5 Minutes

Weekly NFT market snapshot: volume surges

NFT sales volume more than doubled this week, jumping 103.11% to $256.9 million from $84.6 million the prior week, according to CryptoSlam. The market-wide rally in cryptocurrencies — led by Bitcoin and Ethereum — has spilled into NFTs, driving renewed buying activity across multiple chains and collections.

Key marketplace metrics

CryptoSlam data highlights a broad increase in participant counts: NFT buyers rose 18.25% to 694,348, while sellers climbed 17.77% to 584,235. Interestingly, the total number of NFT transactions slipped 8.67% to 1,874,619, suggesting higher-value trades and concentrated volume rather than more frequent low-value flips.

Macro tailwinds: Bitcoin and Ethereum rally

The broader crypto rally supported the NFT rebound. Bitcoin surged toward the $122,000 level, energizing risk appetite across digital assets. Ethereum followed, climbing to around $4,500, strengthening demand for Ethereum-based NFTs and pushing network-level NFT volume higher.

Market cap and momentum

The global crypto market capitalization expanded to roughly $4.2 trillion from $3.78 trillion the previous week. That bullish momentum flowed into NFT marketplaces, where major collections and select blockchains recorded outsized weekly gains.

Hypurrr leads top collections

The Hypurrr collection emerged as the week’s dominant performer, generating $88.77 million in sales across 850 transactions. Hypurrr attracted 406 buyers and 645 sellers, and it claimed four of the top five individual NFT transactions—reflecting concentrated, high-value buys within a single collection.

