5 Minutes

Most Bitcoin holders remain on the sidelines of BTCFi despite rising venture funding and clear demand for yield and liquidity. A new GoMining survey of over 700 Bitcoin owners across North America and Europe finds that nearly 80% have never used BTCFi. The research suggests that awareness, trust, and complexity are the main barriers preventing Bitcoin DeFi from reaching mainstream users beyond the crypto-native crowd.

Survey reveals low BTCFi adoption

While headlines and capital inflows point to rapid growth in Bitcoin DeFi—often called BTCFi—the user metrics tell a different story. According to GoMining’s study, about 77% of respondents who hold BTC said they have never interacted with BTCFi platforms. That gap exists even as investors and companies pour resources into the sector.

GoMining’s results of survey on BTCFi

Institutional interest is visible: data from Maestro, a Bitcoin-focused infrastructure provider, shows BTCFi venture funding reached $175 million across 32 rounds in H1 2025, with two-thirds of deals focused on DeFi, custody, or consumer-facing BTC applications. Still, the capital has not yet translated into broad consumer adoption.

Demand for yield and liquidity

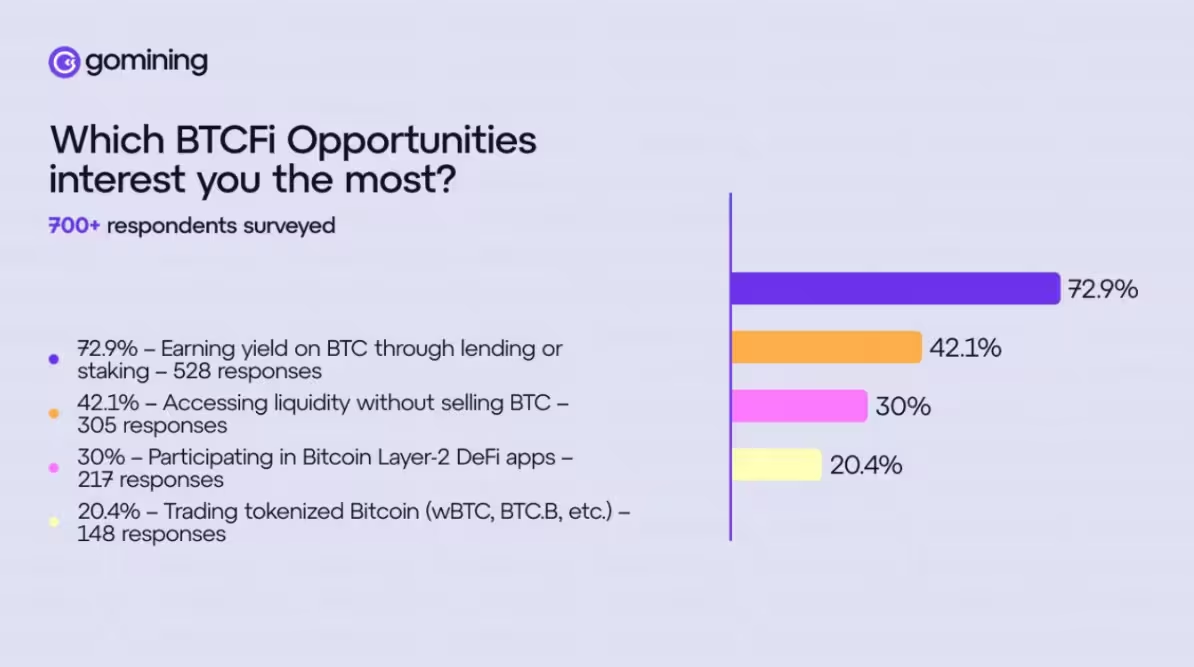

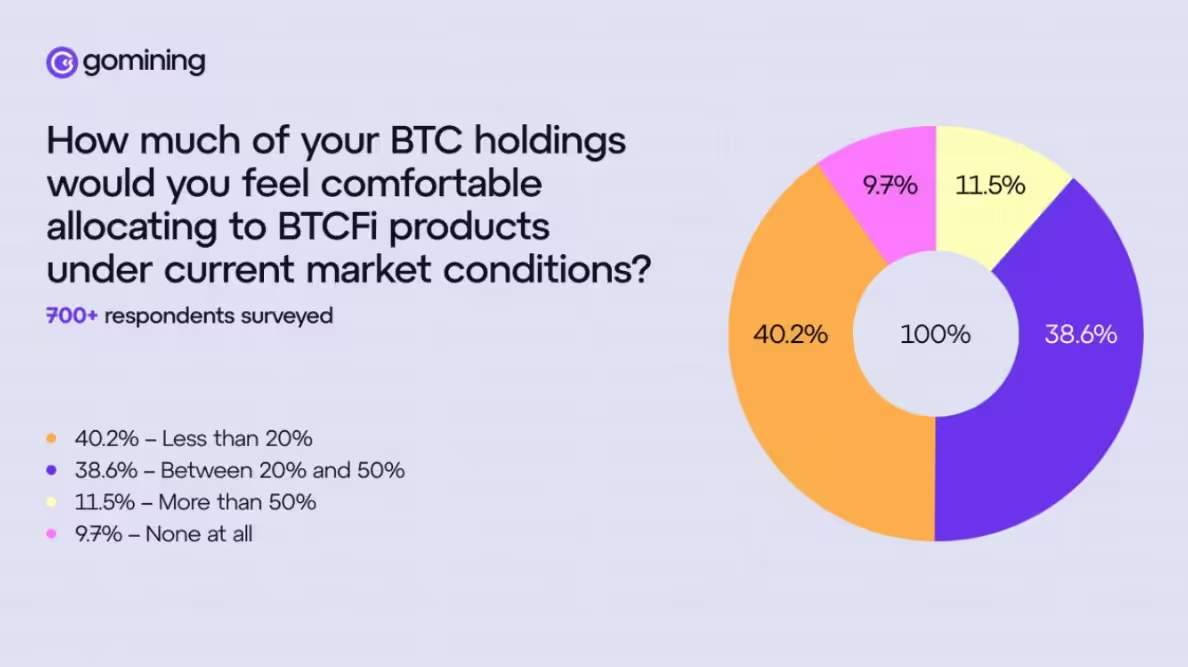

GoMining’s survey clarifies that the problem is not lack of demand. Around 73% of Bitcoin holders said they want to earn yield on their BTC, and 42% expressed interest in accessing liquidity without selling their coins. Yet respondents remain cautious about committing large shares of their holdings to BTCFi: over 40% said they would put less than 20% of their BTC into BTCFi products.

GoMining’s results of survey on BTCFi

Why Bitcoin users stay cautious

Several factors contribute to low BTCFi uptake:

- Complexity: Many BTCFi platforms borrow models from Ethereum DeFi—AMMs, smart-contract-based lending, cross-chain bridges—that can feel unfamiliar to Bitcoin holders used to custodial wallets and regulated products.

- Low awareness: Nearly two-thirds of surveyed holders could not name a single BTCFi project, indicating a communications gap between developers and potential users.

- Trust and security concerns: Uncertainty about smart contract risk, bridge exploits, and custody models makes users reluctant to allocate sizable portions of their BTC to new protocols.

Mark Zalan, CEO of GoMining, summarized the disconnect: there is a strong appetite for yield and liquidity, but many BTCFi offerings are built for crypto natives rather than everyday Bitcoin holders. As a result, BTCFi risks becoming an insider market unless user experience and messaging improve.

