3 Minutes

Visa crypto card usage explodes in 2025

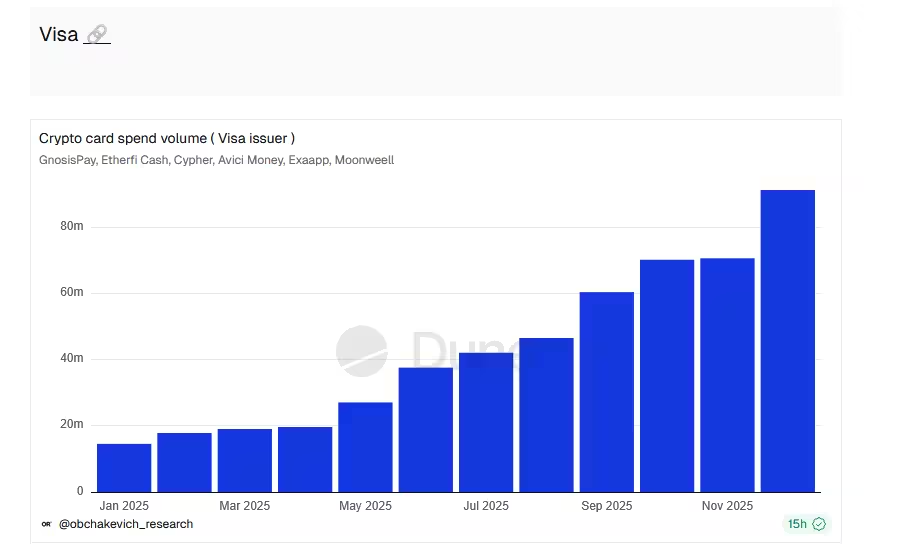

Visa-linked crypto cards recorded a dramatic rise in consumer spending last year, according to on-chain tracking. Data compiled by Dune Analytics shows that net transactions on six Visa-issued crypto cards jumped from $14.6 million in January to $91.3 million by December — a 525% increase that highlights growing mainstream adoption of crypto payments.

Which cards drove the growth?

The analysis tracked products issued in partnership with Visa from crypto payments platforms and DeFi projects: GnosisPay, Cypher, EtherFi, Avici Money, Exa App, and Moonwell. EtherFi’s Visa card led the pack, posting roughly $55.4 million in total spend, more than double the second-place card from Cypher at about $20.5 million. This gap underlines EtherFi’s strong on‑ramp for users spending ether and stablecoins via Visa rails.

Visa crypto card net spend graph

Industry perspective: crypto cards move from niche to everyday tool

Blockchain researchers and industry observers view the surge as evidence that crypto cards are transitioning from experimental products to practical payment instruments. Polygon researcher @obchakevich_ noted on X that the uptick confirms crypto and stablecoins are increasingly integral to Visa’s global payments ecosystem, supporting both retail and institutional use cases.

Why stablecoins matter for Visa

Visa’s recent strategic shift toward stablecoins appears poised to accelerate card usage. The company now supports stablecoin transactions across multiple blockchains and has been expanding partnerships and infrastructure to enable banks, merchants, and fintechs to integrate stablecoin capabilities. In mid-December, Visa formed a dedicated stablecoin advisory team to help onboard clients and scale stablecoin products — a move that could boost card settlement volumes and cross-border crypto payments in 2026.

Implications for crypto payments and DeFi

The spike in net spend signals several broader trends: increasing consumer comfort spending crypto at point-of-sale, clearer regulatory and institutional support for stablecoins, and improved infrastructure connecting wallets, DeFi services, and traditional payment networks. For crypto projects and issuers, success will hinge on user experience, low friction on- and off-ramps, and compliance-ready stablecoin rails.

As Visa continues to scale its stablecoin partnerships and advisory services, expect more card issuers and DeFi platforms to pursue Visa integrations — potentially driving higher transaction volumes, reduced settlement times, and wider crypto payment acceptance worldwide.

Source: cointelegraph

Leave a Comment