3 Minutes

Fed liquidity lifeline sends BTC toward a $50K test

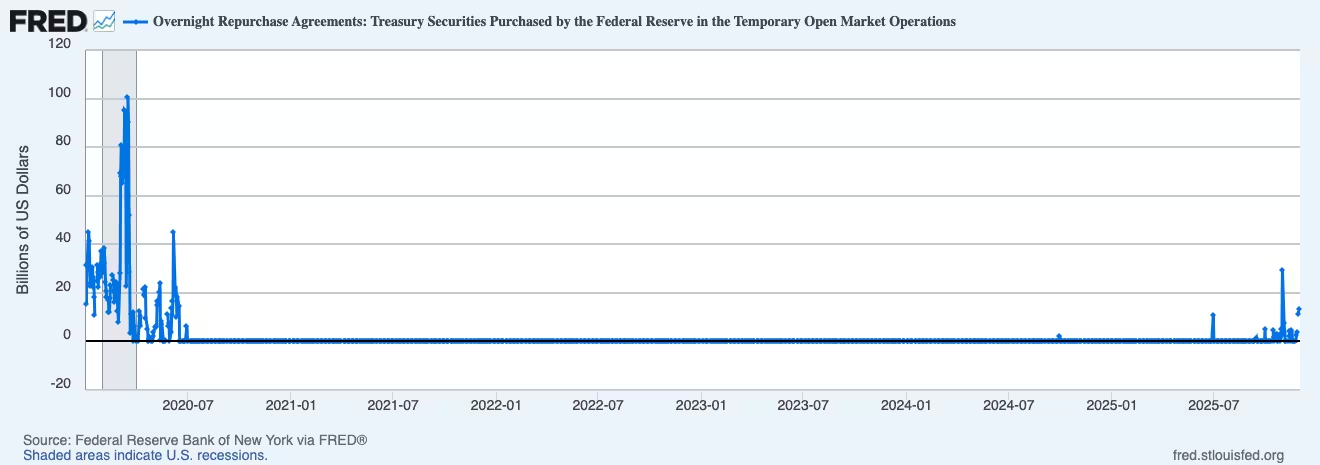

The US Federal Reserve’s sudden $13.5 billion overnight liquidity injection provided a clear macro cue for Bitcoin (BTC) and broader risk assets. The move — coming as the Fed effectively paused quantitative tightening (QT) — marked one of the largest single-day repo inflows since the COVID-19 market collapse, and it has traders reassessing near-term upside and downside scenarios for BTC.

What happened: repo operations and QT pause

Federal Reserve data released on social channels confirmed the central bank halted the most recent phase of balance-sheet reduction. The Fed’s overnight repurchase (repo) operations funneled $13.5 billion into the banking system on Tuesday, the second-largest one-day tally since the pandemic-driven turmoil in 2020. For crypto markets that depend on macro liquidity and risk appetite, the result was an immediate bullish impulse.

Fed overnight repo transactions

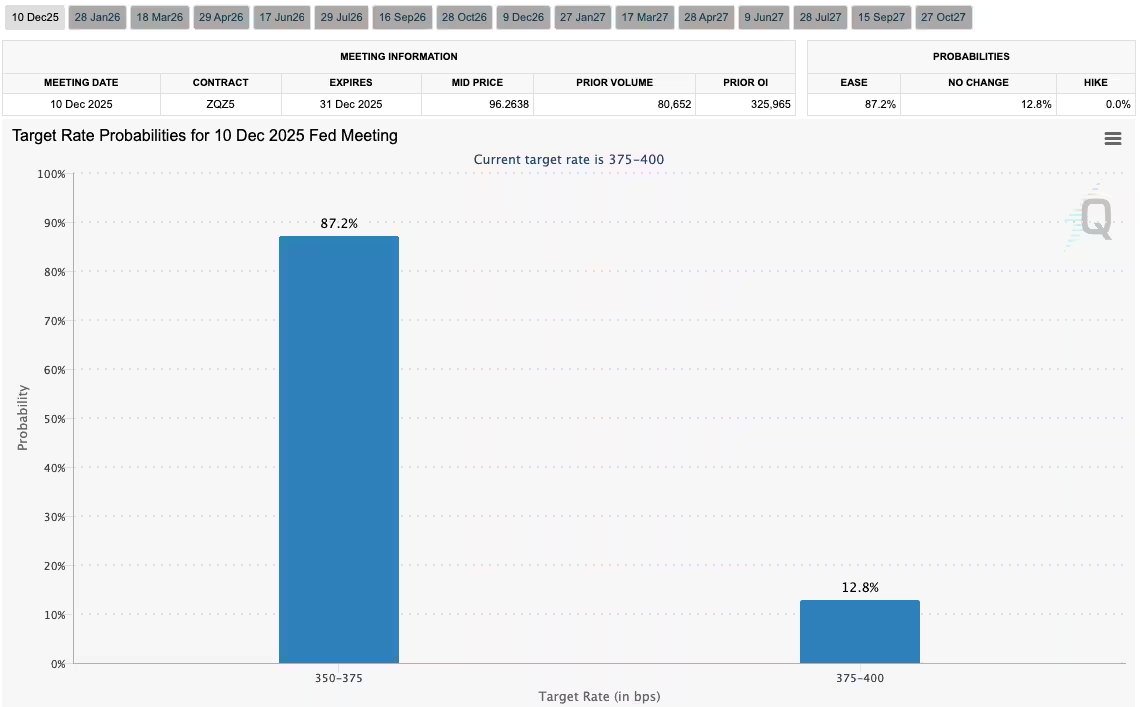

The liquidity boost arrives alongside an active narrative about global central banks in 2025 — including concerns about Japan’s financial stability that could change global monetary settings — even as US markets price in Fed rate cuts beginning in December.

