5 Minutes

Russia's crypto expansion and the rise of a ruble stablecoin

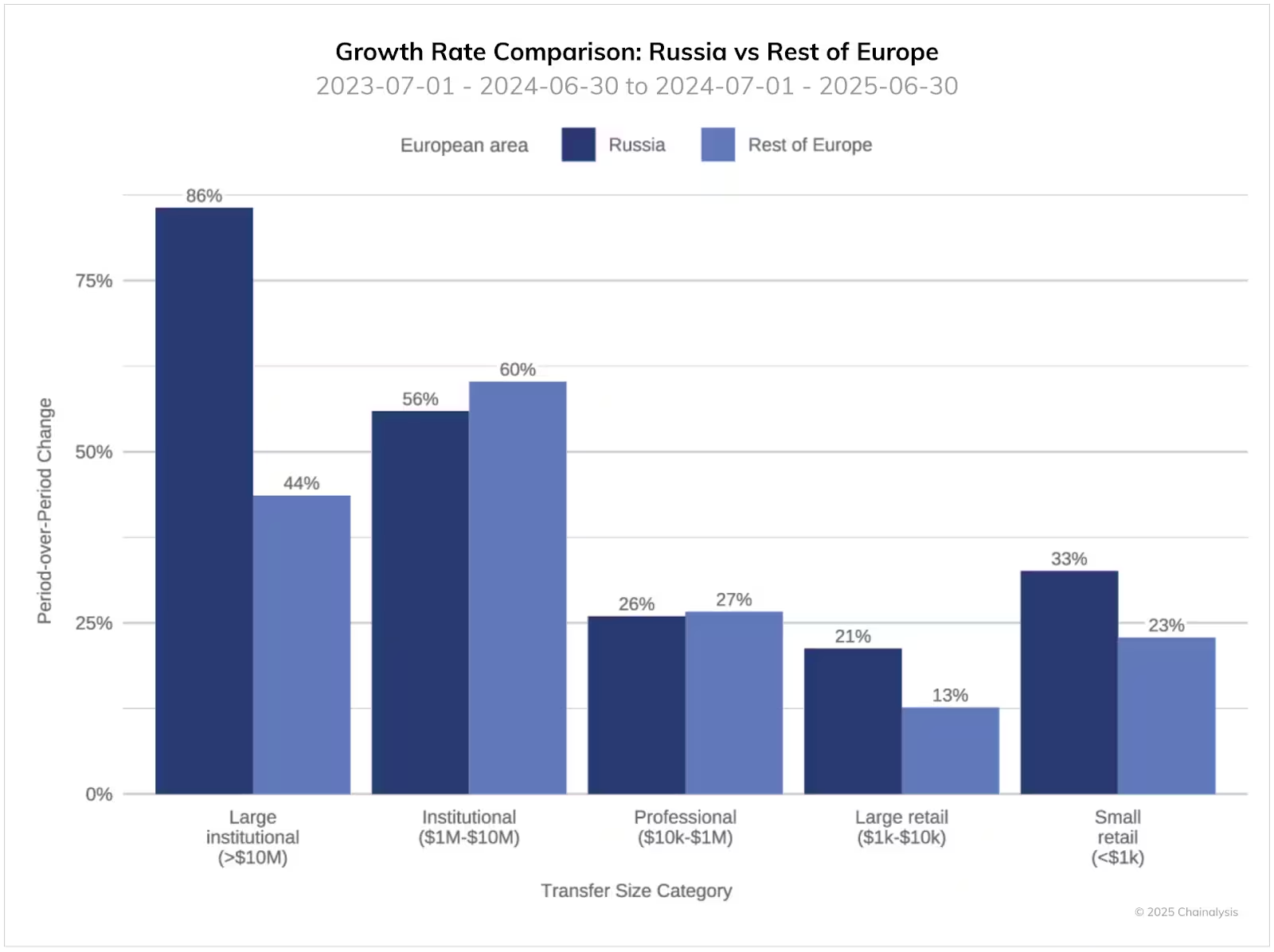

Russian crypto activity has accelerated sharply in recent months, driven in large part by a ruble-pegged stablecoin that is increasingly used for cross-border payments. Chainalysis data show fast growth in on-chain volume as businesses and institutions turn to digital assets to settle international transactions under mounting sanctions and financial restrictions.

