3 Minutes

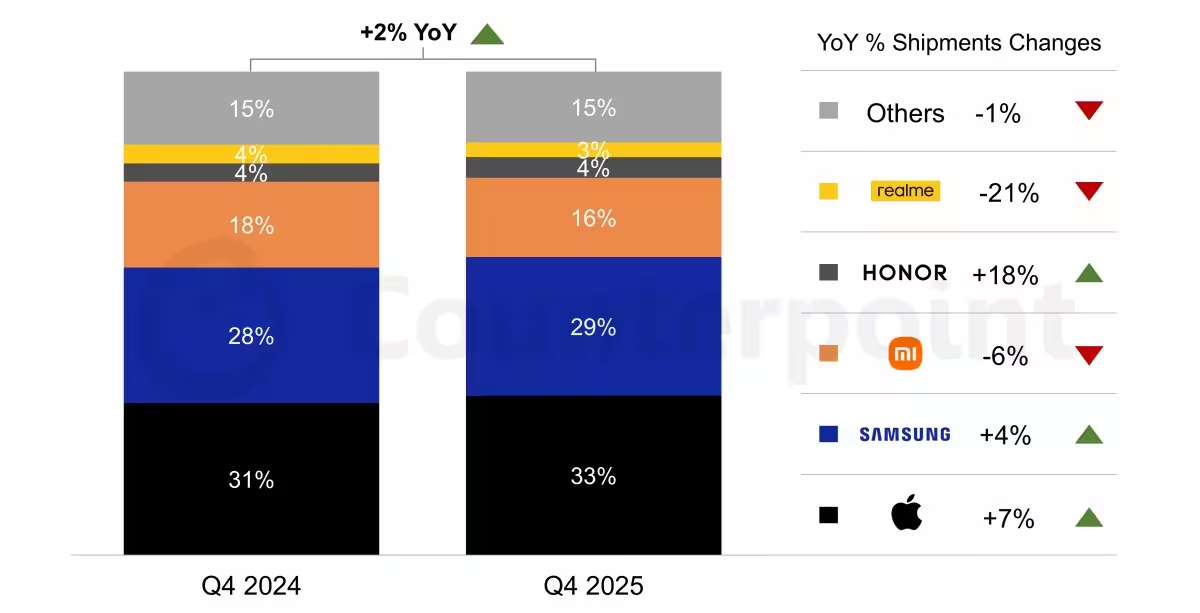

Chip shortages are circling the industry, yet Europe just posted a small victory. Q4 2025 closed with a 2% year‑on‑year increase in smartphone shipments, according to Counterpoint Research's Q4 2025 Smartphone Market Monitor. A modest gain, but one that masks some sharp contrasts.

Apple led the pack with roughly a third of all shipments in the region, an estimated 33% market share. Demand for the iPhone 17 series proved surprisingly resilient, driving Apple shipments up about 7% versus the same quarter last year — especially strong in Eastern Europe. Big, premium devices still sell when they hit the right chord.

Samsung held second place at roughly 29% of the market and managed a 4% shipment increase. Solid performance, steady strategy. Xiaomi slipped to third with about 16% share and a roughly 6% decline in shipments after weaker-than-expected interest in the Xiaomi 15T series. One hit model can ripple through a whole quarter.

Not every story is about the giants. Honor is gaining momentum, accounting for an estimated 4% of shipments and posting an impressive 18% growth driven largely by Western European markets. Realme, by contrast, dropped to about 3% and saw shipments fall some 21% year‑on‑year — a reminder that mid-tier competition remains brutal.

Numbers tell you what happened. Context explains why. The report warns that an ongoing memory chip shortage will make 2026 far more turbulent. Analysts expect demand contraction, and the pain will be felt most by brands that depend heavily on low‑cost, entry‑level devices. Why? Because constrained component supply tends to tighten margins and force prioritization toward higher-margin premium models.

So what happens next? Expect more strategic reshuffling. Manufacturers will chase supply diversification, reprioritize product lineups, and push premium features where margins are healthier. Some brands may double down on software and services to offset hardware volatility. Others will have to pick their battles — and their markets — more carefully than ever.

The quarter showed that Europe can still grow, but that growth is fragile. Keep an eye on chips, pricing, and how quickly manufacturers adapt — those three will shape the next chapter of the smartphone market.

Source: gsmarena

Leave a Comment