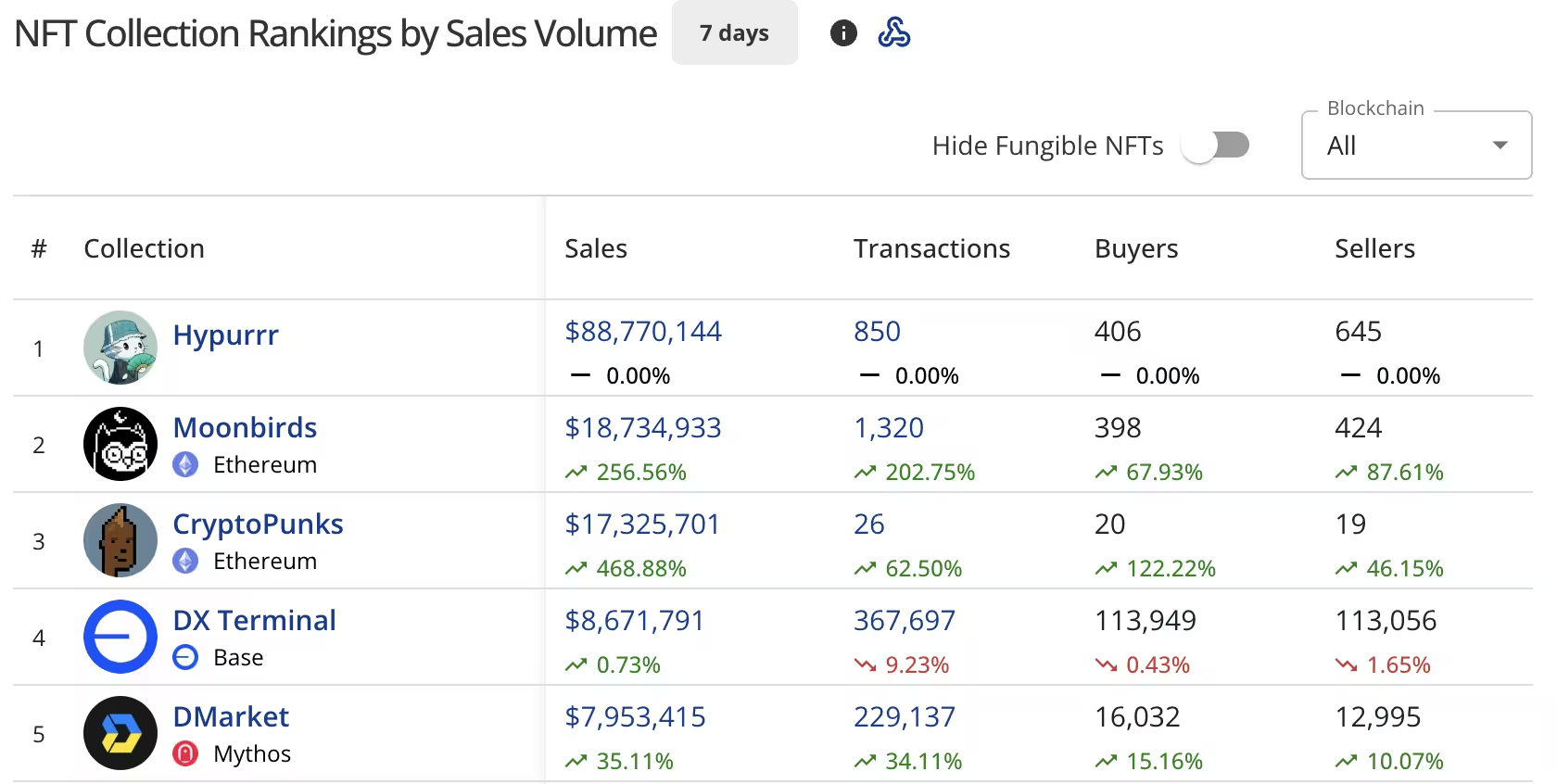

Top collections by NFT Sales Volume

Other top collections included:

- Moonbirds — $18.72 million in volume, a 254.57% increase, with 1,319 transactions, 398 buyers and 424 sellers.

- CryptoPunks — $17.33 million in volume, up 468.88%, with 26 transactions involving 20 buyers and 19 sellers.

- DX Terminal (Base blockchain) — $8.67 million in volume, up 0.73%, processing 367,697 transactions and drawing 113,948 buyers.

- DMarket (Mythos) — $7.95 million in sales, up 34.95% from the previous week.

