5 Minutes

Weekly NFT Market Snapshot: $77M in Sales, Mixed Dynamics

NFT sales volume edged slightly higher this week, reaching $77.10 million — essentially flat versus last week's $77.04 million, according to CryptoSlam data. While overall dollar volume showed little movement, market participation painted a more dynamic picture: buyers surged 23.45% to 490,600 and sellers rose 15.36% to 403,483, even as total NFT transactions fell 18.99% to 1,100,748.

Macro market context

The broader crypto market was also in consolidation. Bitcoin dipped toward the $89,000 range, and Ether remained above the psychological $3,000 level despite a weekly pullback. As a result, the combined global crypto market capitalization cooled to about $3.05 trillion from $3.09 trillion a week earlier — a modest decline but important context for NFT liquidity and valuations.

Top NFT Collections: Winners and Losers

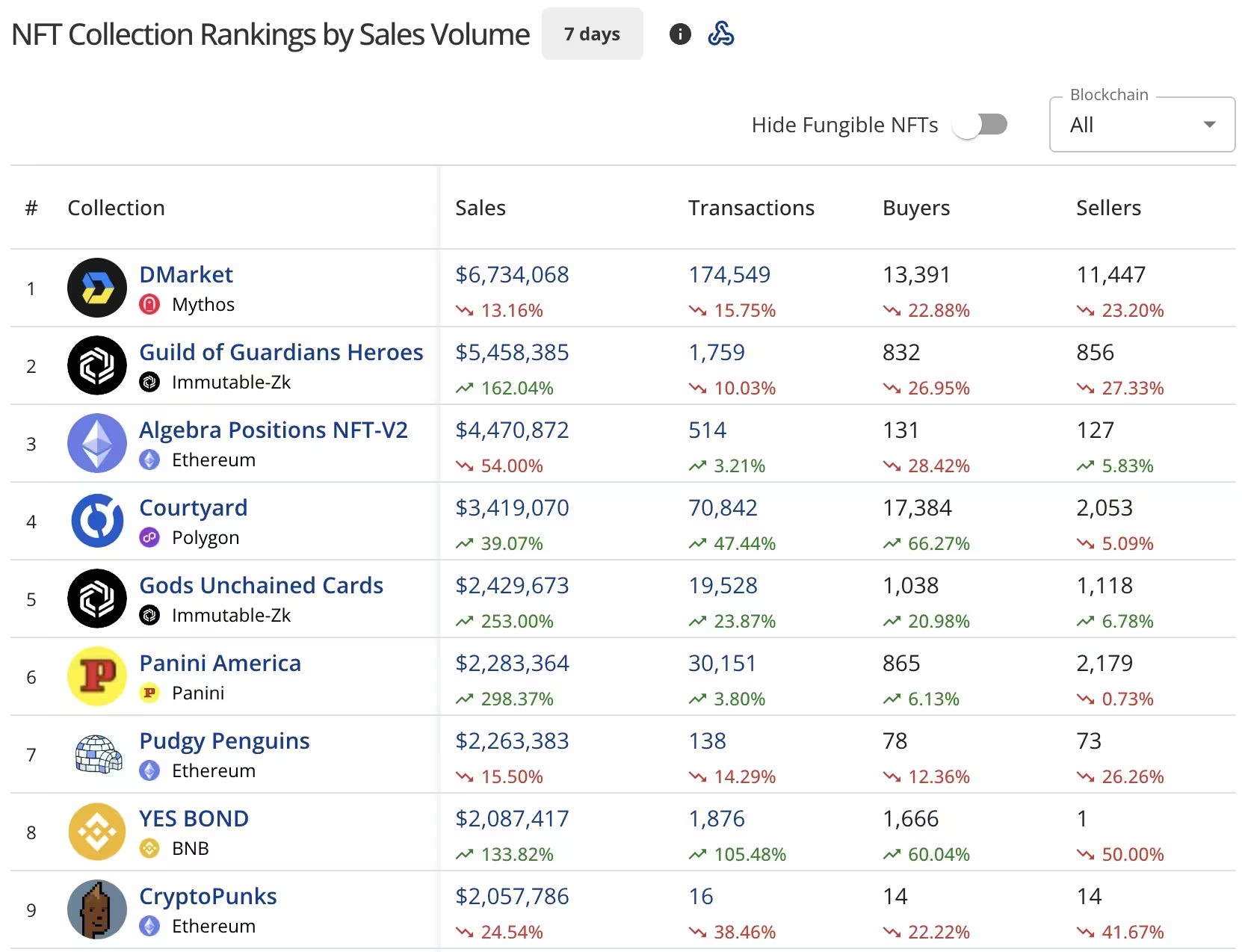

Several collections saw notable swings in weekly sales and rankings. DMarket on the Mythos Chain held the top spot with $6.73 million in sales, although that figure fell 13.16% from $7.77 million the previous week. The collection processed 174,549 transactions with 13,391 buyers and 11,447 sellers.

