4 Minutes

Arthur Hayes weighs in on Bitcoin price trajectories

Former BitMEX CEO Arthur Hayes has issued a fresh BTC price outlook, arguing that Bitcoin will be substantially higher by 2028 but rejecting the notion that it will hit an eye-popping $3.4 million per coin. Hayes framed his views around the prospect of renewed US money printing under a Trump administration and how that could reshape liquidity, credit, and ultimately crypto markets.

Why Hayes thinks BTC will climb—but not to $3.4M

In a recent Substack post titled "Four, Seven," Hayes revisited the relationship between credit growth and Bitcoin price appreciation. Using historical ratios, he ran a theoretical calculation that yields a $3.4 million Bitcoin by 2028 if the past slope between credit expansion and BTC gains held exactly. Hayes is explicit that the math is illustrative rather than a firm forecast: the result is possible on paper, but he calls it implausible as a hard prediction.

Credit growth vs. BTC price: the math and limits

Hayes referenced a historical slope of roughly 0.19 in the percentage increase of Bitcoin relative to dollar-of-credit growth. That figure, when extrapolated, produced the highly bullish $3.4M headline. Yet Hayes cautioned that credit growth dynamics, market structure, and investor behavior have changed since prior cycles—meaning past slopes may not repeat one-to-one.

Policy, politics, and the liquidity story

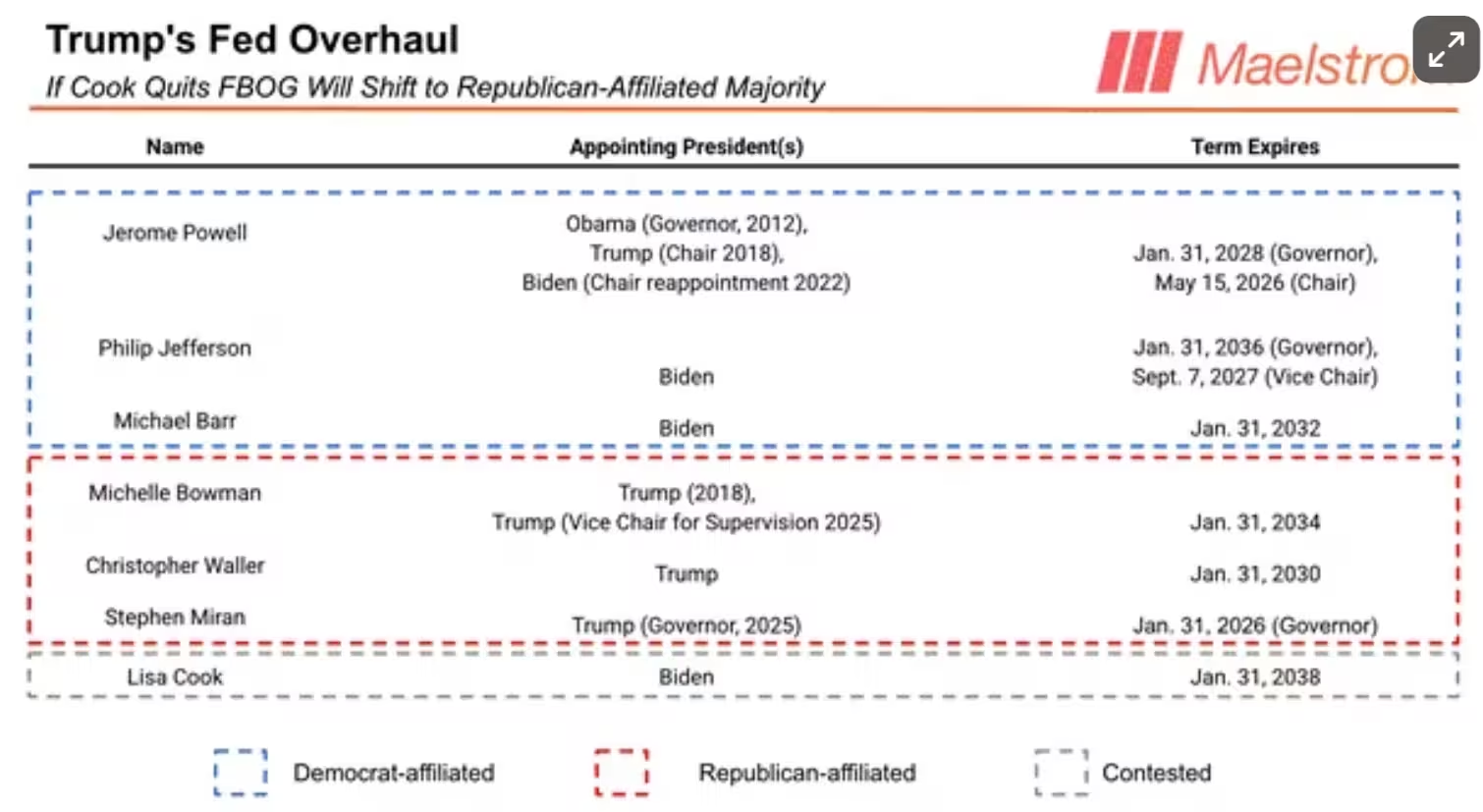

Central to Hayes' thesis is the expectation that a Trump administration will favor aggressive monetary accommodation. He argues that preserving elite purchasing power and geopolitical strategies could prompt large-scale credit allocation changes. Hayes highlights the potential for close coordination between Treasury and the Federal Reserve, and suggests that political appointments will play a key role in steering Fed policy toward easier financial conditions.

Federal Reserve Board of Governors data

Hayes also pointed to ongoing policy debates and personnel disputes as early signals of a shift in US monetary strategy. He believes those moves would increase liquidity across markets and create a structural tailwind for BTC as a store of value and inflation hedge.

How plausible is a liquidity-driven Bitcoin rally?

While many crypto investors welcome easier financial conditions, not all analysts agree on the magnitude or timing of a resulting BTC rally. Some market researchers argue that simple liquidity narratives oversimplify a web of regulatory, macro, and flow-based forces that determine cryptocurrency valuations. Hayes acknowledges the uncertainty, asserting only that Bitcoin will be "markedly higher" than its current trading level by 2028—not necessarily at the extreme $3.4M figure.

Hayes' track record and competing views

Hayes has previously floated seven-figure Bitcoin targets, including a $1 million forecast for 2028 based on capital controls and international repatriation themes. He was pardoned by President Trump in March, a fact he has referenced in his public commentary. Other industry voices remain skeptical of dramatic single-factor forecasts. For example, analysts at established crypto asset managers have dismissed simple liquidity arguments as inadequate to explain multi-trillion-dollar price moves.

What this means for traders and long-term holders

Investors tracking BTC price predictions should treat model outputs as directional rather than definitive. Hayes' core point is that expanded money supply and looser credit could materially lift crypto markets, but many variables will shape how that manifests. Risk management, diversified exposure to crypto infrastructure, and attention to macro signals remain essential for market participants navigating potential upside and volatility through 2028.

Ultimately, Hayes expects a materially higher Bitcoin price over the next three years, driven by macro liquidity and policy shifts. Whether markets converge on the most extreme extrapolations is another question—and one that traders, policymakers, and analysts will be watching closely.

Source: cointelegraph

Leave a Comment