Not just a repeat of Ethereum DeFi

BTCFi projects have attempted to replicate Ethereum’s DeFi blueprint, but Bitcoin holders often have different preferences. The survey shows a stronger tilt toward custodial solutions and exchange-traded products rather than self-custody and complex protocol interactions. Products that prioritize simplicity, compliance, and clear custody arrangements—like spot Bitcoin ETFs and centralized exchange offerings—have historically seen higher adoption among mainstream BTC owners.

What BTCFi needs to reach mainstream Bitcoin holders

To broaden adoption beyond early adopters and developers, BTCFi must address three core issues:

- Simpler onboarding: User flows should match the expectations set by custodial exchanges and ETF providers—less technical jargon, clearer UX, and straightforward steps to earn yield or access liquidity.

- Better communication and education: Projects need targeted outreach to explain value propositions, risks, and protections in plain language. When two-thirds of potential users can’t name a single project, marketing and education become adoption levers.

- Improved trust and safety: Emphasizing audits, insurance, regulated custody partnerships, and transparent security practices will reduce hesitation among conservative BTC holders.

Market opportunity and risks

The contradiction between investor capital and user adoption creates both risk and opportunity. Venture funding, infrastructure upgrades, and developer activity indicate BTCFi is maturing. However, if projects continue to optimize for crypto-native users instead of everyday Bitcoin holders, BTCFi could remain a niche sector for insiders.

On the upside, the sizable number of BTC holders who want yield and liquidity represents a large addressable market. If BTCFi platforms streamline their UX, emphasize security and compliance, and invest in clear outreach, they could convert conservative BTC owners into active users.

Takeaway

BTCFi is not yet a mainstream phenomenon despite headline-grabbing funding rounds. Adoption is limited by poor awareness, perceived complexity, and security concerns. For BTCFi to scale, teams must build simpler, more trustworthy products and communicate effectively with the broader Bitcoin audience. Absent those changes, BTCFi risks remaining a specialized corner of the crypto ecosystem rather than a widely used financial layer for Bitcoin holders.

Source: crypto

Leave a Comment