5 Minutes

Bitcoin futures shift to aggressive long positioning

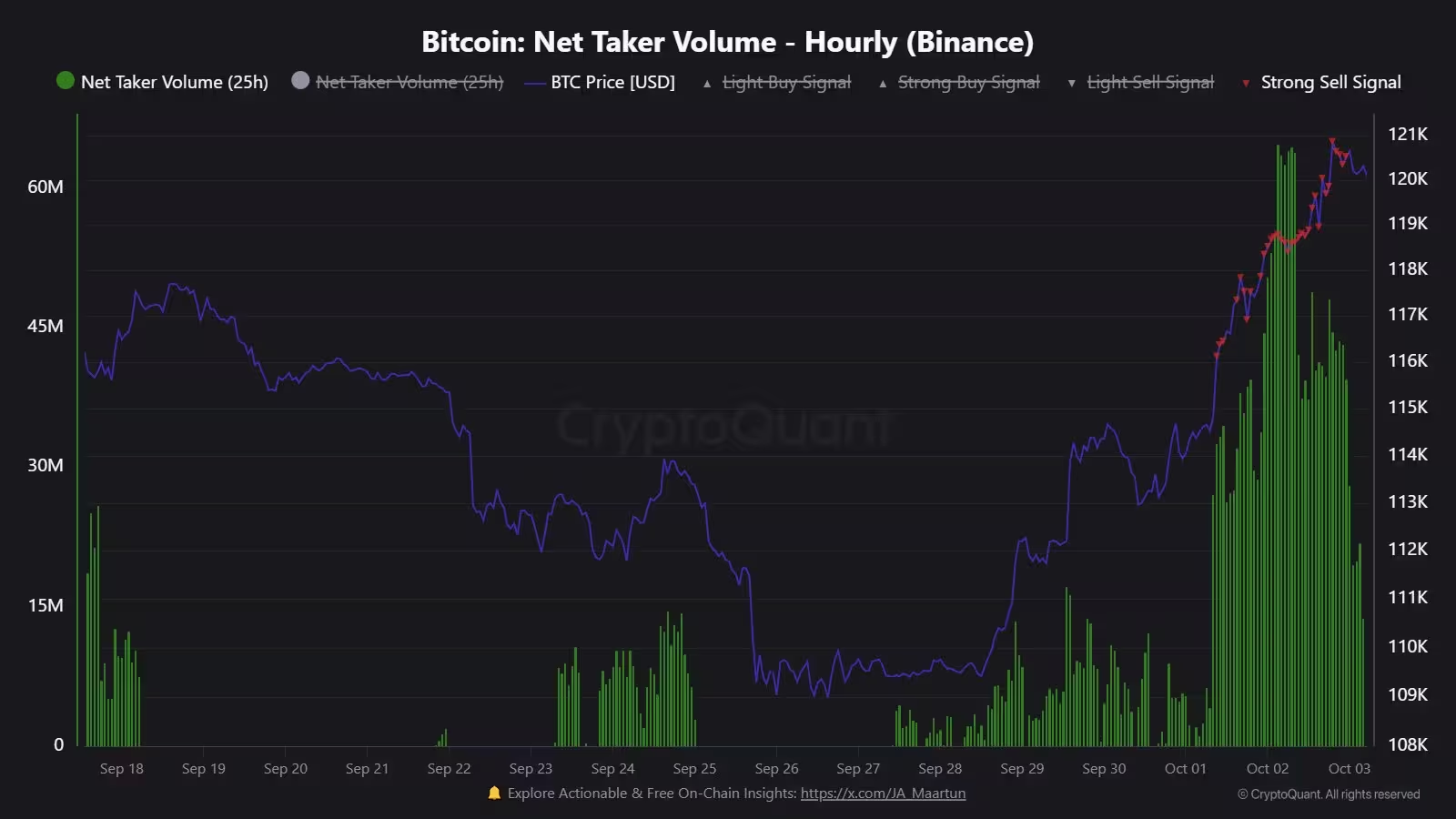

October has opened with a clear directional tilt in Bitcoin derivatives markets: futures traders are increasingly taking long exposure on BTC as price tests fresh highs. On-chain analyst J. A. Maartunn, writing on X, highlighted a marked rise in net buy volume on major exchanges, showing futures buy volume outpacing sell volume by roughly $1.8 billion so far this month. That flow suggests institutional and whale traders are positioning for further upside rather than hedging against a correction.

