3 Minutes

Ethereum added roughly $1B in stablecoins per day last week

Ethereum saw about $5 billion in new stablecoin issuance over the past seven days, driving the total supply of stablecoins on the network to a new record. According to Token Terminal, the supply of stablecoins on Ethereum has more than doubled since January 2024 and now stands at an all-time high near $165 billion.

Data providers differ slightly: RWA.xyz reports $158.5 billion in Ethereum-based stablecoins, also an ATH, which translates to a commanding network market share of around 57% for stablecoin liquidity. By comparison, Tron remains the second-largest host of stablecoins with roughly 27% market share, while Solana holds under 4%.

Tokenized gold and other real-world assets (RWAs) expand on Ethereum

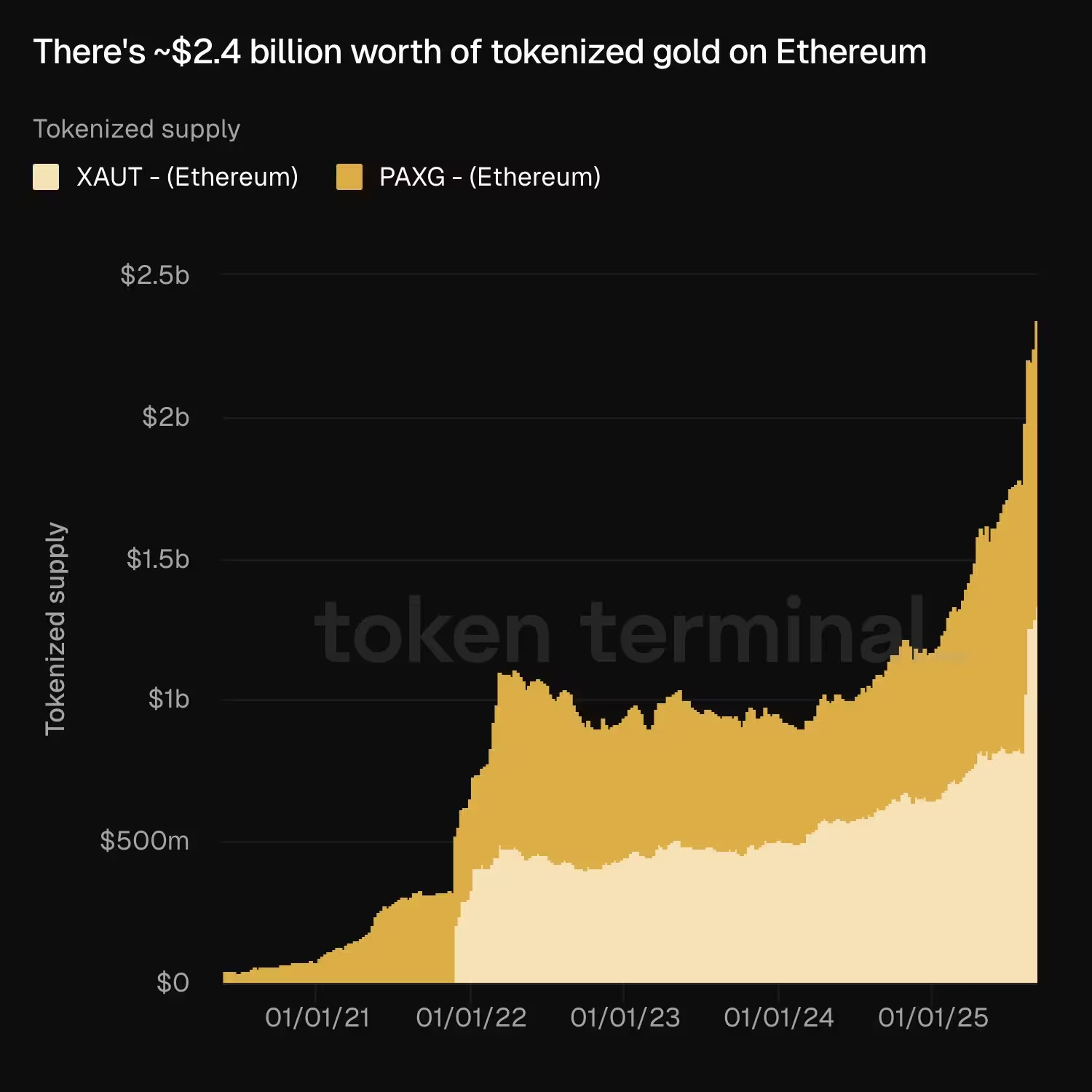

Stablecoins aren’t the only assets flooding Ethereum. Tokenized gold on the chain has also reached fresh highs, with Token Terminal estimating approximately $2.4 billion of tokenized gold now active on Ethereum. That figure represents a doubling year-to-date and underscores expanding demand for on-chain commodity exposure.

Beyond gold, Ethereum dominates tokenized commodities and other real-world assets (RWAs). RWA.xyz reports Ethereum commands roughly 77% of the tokenized commodities market — a share that rises to about 97% when layer-2 Polygon is included. Ethereum also controls over 70% of tokenized U.S. Treasurys, making sovereign debt instruments the second-largest asset class moving on-chain after private credit.

Why RWAs are lifting ETH and drawing institutional activity

The movement of RWAs onto Ethereum has become a key growth narrative for Ether (ETH). Increased on-chain tokenization helped drive ETH’s price up more than 200% since April, pushing it close to a record peak in August. Institutional interest has compounded the effect: corporate treasuries and other entities have accumulated significant Ether holdings, reportedly acquiring nearly 4% of the circulating supply within several months.

Credibility and neutrality attract traditional finance

Observers and Ethereum advocates attribute part of this influx to the network’s perceived neutrality and permissionless architecture. That reputation — that Ethereum is not controlled by any single institution and can host interoperable, trust-minimized financial primitives — helps large asset managers and banks feel comfortable tokenizing regulated products on-chain.

New tokenization products: Fidelity and beyond

Global financial firms are racing to bring traditional assets onto blockchains, with many choosing Ethereum as the settlement layer. One recent example is Fidelity’s tokenized U.S. Treasurys fund, the Fidelity Digital Interest Token (FDIT), which launched on-chain on Sept. 1 and reported a total asset value of about $203.6 million on RWA.xyz.

As asset managers and custodians expand tokenization efforts — spanning stablecoins, tokenized gold, U.S. Treasurys, and private credit — Ethereum’s role as the primary hub for RWAs appears to be strengthening. For crypto investors, traders, and institutional participants, the combination of deep stablecoin liquidity, broad RWA listings, and robust layer-2 integrations continues to make Ethereum a central battleground for on-chain finance.

Source: cointelegraph

Leave a Comment