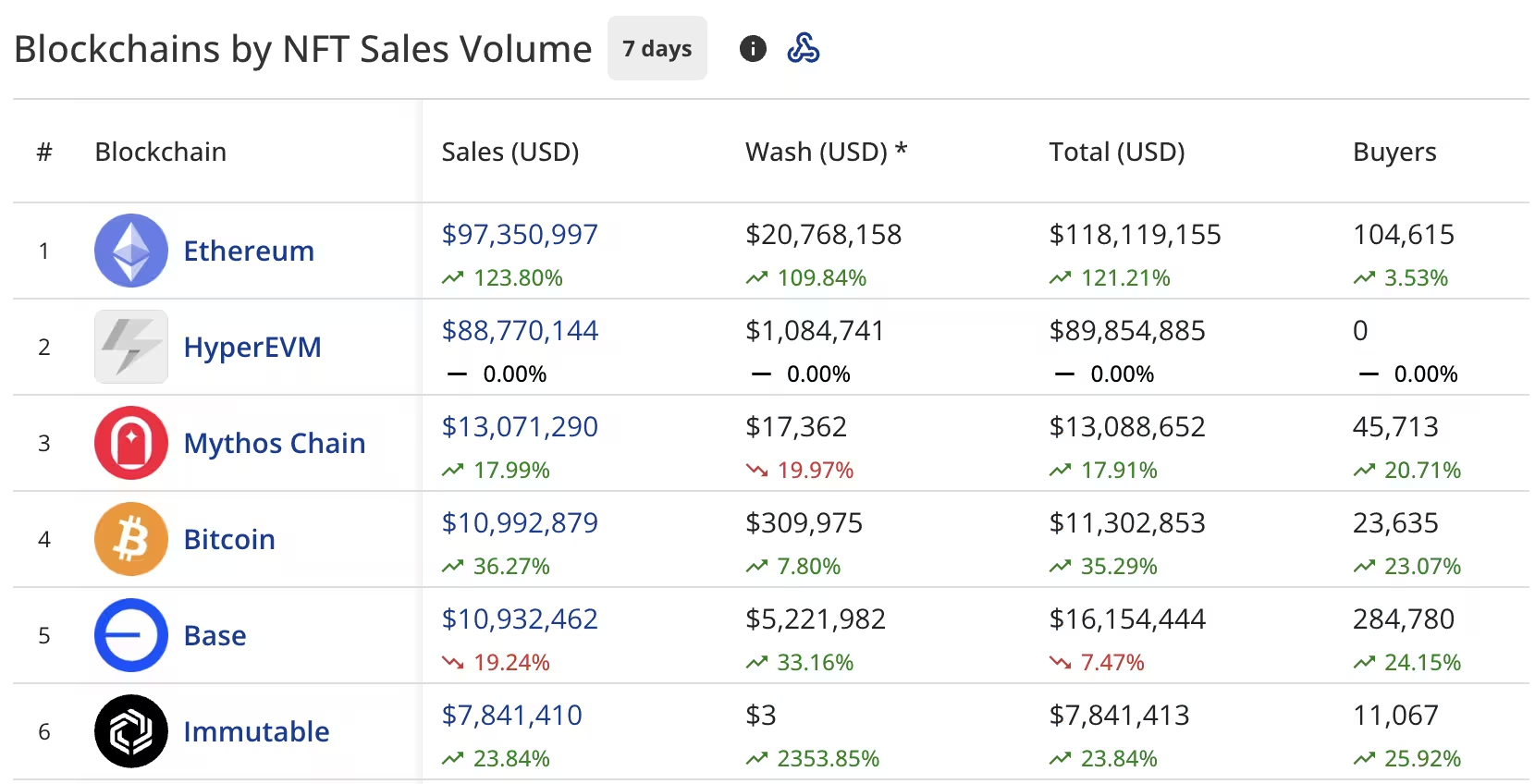

Blockchain breakdown: Ethereum still leads

Ethereum remained the dominant blockchain for NFT sales, recording $97.4 million in weekly volume — a 124.35% increase from $28.3 million the prior week. However, the network also registered $20.84 million in wash trading, bringing a reported total of $118.24 million when that activity is included. Ethereum’s buyer pool grew modestly, with 104,625 buyers (up 3.55%).

HyperEVM captured second place with $88.77 million in sales, entirely driven by the Hypurrr collection’s activity; notably, CryptoSlam’s tracked period showed zero buyers recorded on the chain, an anomaly worth monitoring for data transparency.

Other blockchain standings included:

- Mythos Chain — $13.07 million, up 17.69%, drawing 45,713 buyers (up 20.71%).

- Bitcoin — $10.97 million in NFT volume, a 36.20% increase, with 23,635 buyers (up 23.07%).

- Base — $10.92 million, down 19.71% week-over-week, but with buyer counts rising to 284,780 (up 24.15%).

- Solana — $7.74 million, up 56.23%, and 56,811 buyers (up 18.33%).

Blockchains by NFT Sales Volume

Top individual NFT sales this week

High-ticket transactions were a major factor behind the surge. CryptoPunks #1563 led individual sales at $12.05 million (2,745 ETH), sold two days ago. Four Hypurrr NFTs followed with multi-million-dollar sales—all occurring five days ago:

- Hypurrr #3926 — $7.86 million

- Hypurrr #175 — $7.82 million

- Hypurrr #1131 — $7.63 million

- Hypurrr #3460 — $6.46 million

What this means for collectors and investors

The concentration of volume in a few large transactions and single-collection dominance underscores two simultaneous trends in the NFT market: renewed appetite for blue-chip and hyped drops, and continued concentration of value among a small set of assets. For collectors and institutional traders, this means volatility remains high but so do opportunities for outsized returns in targeted niches.

Investors should watch for wash-trading signals and chain-level anomalies in reporting, as illustrated by the HyperEVM/Hypurrr data and Ethereum’s reported wash trading. Proper due diligence, transparent marketplace analytics, and a focus on liquidity and provenance remain essential when navigating the current NFT cycle.

Outlook

As Bitcoin and Ethereum prices continue to climb, NFT volume is likely to stay elevated in the short term. Market participants should expect further concentration around marquee collections and headline-grabbing sales, while also monitoring blockchain-specific metrics and potential market manipulation indicators that can distort perceived demand.

Source: crypto

Leave a Comment