3 Minutes

American Bitcoin Seeks $2.1 Billion in Share Sales After Rollercoaster Nasdaq Opening

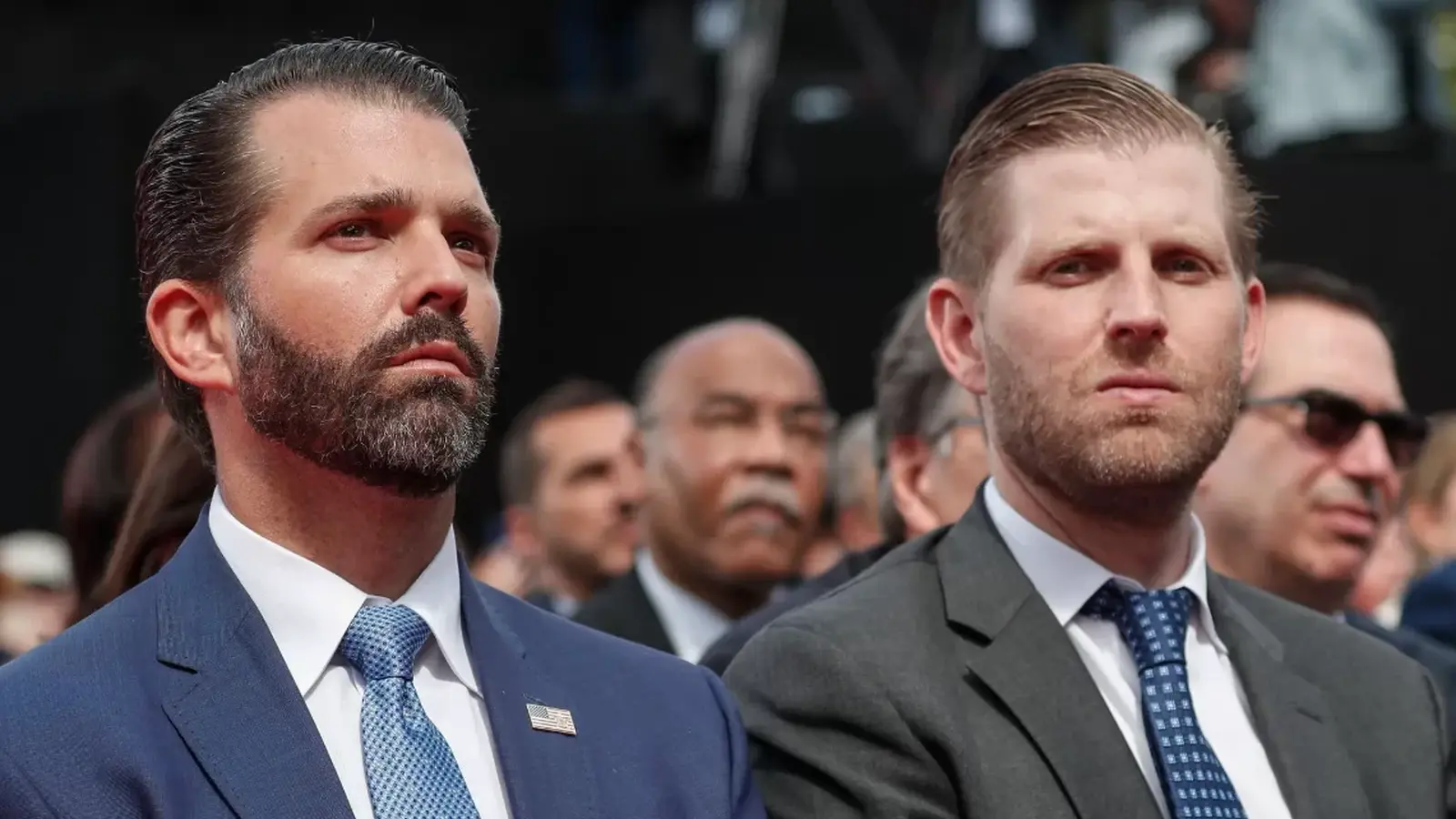

American Bitcoin Corp. (ABTC), backed by Donald Trump Jr. and Eric Trump, filed an SEC registration on Sept. 3 seeking to raise up to $2.1 billion through the sale of shares. The move follows a tumultuous Nasdaq debut in which ABTC stock spiked 91% within an hour before slipping below its opening price by the close.

Nasdaq volatility: frenzied open, multiple trading halts

ABTC opened at $6.90 and surged to $13.20 during early trading, triggering five trading halts as momentum and retail demand pushed prices sharply higher. The rally proved unsustainable and shares retreated back to the open price before recovering modestly late in the session. In after-hours trading the stock showed renewed strength, trading around $8.06 — roughly a 16% gain on the day as investors digested the SEC filing and the company’s strategic plans.

Why the $2.1B raise matters

The proposed capital raise would give American Bitcoin expanded firepower to pursue institutional-scale Bitcoin accumulation, fund operations and accelerate growth as a publicly traded platform. The SEC filing underscores management’s intent to leverage public markets to scale Bitcoin holdings and to support its mining and accumulation strategy amid a consolidating sector.

Merger background and corporate structure

American Bitcoin became a publicly traded vehicle through a stock-for-stock merger with Gryphon Digital Mining, creating a combined company under the ticker ABTC. The transaction positions American Bitcoin as the parent company, with former American Bitcoin shareholders retaining roughly 98% of the combined equity.

Ownership, leadership and mining assets

The newly formed group emerged in part from a March launch as a majority-owned subsidiary of Hut 8, which holds an 80% stake. The Trump brothers are minority investors in the remaining 20% alongside other founding partners. Eric Trump serves as chief strategy officer while Matt Prusak — now CEO — leads operations. Gryphon contributes operational mining capacity, reporting 899 petahash per second of self-mining hash rate as of Q2 2024, and emphasizes renewable and low-cost energy, including recent natural gas acquisitions in Canada.

Sector context: post-halving consolidation

The merger and planned capital raise reflect broader consolidation in U.S. Bitcoin mining following the recent halving, which compressed margins and pushed smaller miners toward M&A or strategic partnerships. By combining Gryphon’s operational assets with American Bitcoin’s market access, the company aims to scale Bitcoin accumulation and achieve cost efficiencies important for long-term competitiveness in crypto mining and institutional Bitcoin exposure.

Source: cryptoslate

Leave a Comment