How A7A5 powers cross-border payments

A7A5, the rouble-pegged stablecoin launched this year, has become central to Russia’s crypto payment strategy. By offering a ruble-denominated digital settlement option, the token simplifies cross-border transfers for companies that need fast, low-cost rails outside traditional correspondent banking. Chainalysis reports that A7A5 has grown to be the largest non–U.S. dollar stablecoin by market capitalization, topping $500 million in early October, and has recorded more than $40 billion in transaction volume in a short period.

Sanctions risks and regulatory scrutiny

Western authorities have flagged A7A5 as a potential vehicle for sanction evasion. U.S. and EU regulators have raised concerns about the stablecoin’s role in moving value across borders without traditional oversight. U.S. officials have also publicly linked A7A5 to Grinex, the successor platform to the blacklisted exchange Garantex, which faces accusations of laundering millions of dollars through crypto channels.

Despite those warnings, the stablecoin’s adoption underscores how crypto infrastructure can be deployed to sustain trade and payments when conventional financial pathways are constrained.

The digital ruble and formalizing Russia’s crypto sector

Alongside private stablecoins, Russia is pushing forward with a sovereign central bank digital currency (CBDC). After parliamentary approval in July, the central bank confirmed a nationwide launch of the digital ruble on September 1, 2026. The rollout will require large companies to offer CBDC services from day one, with smaller firms phased in later.

Policy moves to bring crypto into the regulated fold

Policymakers are proposing complementary measures to integrate crypto into the formal economy. Yevgeny Masharov of the Russian Public Chamber has suggested creating a "national crypto bank" to convert informal digital transactions into regulated flows and boost federal revenue by bringing hundreds of billions of rubles out of the informal market. Meanwhile, the Ministry of Finance has recommended lowering income thresholds for retail access to crypto markets — signaling a softer stance and wider consumer participation.

State-owned Sberbank has also signaled intent to provide crypto custody services and submitted operational proposals to the central bank. The move by Russia’s largest lender reflects growing institutional engagement and an effort to build compliant custody and settlement infrastructure domestically.

