3 Minutes

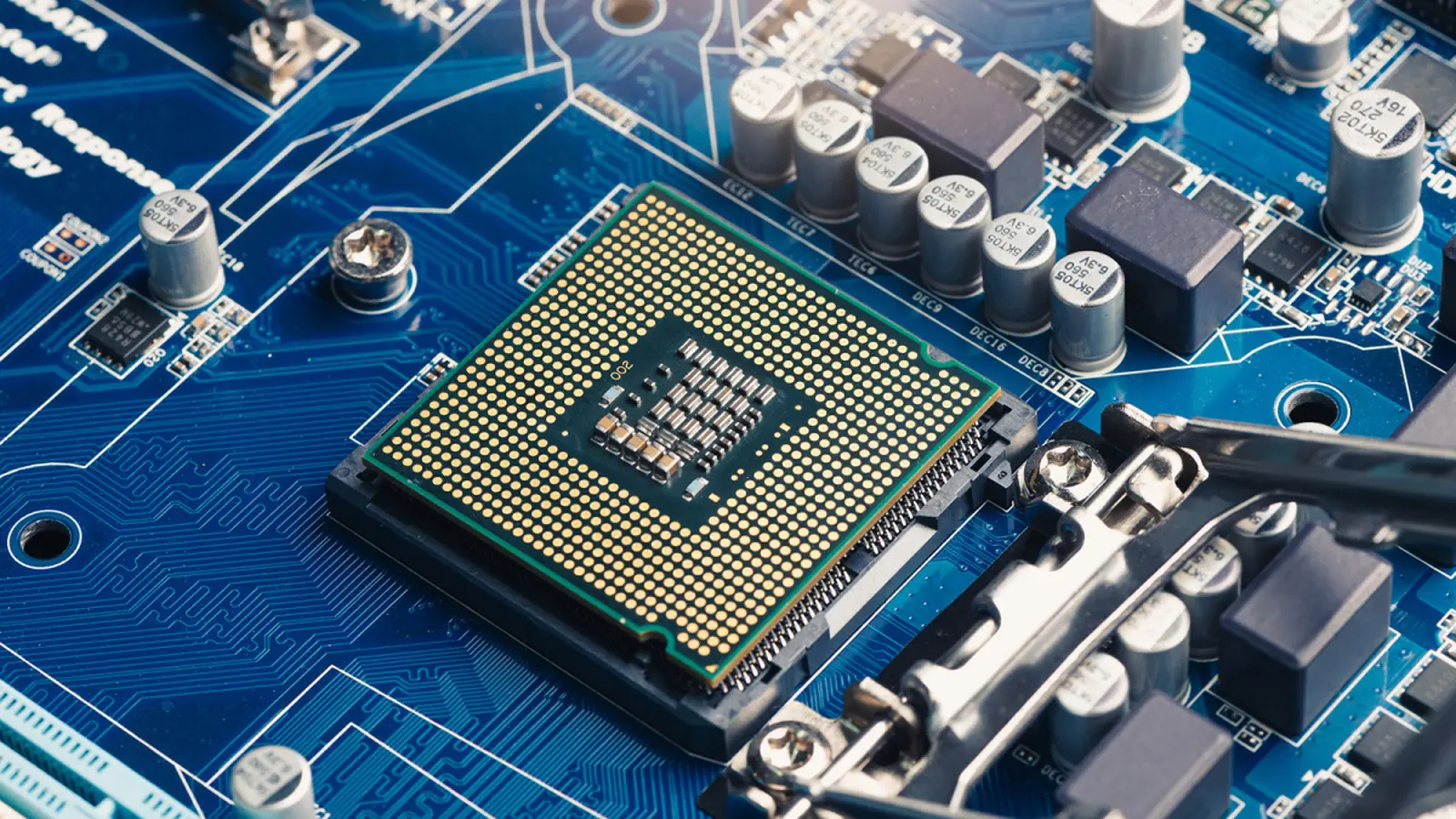

The hum in data centers has become a roar, and it's echoing through store shelves. Reuters reports that a fresh surge in AI infrastructure spending is squeezing the global supply of server processors, pushing prices up and lead times out by months.

Enterprise cloud providers are buying Intel and AMD server CPUs faster than factories can churn them out. In China, certain Intel server chips have seen pronounced price hikes, while corporate buyers are being told to wait—sometimes more than six months—for specific models. Why the delay? Companies are upgrading data centers with the latest x86 generations to handle AI workloads, and that demand is swallowing available inventory.

AMD faces a related bottleneck. Its EPYC server chips are produced at TSMC, which has redirected a large slice of its wafer and packaging capacity toward the broader AI supply chain. The consequence is longer production cycles and reduced flexibility to respond to sudden spikes in orders.

Intel's leadership has acknowledged the mismatch between demand and current supply capacity in recent quarterly results, noting that prioritization decisions have already cost the company some AI-related orders. This is not an abstract line item anymore; it's real chips leaving enterprise buyers waiting and retail channels watching nervously.

What does this mean for everyday users and PC buyers? Historically, manufacturers earn higher margins from server and data center sales, and analysts expect that pattern to repeat. If data centers come first, desktops and laptops will be further down the queue. The retail market could see constrained inventories and gradual price increases—especially if memory and GPUs remain tight as well.

Gamers remember the GPU crunch during the crypto-mining boom. A similar, though not identical, scenario is possible for CPUs: stock levels may still look normal on shelves today, but a steady uptick in orders can translate into narrower selection and creeping prices over the next few months.

Manufacturing capacity is the linchpin. Unless wafer fabs and advanced packaging sites ramp up throughput, the strain is likely to last several financial quarters. Some analysts are optimistic, betting that once the initial wave of AI infrastructure spending stabilizes, demand will normalize to a more sustainable pace.

Expect tighter supplies and slower deliveries for desktop CPUs as data center orders take precedence.

For consumers and industry watchers, the question now is how long patience will hold—and whether chip-makers and fabs can move fast enough to ease the bottleneck.

Leave a Comment