5 Minutes

Whales Unload 115,000 BTC, Adding Short-Term Price Pressure

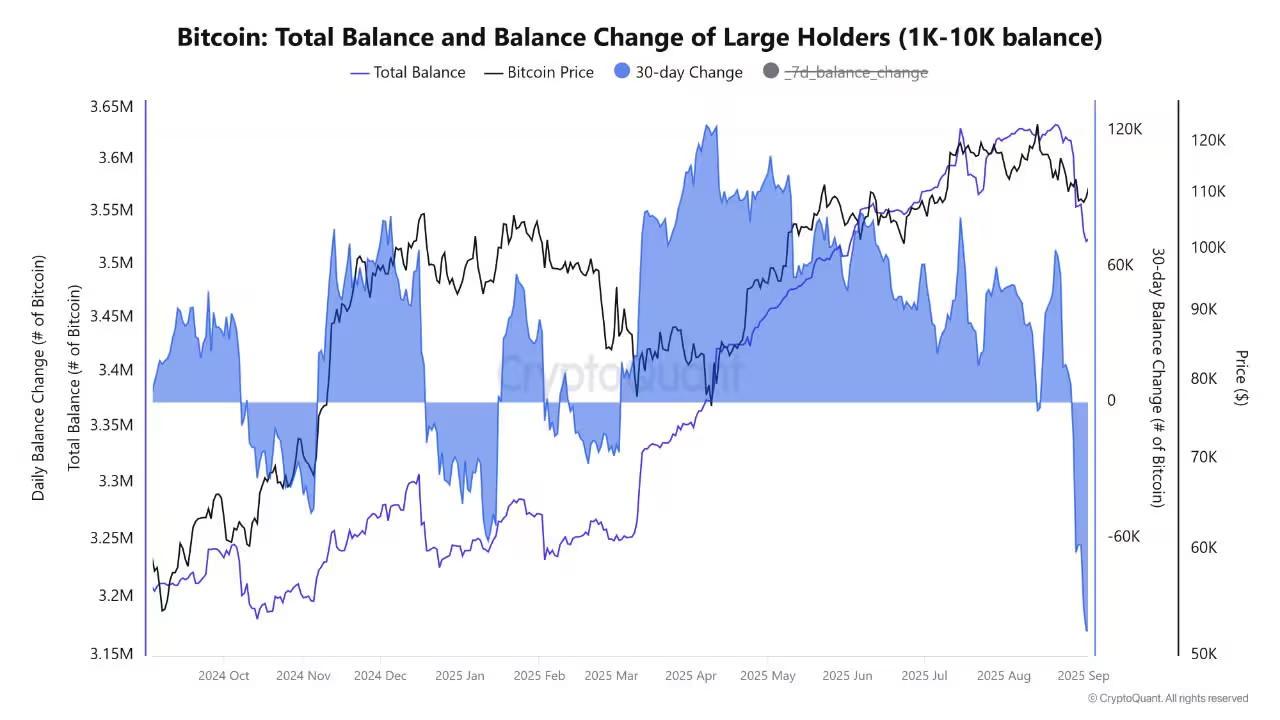

Over the past month, major Bitcoin holders have offloaded roughly 115,000 BTC, equivalent to about $12.7 billion at current market prices, in what on-chain analysts describe as the most significant whale sell-off since July 2022. The wave of selling has increased downside pressure on BTC price action and highlighted growing risk aversion among large investors.

On-chain data provider CryptoQuant flagged the distribution, noting that aggregate whale reserves fell by more than 100,000 BTC in the last 30 days. Market participants have taken notice: the sell-off has already weighed on short-term price structure and helped push Bitcoin below recent intraday levels.

What the Numbers Show

CryptoQuant metrics reveal a 30-day change of approximately 114,920 BTC moved out of whale balances, equal to an estimated $12.7 billion. The seven-day shift reached a peak earlier in the month when whales moved more than 95,000 BTC in a single week, the platform says. That spike represented the highest weekly whale activity since March 2021.

More recently, the pace of transfers appears to have slowed, with a seven-day balance change dropping to around 38,000 BTC as of September 6. This moderation coincided with a period of range-bound trading, as Bitcoin traded in a tight channel between roughly $110,000 and $111,000 over several days.

CryptoQuant classifies whales as addresses holding between 1,000 and 10,000 BTC, a cohort whose behavior often signals shifting sentiment among deep-pocketed retail and non-institutional holders.

Why This Matters for Bitcoin Price and Markets

Large-scale selling from whales can create immediate liquidity stress, prompt liquidations for leveraged positions, and suppress short-term price momentum. Analysts warn that continued distributions from major wallets may keep downward pressure on BTC in the coming weeks.

At the same time, the market is not one-dimensional. Institutional accumulation and ETF-driven flows have continued to inject demand, partially offsetting wholesale unloading by big private holders. This structural counterbalance may limit the extent of a deeper correction if corporate buyers and funds maintain or accelerate purchases.

Institutional Demand vs Whale Supply

Nick Ruck, director at LVRG Research, noted that while whale sell-offs have generated short-term volatility, institutional buying has provided an important counterweight. He emphasized that traders should watch whether institutional dip-buying can overwhelm whale-driven distribution, especially as macroeconomic catalysts like the Federal Reserve rate decision could swing broader market direction.

Market Voices and Price Targets

Some industry commentators remain bullish on the medium-term outlook despite the recent sell-off. Bitcoin entrepreneur David Bailey has argued that if a handful of active whales stop selling, BTC could regain momentum toward a $150,000 target. Meanwhile, popular analyst Dave the Wave points to healthy longer-term technicals, noting that the one-year moving average has climbed substantially year-over-year and could push through higher thresholds soon.

These bullish perspectives are tempered by the reality of current on-chain flows: sustained large-scale selling combined with macro uncertainty would make a near-term rally more difficult.

Short-Term Volatility, Longer-Term Strength

Even with the recent distribution, Bitcoin's pullback has been relatively shallow compared to historical sell-offs. From its mid-August all-time high, BTC has corrected about 13%, a much smaller retracement than prior cycles. That comparatively muted decline, alongside higher moving averages, suggests broader market resilience and deeper structural health.

How Traders and Investors Should React

For traders, the immediate implication is to monitor liquidity pools, on-chain whale wallets, and ETF inflows closely. Short-term strategies should account for potential renewed selling pressure from remaining large holders, while also watching for institutional accumulation events that could offer support.

Longer-term investors can view this distribution as a reminder of market dynamics: whales can temporarily amplify volatility, but sustained demand from institutions and retail adoption trends will largely shape Bitcoin's path over months and years.

Practical Signals to Watch

- Whale balance changes and 7-30 day transfer volumes on on-chain analytics platforms

- ETF inflows and institutional custody reports for signs of accumulation

- Spot price reaction around key technical levels, including the 1-year moving average

- Macro catalysts such as central bank policy announcements and US economic data releases

Outlook: Balanced but Uncertain

The largest whale sell-off since mid-2022 underscores the dynamic tension in the crypto market between concentrated holders and growing institutional participation. While large transfers have pressured price structure in the short term, a combination of corporate buying, ETF demand, and a resilient longer-term trend could limit the damage and create opportunities for disciplined investors.

Market participants should remain cautious and data-driven: track on-chain signals, evaluate order-book liquidity, and consider macro events that could amplify moves. Whether whale sales continue or abate will be a key determinant of Bitcoin price action in the coming weeks, but the broader narrative of institutional adoption and structural market improvement remains intact.

Source: cointelegraph

Leave a Comment