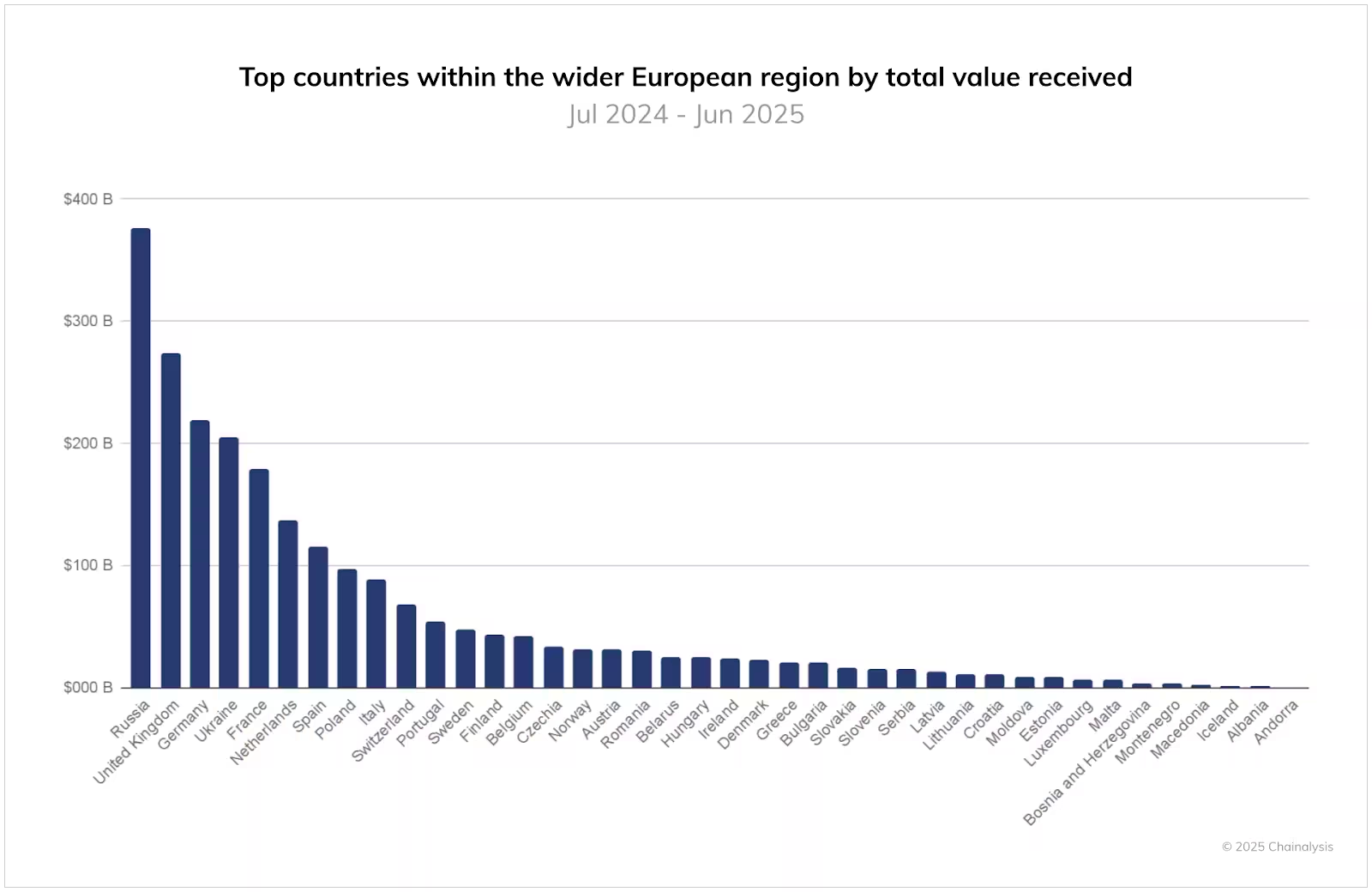

Russia’s position in the European and global crypto landscape

Russia’s growing on-chain flows in Europe reflect not only domestic initiatives but also shifting regulatory dynamics abroad. The EU’s Markets in Crypto-Assets (MiCA) framework has harmonized rules across the EEA, but its phased implementation has created transitional gaps. Those timing differences have allowed non-EEA players like Russia to expand crypto usage without facing the same regulatory bottlenecks.

Chainalysis data highlight strong crypto transfer volumes across Europe. Germany recorded $219.4 billion in transfers during the same period, up 54% year-over-year due to institutional activity and the MiCA transition. Ukraine and Poland followed with $206.3 billion and similar double-digit growth, driven by remittances and grassroots adoption.

Global adoption context

In Chainalysis’s 2025 Global Adoption Index, Russia ranks among the world’s top 10 countries for crypto use, closely trailing other high-growth markets such as Indonesia, Ukraine, and the Philippines. India remains the leader for the third straight year, while the United States moved to second place amid clearer regulations and rising institutional participation. These rankings underscore how regulatory frameworks, domestic policy choices, and payment needs shape national crypto adoption trends.

As Russia accelerates with both private stablecoins and a national CBDC, monitoring regulatory responses and potential sanctions implications will be critical for market participants, compliance teams, and cross-border businesses using crypto rails.

Source: cryptonews

Leave a Comment