4 Minutes

Lucky early buy: $3K grows into roughly $2M on a viral memecoin

A cryptocurrency trader transformed an initial $3,000 BNB stake into nearly $2 million in a matter of hours after Binance co-founder Changpeng "CZ" Zhao amplified attention around a BNB Chain memecoin labeled "4" ($4) on X. On-chain analytics reveal wallet 0x872 was among the earliest buyers of the freshly launched token and rode the parabolic spike driven by a mix of social buzz and on-chain momentum.

How the return materialized

Blockchain monitoring by Lookonchain shows the trader swapped $3,000 worth of BNB into the new token shortly after its launch. The position appreciated roughly 650x, converting a small capital outlay into almost $2 million in gross value. The trader realized only a fraction of those gains in a partial sell; the remainder—about $1.88 million—remains on-chain as unsold holdings.

Memecoin born from a phishing incident

The "4" token emerged in the wake of a phishing attack on the BNB Chain, an incident where an attacker reportedly profited around $4,000 before community members turned the episode into a meme. The memecoin gained traction not because of tokenomics or intrinsic utility, but because of narrative — a classic memecoin dynamic where community sentiment and social signals create explosive liquidity and volatility.

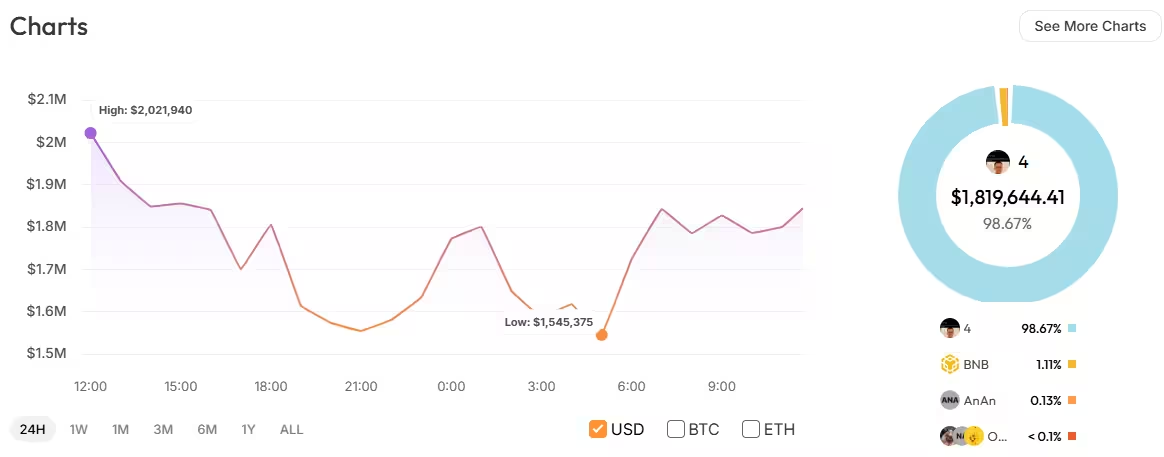

Portfolio concentration and unrealized gains

Public wallet data aggregated by CoinStats indicates this trader concentrated over 98% of their crypto holdings in the "4" token, producing more than $1.8 million in unrealized profit over the prior week. Such concentrated bets can yield outsized returns but also carry elevated downside risk if sentiment reverses.

