6 Minutes

Gold Climbs Toward Record as Treasury Curve Steepens

Gold prices have accelerated to levels not seen since April, edging close to the all-time high set earlier in the year. Market dynamics in the U.S. Treasury market — specifically a steepening of the yield curve — are playing a major role in the rally. For investors watching stores of value, this development matters not only for bullion but also for non-yielding digital assets such as Bitcoin.

What is driving the move?

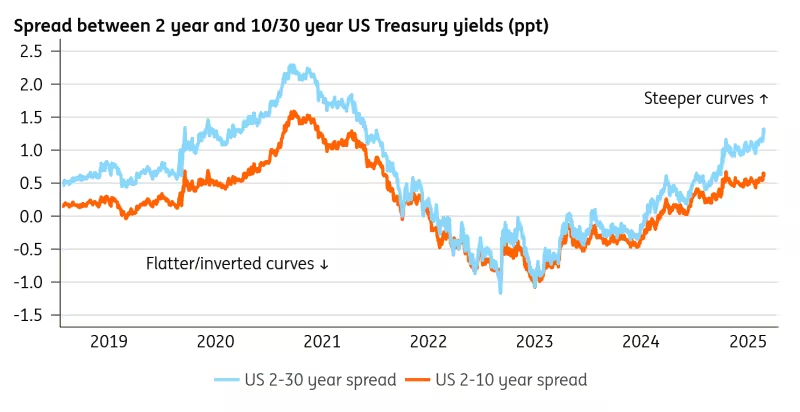

The broad catalyst behind the precious metal’s recent appreciation is a pronounced change in the relationship between short- and long-term Treasury yields. The spread between the 10-year and 2-year yields has widened significantly, a sign that 2-year yields are falling faster than longer-dated yields. In August, the 2-year rate dropped substantially while the 10-year yield declined by a smaller amount — a configuration market participants describe as "bull steepening." In plain terms, short-term borrowing costs eased more quickly than longer-term borrowing costs.

This behavior lowers the opportunity cost of holding non-yielding assets. Gold — which pays no interest or dividends — becomes relatively more attractive when short-term yields fall. The same logic often extends to Bitcoin, another asset commonly compared to gold because of its scarcity and perceived utility as a store of value.

How Yield Components Are Shaping Investor Behavior

U.S. Treasury yields are built from two main components: inflation expectations (the inflation breakeven) and the real yield. Inflation breakevens reflect the market’s view of average future inflation, while the real yield is the compensation investors demand above inflation. Today, inflation expectations remain elevated enough to keep longer-dated yields sticky, even as shorter-term yields have softened. That mixture signals lingering inflation concerns and a premium for fiscal and policy uncertainty.

Why that matters for gold and Bitcoin

When investors expect higher inflation or worry about central-bank credibility, they often look to assets that preserve purchasing power. Gold is a traditional hedge against inflation and political or fiscal risk. Bitcoin has increasingly appeared in that same conversation, often described as "digital gold" for its fixed supply and decentralized character.

Lower front-end yields reduce the financing cost of holding these non-yielding assets for institutional managers and large allocators. During periods when short-term rates were elevated, flows into bullion-backed ETFs and other safe-haven allocations were constrained. As front-end rates ease, those allocations can restart, supporting higher prices for both gold and potentially BTC.

Market Implications: Equities, Miners and Crypto

Historically, bull steepening episodes — when the yield curve steepens because short-term yields fall faster than long-term yields — have favored gold and gold miners. Stocks, especially high-duration equities, can underperform during the same periods because a steepening curve often reflects concerns that future inflation or fiscal expansion will pressure longer-term rates.

Bitcoin sits at an intersection. It behaves like a risk asset at times, correlating with growth-oriented markets such as the Nasdaq, but also demonstrates safe-haven characteristics at other moments. That dual nature means BTC could move in either direction depending on how macro drivers evolve: if the market prices a sustained inflation risk and demand for stores of value rises, Bitcoin could gain alongside gold; if risk appetite dominates and equities rally, BTC could follow growth assets.

ETF flows and institutional allocation

Between 2022 and 2024, holdings in bullion-backed ETFs dropped significantly as the Federal Reserve’s rate-tightening pushed short-duration yields higher. With funding costs now subsiding at the short end, real asset managers who faced allocation limits or higher carrying costs may revisit gold exposure. That reopening of demand channels increases the probability of further gold upside. For Bitcoin, renewed institutional interest — through regulated funds, futures, or direct holdings — could be another tailwind, especially as allocators seek diversification beyond traditional bonds and equities.

What traders should watch next

Key market indicators to monitor include: the 2-year and 10-year Treasury yields and their spread (10y2y); inflation breakeven rates; ETF flows into bullion and crypto-related products; and central-bank commentary around policy and fiscal risk. A persistent decline in front-end yields paired with sticky long-end yields would sustain the bull-steepening narrative and likely remain constructive for gold and other non-yielding stores of value.

Risks and caveats

While the yield-curve dynamic favors gold and could be supportive for Bitcoin, risks remain. A sudden improvement in growth expectations or aggressive risk-on sentiment could push BTC higher through correlation with tech stocks, while leaving gold lagging. Conversely, a sharp move higher in long-term yields — driven by spike in inflation expectations or fiscal concerns — would complicate the environment for both bonds and risk assets. Market participants should weigh liquidity, portfolio allocation limits, and the evolving regulatory landscape for cryptocurrencies.

Bottom line

The current gold rally is backed by a meaningful shift in the Treasury curve: falling short-term yields are reducing the opportunity cost of holding non-yielding assets. That same mechanism can benefit Bitcoin, which shares many of gold’s store-of-value characteristics despite its occasional tight correlation with growth assets. For investors focused on inflation hedges and portfolio diversification, monitoring yield-curve steepening, inflation expectations, and ETF flows will be critical to positioning effectively in both bullion and crypto markets.

Source: coindesk

Leave a Comment