5 Minutes

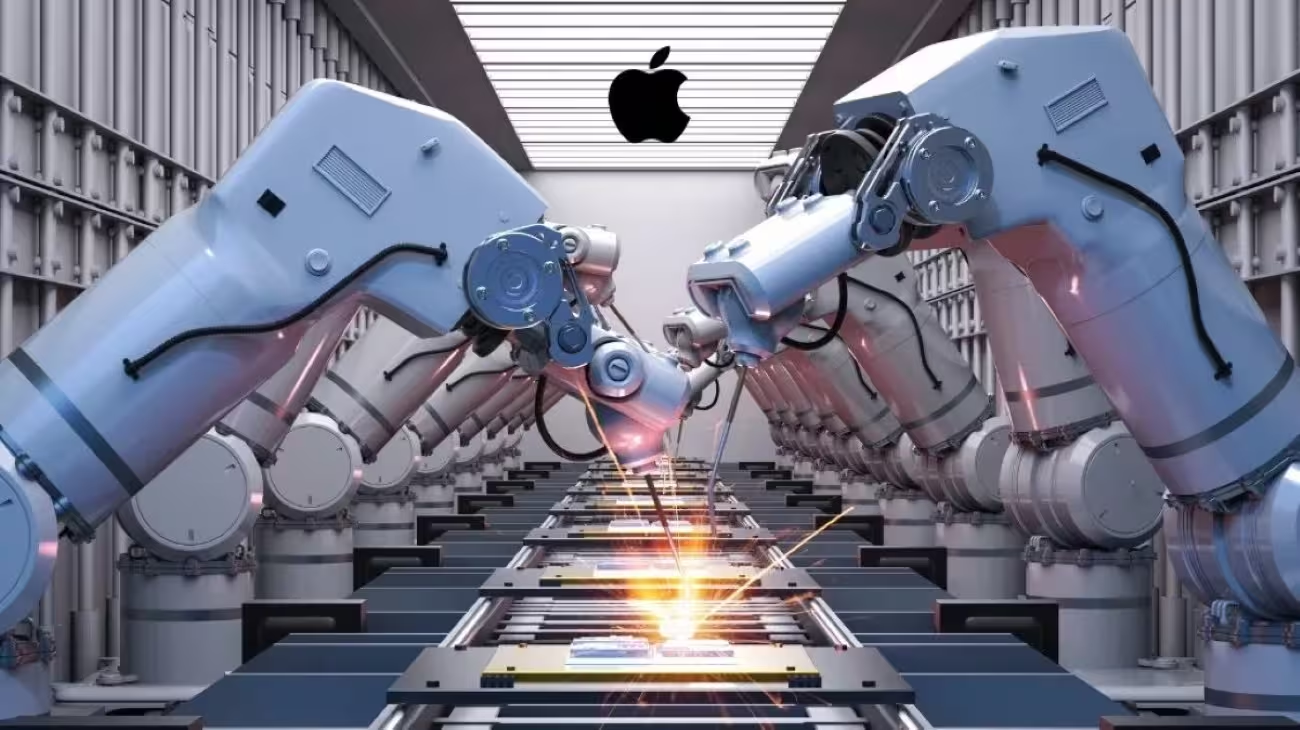

Apple pushes automation across its supply chain

Apple is pressing its manufacturing partners to adopt automation and robotics to lower production costs and improve throughput, or face the risk of losing future product contracts, including orders for iPhone models. The move reflects growing pressure on tech companies to optimize margins amid rising tariffs and complex global supply chains.

Why Apple is accelerating automation

Industry sources close to DigiTimes report that Apple now expects its suppliers to make the capital investment in automated assembly lines themselves, rather than relying on past financing support from Cupertino. Automation can reduce manual labor, speed production, and shrink per-unit overhead — all key metrics for managing margins when external costs, such as tariffs or component price shifts, tighten the bottom line.

Tariffs, cost pressure, and the iPhone 17 launch

Analysts link Apple’s push to automation to recent tariff developments that could increase the landed cost of devices. With the iPhone 17 launch announcement expected in early September, the company faces a choice: absorb additional levies, pass them to consumers, or find cost savings elsewhere. Encouraging suppliers to invest in robotics is one strategic lever to reduce long-term manufacturing costs and protect pricing power.

Product features and manufacturing tech

Automation initiatives typically include integrated robotics, machine vision for quality control, and advanced pick-and-place systems for component assembly. For smartphone production these technologies improve consistency across millions of units, accelerate cycle times, and support higher yields on complex assemblies such as camera modules and PCB integration. Suppliers upgrading to industrial robots and automated test stations can also implement predictive maintenance systems and data-driven production analytics.

Comparisons: automated lines versus manual assembly

Automated lines generally outperform manual operations on speed, repeatability, and long-term cost per unit. Human labor remains more flexible for custom tasks and small-volume runs, but robotics scale better for high-volume consumer electronics. Historically, Apple sometimes subsidized machinery purchases for partners to accelerate the shift; the current reports suggest suppliers may now be expected to fund those upgrades themselves.

Advantages, risks, and use cases

Advantages of the automation push include faster ramp-up times for new product cycles, lower defect rates through vision-inspected assembly, and reduced labor variability. Use cases are clear: high-volume iPhone assembly, AirPods production lines, and component subassembly where precision is paramount.

Risks are significant too. Suppliers that cannot secure financing to modernize may lose Apple business, threatening their survival. At a macro level, fewer factory jobs will be created in regions where Apple expands production, introducing political and social pressure that could force regulators to seek concessions or labor protections.

Market relevance and strategic implications

For Apple, encouraging automation helps manage a fragmented supply chain that still relies heavily on Chinese component suppliers, even as final assembly shifts to alternative regions like India. Automation reduces unit labor costs and limits exposure to geopolitical shocks. For suppliers, this is a turning point: invest in robotics and digital manufacturing to remain competitive, or risk disqualification from lucrative contracts.

Broader industry impact

The push toward automated manufacturing is not unique to Apple, but its sheer purchasing power means its requirements often become industry standards. Suppliers that upgrade to support Apple’s volume and quality targets can leverage the same capabilities across other OEM deals, creating a modernization ripple effect across electronics manufacturing.

What to watch next

Expect follow-up reporting in the months after product launches as contract awards and supplier performance reveal who successfully transitioned. Keep an eye on supplier investment announcements, automation partnerships, and any government interventions in countries where Apple’s manufacturing footprint grows.

For technology professionals and supply chain managers, the takeaways are clear: invest in automation, strengthen financing strategies, and prioritize scalable quality controls to remain relevant in a market where major buyers increasingly demand digitalized, efficient manufacturing operations.

Source: wccftech

Leave a Comment