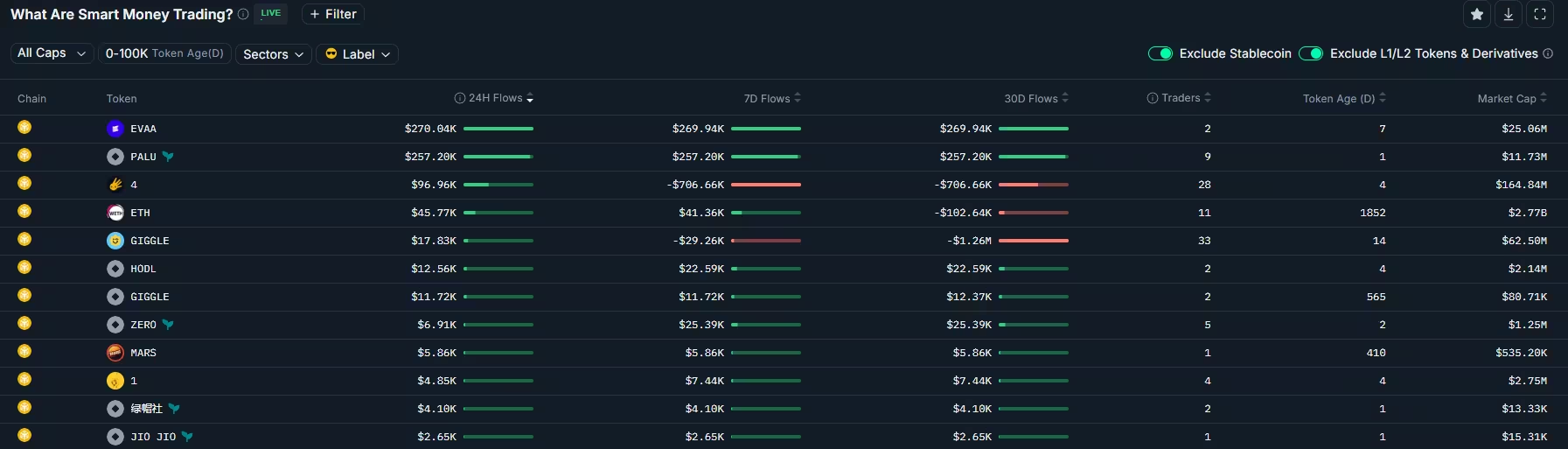

Smart money and analytics show broader interest

Analytics platforms flagged increased interest from institutional-grade or high-performing traders. Nansen’s smart money trackers recorded the memecoin as the third-most-purchased token by top-performing traders on the BNB Chain over a 24-hour window, with nearly $100,000 in smart money flows into the asset. These flows often act as a signal to retail traders that aggressive capital is chasing the trade.

Smart money trader flows, 24 hours

CZ’s repost was the ignition

Attention spiked when CZ reposted the BNB Chain’s statement about the phishing incident to his 8.9 million followers on X, noting the irony that the hacker made a $4k profit and the community later bought the meme coin higher to mock the attacker. That repost served as a social catalyst, accelerating retail FOMO and driving on-chain orders from newly created and anonymous wallets.

Other memecoin windfalls and risks

This episode echoes earlier memecoin mania. In March, an early buyer turned $2,000 into an estimated $43 million on the Pepe memecoin at its peak, only to see substantial drawdown before realizing profits. Another on-chain record showed an investor converting $27 into $52 million in May 2024. These stories underscore both the outsized upside and extreme volatility typical of memecoins.

On-chain visualization of rapid gains

BubbleMaps and other visual trackers highlighted another anonymous wallet that bought the token minutes prior to CZ’s repost and saw paper gains surpassing $1.5 million within hours—illustrating how social posts, on-chain tracking, and rapid liquidity can create short-lived but massive price moves.

Takeaways for traders and crypto investors

Memecoins like "4" respond primarily to narrative and social amplification rather than fundamental utility. While they can generate extreme short-term returns, they also pose significant risks: rug pulls, steep corrections, and the unpredictability of social-driven markets. Traders should apply strict risk management, avoid over-concentration, and treat such positions as speculative plays within a diversified crypto strategy.

For those monitoring on-chain behavior, platforms like Lookonchain, CoinStats, Nansen and Bubblemaps provide real-time insights into wallet flows and smart money activity—useful tools when assessing momentum-driven trades.

Source: cointelegraph

Leave a Comment