Major movers

- Guild of Guardians Heroes (Immutable-Zk): A standout winner, jumping 162.04% to $5.46 million from $2.04 million a week ago. That collection logged 1,759 transactions with 832 buyers and 856 sellers, demonstrating renewed demand on Immutable.

- Algebra Positions NFT-V2 (Ethereum): Slid to third place with $4.47 million, a steep 54.00% drop from $9.60 million. The collection recorded 514 transactions, 131 buyers and 127 sellers.

- Courtyard (Polygon): Climbed to fourth with $3.42 million, up 39.07% and processing 70,842 transactions — suggesting strong on-chain engagement on Polygon.

- Gods Unchained Cards (Immutable-Zk): Entered the top five with $2.43 million, soaring 253.00% and logging 19,528 transactions.

- Panini America (Panini chain): Jumped sharply by 298.37% to $2.28 million with 30,151 transactions.

Other collections including Pudgy Penguins, YES BOND on BNB, and CryptoPunks experienced mixed performance, with CryptoPunks slipping 24.54% to $2.06 million while seeing minimal transaction counts.

Source: Top collections by NFT Sales Volume

Blockchain Rankings: Immutable Climbs as Ethereum Retreats

Ethereum remained the largest NFT market by dollar volume but saw a weekly decline: $27.30 million in sales, down 13.55% from $31.86 million. Notably, CryptoSlam flagged $4.63 million as wash trading on Ethereum, lifting its reported total to $31.93 million. Despite the drop in volume, Ethereum posted a strong uptick in participation, with buyers increasing 30.87% to 41,109.

Immutable exploded to second place with $8.51 million in weekly sales — up 148.59% from $3.35 million — while BNB Chain held third with $7.73 million, up 3.55% and reporting $92,941 in wash trading. Bitcoin-based NFTs gained traction too, with Bitcoin network sales rising 17.60% to $7.19 million.

Other networks notable this week: Mythos Chain at $6.88 million, Polygon at $4.38 million (despite $5.71 million flagged as wash trading), and Solana at $4.03 million. Many chains reported healthy buyer growth, underscoring expanding market participation across layer-1 and layer-2 ecosystems.

.avif)

Source: Blockchains by NFT Sales Volume

Wash trading: what to watch

Wash trading — coordinated buy-sell activity that artificially inflates volume — remains a critical signal to monitor. CryptoSlam’s reporting of wash trading on Ethereum and Polygon highlights why analysts look beyond raw volume to assess genuine demand and market health.

Top Individual NFT Sales This Week

The week’s single largest sale was a $X@AI BRC-20 NFT on Bitcoin, which fetched $809,337.16 (8.7195 BTC). That BRC-20 transaction led the leaderboard and underscores the rising prominence of Bitcoin-native NFTs and BRC-20 activity.

High-value Ethereum sales included several CryptoPunks: #1925 sold for $547,161.69 (195 ETH), while #6615, #309 and #5203 completed the top five with multi-hundred-thousand-dollar price tags.

What this means for collectors and traders

The combination of a flat overall sales figure and rising buyer counts suggests interest is broadening even if average transaction frequencies are down. Collectors and traders should watch network-level metrics, wash-trade disclosures, and top collection momentum when evaluating opportunities. Immutable’s surge and the top BRC-20 sale illustrate how shifting network dynamics can rapidly change where value accumulates in the NFT ecosystem.

In short: volume is steady, participation is increasing, and blockchain market share continues to shift — all key signals for NFT investors, builders, and collectors tracking the next wave of opportunities in crypto and Web3.

Source: crypto

Comments

NyxRo

Immutable jump is cool, but Polygon having $5.7M flagged as wash trading makes me skeptical. buyers up, txns down, feels like hype not depth. hmm

fundrift

Wait 77M flat but buyers +23%? where's the real liquidity coming from, wash trades skewing numbers? BRC-20 whale sale feels wild… suspicious

Leave a Comment