The surge in buy-side activity has been most visible on Binance, where net taker volumes have flipped strongly positive. CryptoQuant contributors and market observers are interpreting the move as a sign of bullish conviction among derivatives desks and large holders, rather than short-term speculative cycles.

Bitcoin net taker volume (Binance).

Why this matters for BTC price action

A sustained increase in long futures exposure tends to compress available short liquidity and can amplify rallies as leverage builds. When whales and derivatives traders skew long, even moderate catalysts can trigger squeezes that push spot BTC toward new all-time highs. Traders monitoring order books, open interest and net flows use these signals to estimate the probability of continued upside.

The unresolved $110K CME gap and round-the-clock trading plans

Still present in the background is the so-called CME gap just above $110,000 — a weekend price difference in CME Group’s Bitcoin futures contract that historically has drawn attention from traders expecting it to be filled. Recent price action did not produce a deep enough retracement to fill that gap this week, even though similar gaps have closed within days or weeks in past cycles.

Cointelegraph and TradingView highlighted the one-hour CME chart showing the gap area. Market participants are watching whether future changes at CME — including plans under discussion to expand trading hours and reduce the gap phenomenon — will alter how quickly these weekend gaps are addressed.

CME Group Bitcoin futures one-hour chart with gap highlighted.

Implications for derivatives traders

If CME moves to continuous, around-the-clock trading for Bitcoin futures, the gap mechanic could diminish, changing risk models for arbitrage desks and fund managers. That would be another structural change in derivatives market behavior to monitor alongside rising futures open interest and shifting options flows.

Spot Bitcoin ETFs and options drive structural market change

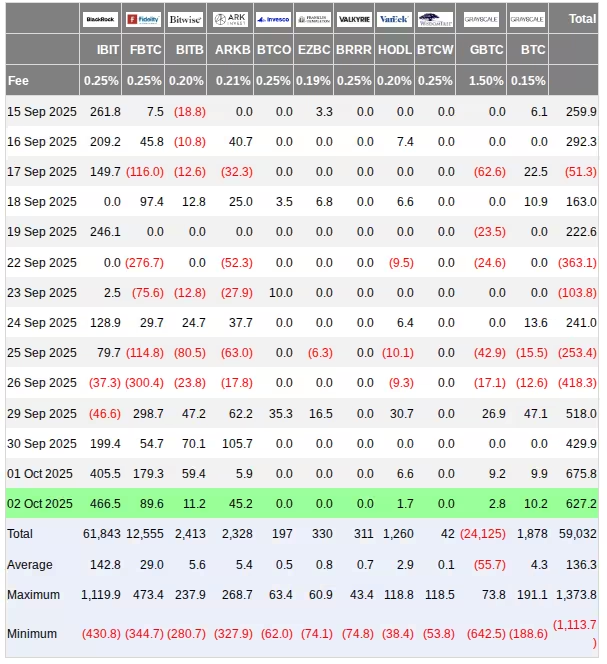

While futures flows turn aggressively long, the ecosystem around spot Bitcoin ETFs is expanding rapidly. U.S. spot ETFs collectively recorded strong inflows, with more than $600 million in a single Wall Street session and weekly totals surpassing $2 billion. ETF net flows are now a material driver of spot liquidity and price discovery.

