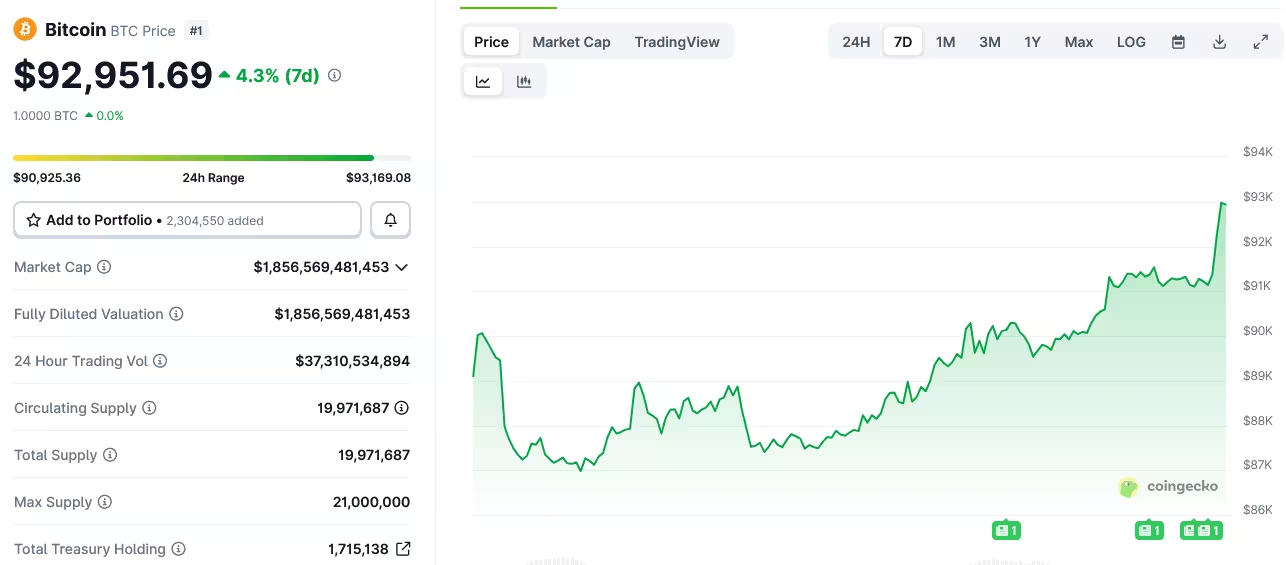

Bitcoin pushed toward the $93,000 level on Monday as comments from US President Donald Trump added fresh geopolitical uncertainty in Latin America. Markets reacted to remarks that signaled potential tougher action against Colombia and Mexico after a US operation in Venezuela over the weekend.

Trump's statements and regional implications

On Sunday, Trump criticized Colombia for alleged involvement in cocaine trafficking and said a new US military operation focused on the country “sounds good to me,” according to Reuters. He also warned that “something is going to have to be done” in Mexico, despite friendlier relations with Mexican President Claudia Sheinbaum, who declined US requests for assistance against cartels.

Market reaction: modest gains despite geopolitical risk

Data from CoinGecko showed Bitcoin (BTC) around $92,669 as the asset rose roughly 3.35% from $89,990 to near $93,000 following the Venezuela operation. The move highlights crypto's sensitivity to geopolitical shocks but also suggests the market absorbed the news without triggering a broader panic.

Market analyst Crypto Rover noted that the capture of Nicolás Maduro was executed quickly enough that uncertainty did not have time to spread widely — a contrast with past conflicts that spurred sustained sell-offs across crypto markets.

Wider strategic flashpoints: Cuba and Greenland

Trump also flagged Cuba — a close ally of Venezuela — calling it a failing state now cut off from Venezuelan oil. Separately, he reiterated interest in Greenland, framing the mineral-rich territory as important to US national security. Officials in Denmark and Norway have repeatedly responded that Greenland is not for sale and urged the US to stop the threats.

What crypto traders should watch next

Traders and investors should monitor developments across multiple fronts: any escalation in Colombia or Mexico, how Cuba responds to shifting oil flows, and the global risk-on/risk-off sentiment that typically drives Bitcoin volatility. Key on-chain indicators, BTC order books, futures funding rates, and CoinGecko pricing updates will be useful to gauge whether this geopolitical noise translates into sustainable price momentum or only a short-lived rally.

As always, crypto market participants should balance geopolitical exposure with risk management — diversifying positions and watching liquidity conditions when headlines break.

Source: cointelegraph

Leave a Comment