Source: CME Group FedWatch Tool

Market reaction and risk-asset momentum

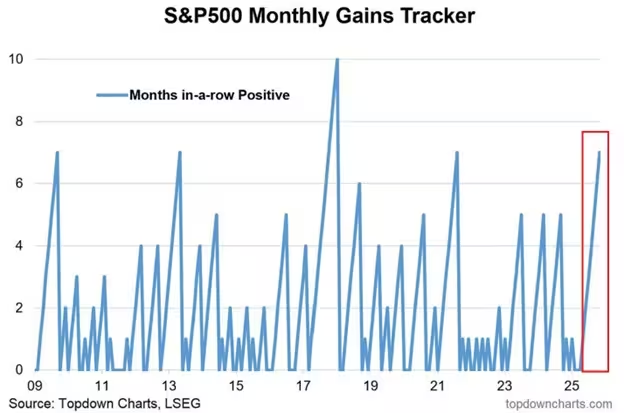

Traders generally interpret the repo inflow and the QT pause as supportive for risk assets. With December historically delivering strong seasonal performance for equities, some analysts say the immediate upside momentum is firmly in favor of bulls. The S&P 500’s recent gains and low realized volatility support a short-term risk-on environment, which often helps correlated assets like BTC.

S&P 500 monthly gains data

However, liquidity and rate-expectation stories can change quickly. Market participants still debate the timing and pace of Fed rate cuts — a key driver for risk-asset liquidity — while cross-border monetary shifts could temper enthusiasm.

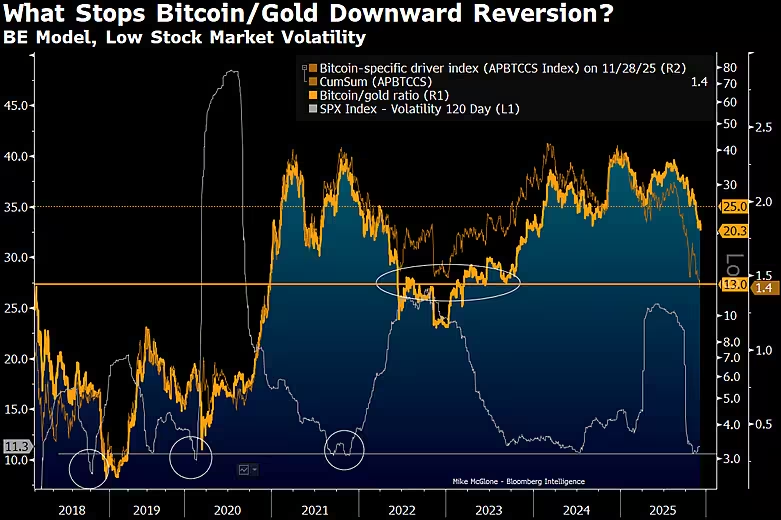

Why Bitcoin could still lead a downside reversion

Even with this fresh liquidity, Bitcoin’s trajectory is not guaranteed. Some strategists warn BTC may be a leading indicator if broader risk sentiment reverts. Bloomberg Intelligence’s Mike McGlone highlighted that extreme complacency in stocks and subdued volatility could foreshadow downside for risk assets, with Bitcoin potentially correcting more sharply.

Valuation signals: Bitcoin vs. gold

McGlone’s analysis compares Bitcoin’s valuation against gold (XAU/USD) to estimate a fair-value cross. Using historical relationships, he suggested that if BTC/gold reverts from about 20x to nearer 13x, BTC/USD could trade around the $50,000 mark. That scenario assumes volatility remains low and risk assets lose momentum — conditions that have pushed prior reversions.

Bitcoin versus gold data

What traders should watch

Key indicators to track include Fed communications around QT and rate cuts, overnight and term repo levels, realized volatility in the S&P 500, and on-chain BTC liquidity metrics. A sustained drop in market volatility coupled with any liquidity withdrawal could accelerate a move toward McGlone’s projected reversion level.

Takeaway

The Fed’s $13.5 billion repo injection has given Bitcoin and other risk assets a short-term tailwind, but macro signals remain mixed. With expectations for Fed rate cuts and lingering global central-bank uncertainty, BTC traders should monitor liquidity flows, volatility, and cross-asset valuations — especially the Bitcoin-to-gold relationship — for signs that a reversion toward $50K may be unfolding.

Source: cointelegraph

Leave a Comment