US spot Bitcoin ETF netflows

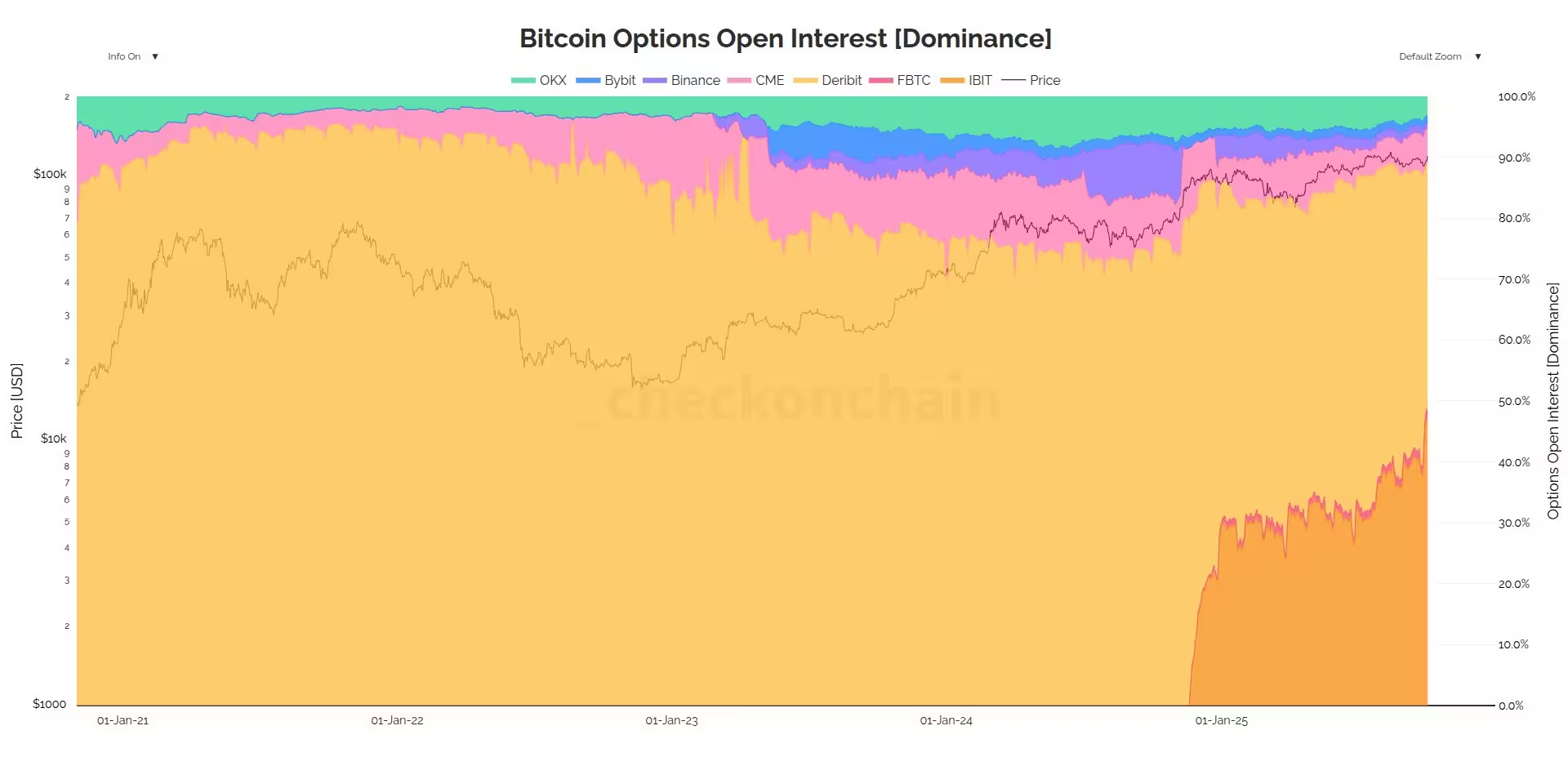

More notable is the jump in options activity tied to the largest ETF, BlackRock’s iShares Bitcoin Trust (IBIT). On-chain analyst James Check and Bloomberg ETF expert Eric Balchunas flagged that IBIT options open interest has grown to rival — and in some measures surpass — established crypto options venues. IBIT’s options open interest has reached levels that put it in competition with Deribit and traditional futures, a shift that could reframe how professional market makers hedge and price risk.

Bitcoin options open interest dominance.

.avif)

IBIT vs Deribit Bitcoin options open interest.

What traders should watch next

Key metrics to monitor are overall derivatives open interest, IBIT options open interest, ETF net inflows, and whether CME alters trading hours. Combined, these indicators will shape liquidity, volatility and the potential for extended moves in BTC. For traders and investors focused on Bitcoin, keeping tabs on whales’ futures positioning, ETF flows, and the evolving options landscape is essential to navigate the current market environment.

Source: cointelegraph

Leave a Comment