3 Minutes

Onchain Liveliness Points to Ongoing Bitcoin Bull Market

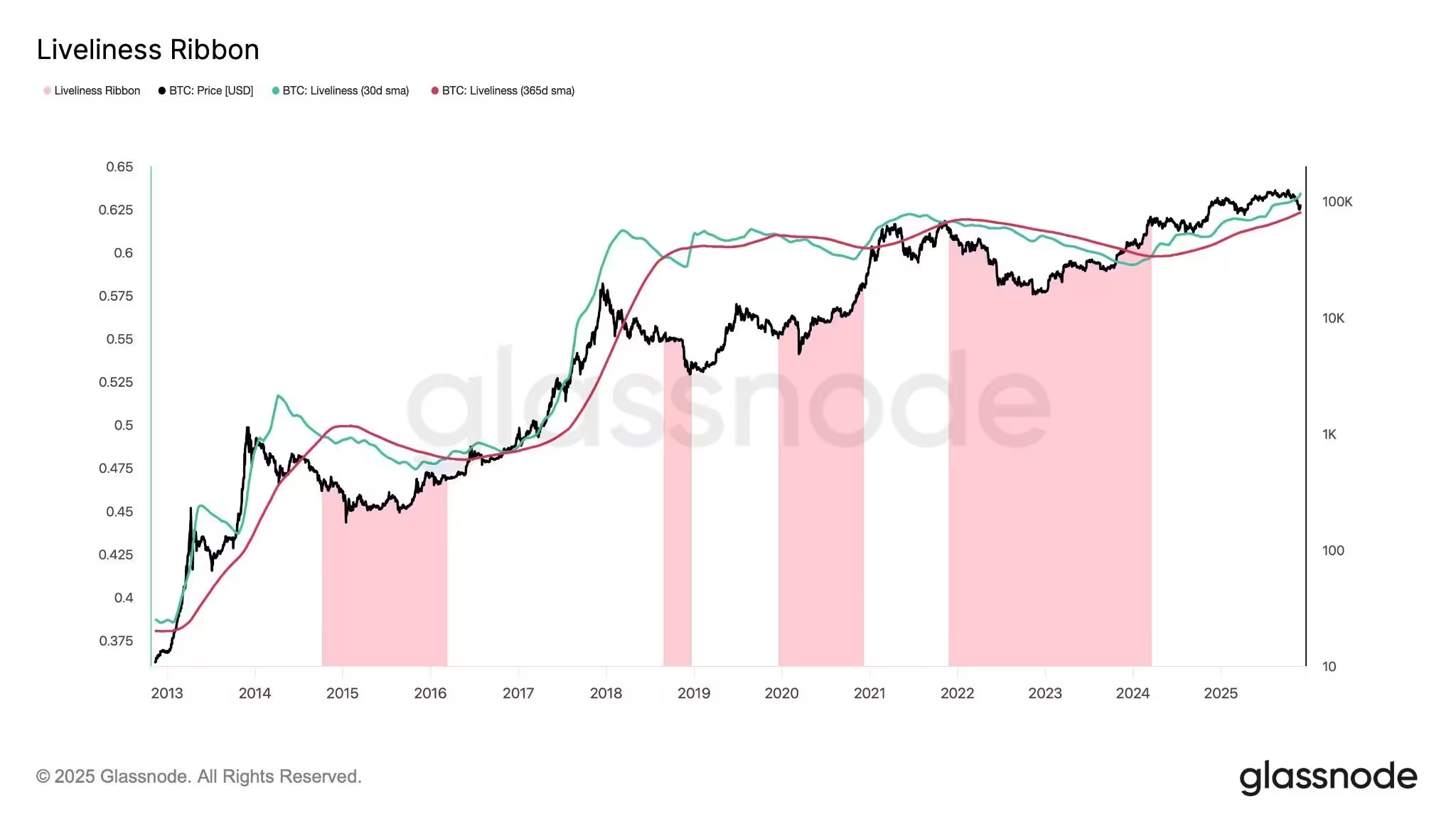

A rising onchain metric known as "liveliness" has reached fresh highs, prompting analysts to suggest the Bitcoin bull cycle may not be finished. While spot prices have shown short-term weakness, the liveliness indicator — a long-term gauge of transaction activity versus holding behavior — is signaling robust demand and a rotation of capital back into the market.

What the liveliness metric measures

Liveliness is effectively a running sum that compares lifetime coin spending to cumulative holding activity. It grows when more coins are transacted and falls when coins are predominantly retained, with older coins weighted differently than younger ones. In plain terms, increasing liveliness usually means previously dormant coins are being moved, often at higher price levels, which historically aligns with bullish phases.

Bitcoin liveliness has reached a new peak

Why this rise matters for traders and investors

Analysts note that liveliness climbing despite lower or consolidating prices indicates a hidden floor of spot demand not immediately evident from price charts. In prior bull markets, such as 2017, liveliness also climbed — but the scale this cycle is markedly larger. Instead of transactions sized in the hundreds or thousands of dollars, observers are seeing flows in the multi-billion-dollar range, reflecting heavier participation from long-term holders and large-cap capital.

One onchain analyst described the metric as an "elegant" long-term moving average for network activity: it emphasizes the flow of coins through wallets and exchanges rather than transient price noise. Fellow analysts have highlighted a dramatic increase in "coin days destroyed," a related measure that captures how long coins remained dormant before moving, reinforcing the narrative of a major capital rotation.

Short-term price action and scenarios to watch

Price-wise, Bitcoin has consolidated in a relatively tight range, dipping briefly below $89,000 before recovering to around $89,500. Market commentators view the $86,000–$92,000 zone as short-term noise. If BTC breaks above $92,000 with strong volume, analysts expect momentum to continue; failure to hold that level could open a retest of the low-$80,000 area and potentially form a double-bottom structure.

Some market observers remain optimistic that the current consolidation is part of a bottoming process that could set the stage for a late-year rally into Q1. The combination of rising liveliness and large-scale movement of long-dormant coins suggests fresh capital is entering the ecosystem — a bullish signal for traders focused on onchain indicators.

How to interpret liveliness alongside other crypto metrics

Liveliness should be read in context with transaction volume, exchange flows, and derivatives positioning. Onchain signals can precede visible price moves, but they are not guarantees. For risk-managed exposure, traders often combine liveliness insights with liquidity metrics, order book data, and macro factors to form a comprehensive view of Bitcoin's trajectory.

Overall, the surge in liveliness points to a significant transfer of Bitcoin supply and renewed investor engagement — factors that could sustain the ongoing bull market cycle if confirmed by rising prices and volume in the weeks ahead.

Source: cointelegraph

Leave a Comment