3 Minutes

One device quietly became the region's default pick: the Samsung Galaxy A06. It wasn't flashy. It didn't promise flagship-level photography or a headlining spec sheet. It did something more useful—hit the right price and the right features for millions.

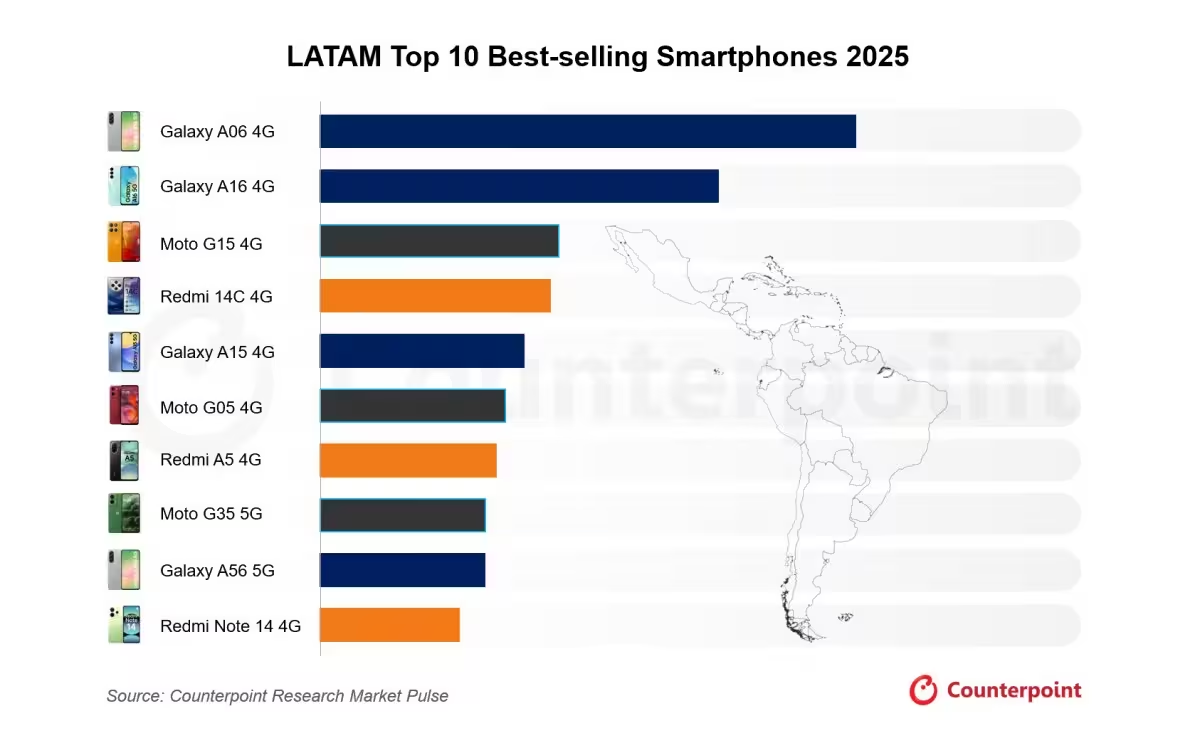

Samsung's Galaxy A06 accounted for 7% of all smartphone sales in LATAM in 2025.

Counterpoint Research's annual rundown paints a clear picture: Samsung led the pack. Four Galaxy models made the top ten—A06, A16, A15 and A56—while Motorola and Xiaomi filled much of the remaining roster. Motorola's Moto G15 climbed to third place, and its G05 and G35 also landed in the top ten. Xiaomi placed three entries as well, including the Redmi 14C and Redmi Note 14 4G.

So what explains this pattern? Price, plain and simple. About 80% of the best-sellers were 4G phones and most carried an average selling price below $200. For shoppers across Brazil, Mexico, Colombia and Argentina—LATAM's largest markets in 2025—value still trumps bells and whistles. Buyers want reliable battery life, decent cameras, and a price that doesn't force a choice between groceries and a new handset.

That consumer logic has near-term consequences. With global smartphone prices expected to rise in 2026, many owners will hang onto devices longer. Replacement cycles stretch. Demand softens. But there’s a twist: higher prices could nudge networks and buyers toward more affordable 5G options faster than you'd expect, accelerating 5G adoption even as overall unit volumes dip.

These trends matter beyond quarterly charts. They shape how manufacturers allocate R&D and shelf space, and how carriers pitch plans to cost-conscious customers. For brands aiming to win in LATAM, the playbook remains pragmatic: balance features, ensure broad distribution, and hit accessible price points.

If 2025 was a year of budget champions, 2026 could be when the region decides whether to upgrade into 5G or squeeze more life from trusted 4G models. Which way will consumers lean? Watch how price and network availability answer that question.

Source: gsmarena

Leave a Comment