4 Minutes

Institutional Adoption May Temper Bitcoin Volatility

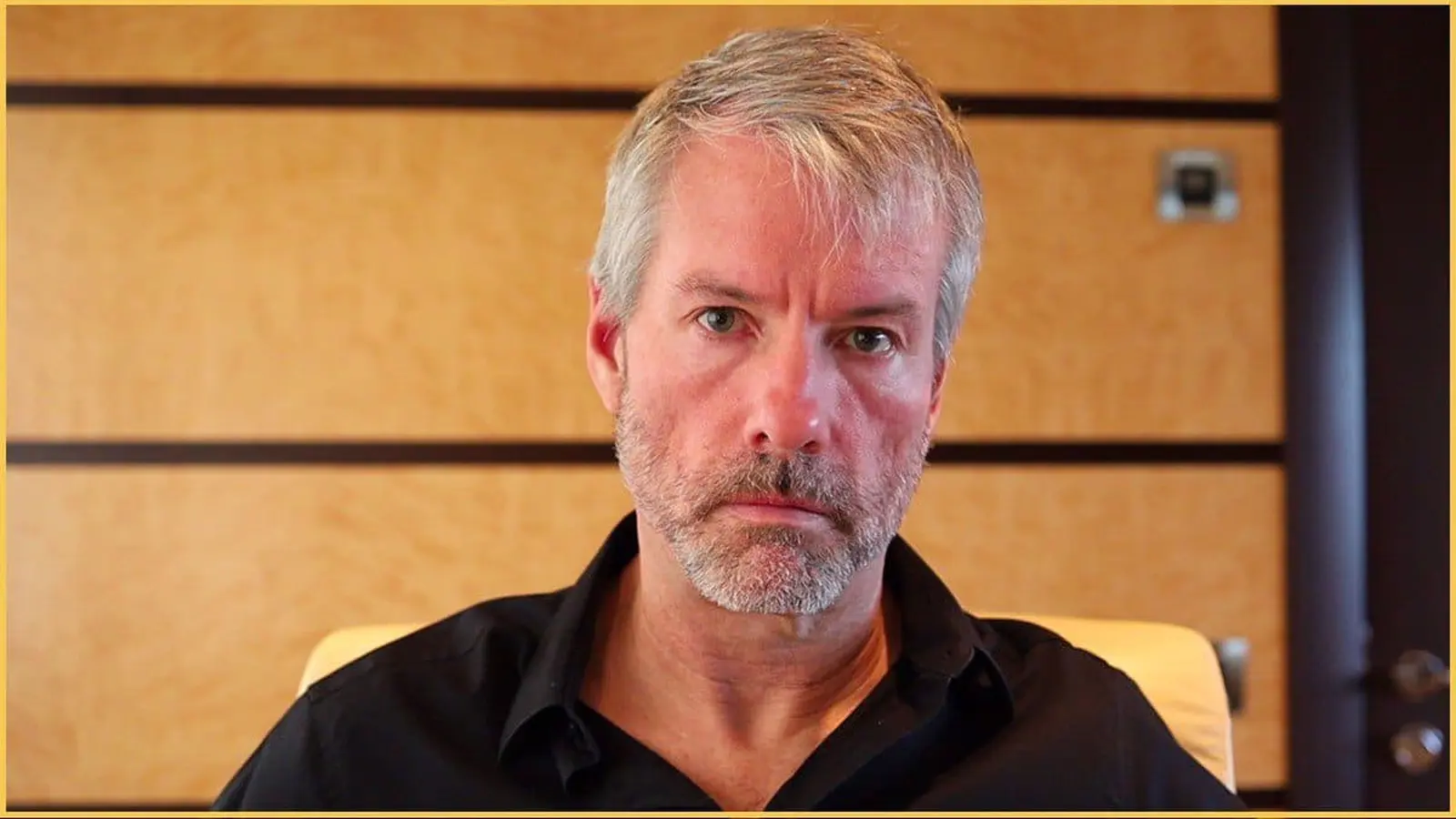

Bitcoin's shift from a high-volatility asset toward a steadier store of value could be an inevitable trade-off as more large institutions enter the market, Strategy executive chairman Michael Saylor said in a recent podcast interview. According to Saylor, reduced volatility helps "mega institutions" feel comfortable taking sizable positions — a development that may make the market feel "boring" to retail traders who chase rapid price swings.

Why lower volatility appeals to institutions

Large financial firms, hedge funds, and corporate treasuries typically require more predictable price behavior and deeper liquidity before allocating meaningful capital to a new asset class. Saylor argued that declining volatility signals maturation and a healthier market structure for Bitcoin and BTC-based products. That environment can unlock new capital flows from institutional investors and pave the way for broader product innovation, such as ETFs, custody solutions, and regulated trading desks.

The conundrum for retail traders

Saylor called the situation a "conundrum": as volatility drops, the adrenaline that fuels short-term speculative interest may fade. He described this phase as a normal "growing stage" in Bitcoin's lifecycle, suggesting that a calmer market is a positive structural change despite temporarily reduced excitement among some retail participants.

Price action, forecasts and broader market context

The comments arrive amid a mixed price backdrop. Bitcoin hit a reported intraday high of $124,100 on Aug. 14, then traded near $115,760 at the time of publication — close to a prior level around $114,618 reached on Aug. 21, per CoinMarketCap data. Over the past 12 months, BTC has surged roughly 81.25%, underscoring strong longer-term performance even as short-term momentum cools.

Analyst projections and risks

Market participants remain divided over near-term targets. BitMEX co-founder Arthur Hayes has forecast a bold $250,000 year-end target, while other analysts expect levels closer to $150,000. Some, like analyst PlanC, do not expect a new peak this year, and voices such as Benjamin Cowen have warned of possible deep drawdowns, suggesting BTC could face a 70% retracement from any future all-time high. These divergent views reflect the range of scenarios still priced into crypto markets.

Macro catalysts and the path forward

Speculation around U.S. Federal Reserve policy has also influenced sentiment. Many traders expected the Fed's Sept. 17 rate decision to be largely priced in, but further rate cuts later in the year could support risk assets, including crypto. Saylor sees the coming decade as a period of intense innovation: he called 2025–2035 a potential "digital gold rush," where new business models, products, and mistakes will shape the ecosystem.

Institutional holdings and industry growth

Publicly listed companies that hold Bitcoin as treasury assets reportedly control significant amounts of BTC; BitcoinTreasuries.NET estimates these firms hold approximately $117.91 billion in Bitcoin at the time of publication. That concentration of institutional reserves highlights the broader institutional appetite for digital assets even as market structure evolves.

Overall, the transition toward lower volatility and deeper institutional participation may reduce short-term excitement, but many industry leaders view it as a necessary step for sustainable growth, enhanced custody, and broader product development across the crypto ecosystem.

Source: cointelegraph

Leave a Comment